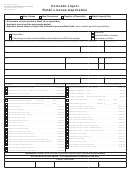

Form Dr 0589 - Vendor Special Event License Application With Instructions Page 4

ADVERTISEMENT

RETAIN THIS COPY FOR YOUR RECORDS.

DR 0098 (03/99) COLORADO DEPARTMENT OF REVENUE

SPECIAL EVENT

RETAIL SALES TAX

Date

(

)

Phone

Signature

SIGNED UNDER PENALTY OF PERJURY

IN THE SECOND DEGREE

Name

17

0020-100

Due Date

00

1. Gross Sales

•

Acct. No.

Period

00

2. Sales to other licensed dealers for resale

•

3. Line 1 less line 2 (Enter this amount on line 4 in all applicable columns)

4. Net Taxable Sales for each Tax

•

00

00

00

00

(4)

(4)

(4)

(4)

COUNTY

CITY

STATE

RTD/CD/BD

5.

Name of event & city and/or county &

County: : : : :

City:

tax rate where sale was made.

Tax rate: .008

Tax rate: .03

Tax rate:

Tax rate:

(See reverse side.)

event

6. Total tax (line 4 x line 5)

00

00

00

00

7. Service fee rate

.0333

.0333

8. Service fee allowed vendor

•

(8)

00

00

00

00

(8)

(8)

(8)

(line 6 x line 7)

9. Sales Tax Due (line 6 minus line 8)

(100)

(11)

00

00

00

00

(11)

(11)

(11)

10. Penalty (.10 x line 9)

(200)

(12)

00

00

00

00

(12)

(12)

(12)

11. Interest

% per Month

(13)

00

00

00

00

(300)

(13)

(13)

(13)

12. Total Each Tax (add lines 9, 10 & 11)

Make check payable to

13.

TOTAL AMOUNT PAID (355)

DO NOT WRITE BELOW THIS LINE

Colorado Department of Revenue.

DR 0098 (03/99) COLORADO DEPARTMENT OF REVENUE

SPECIAL EVENT

RETAIL SALES TAX

Date

Phone

(

)

Signature

SIGNED UNDER PENALTY OF PERJURY

IN THE SECOND DEGREE

Name

17

0020-100

Due Date

00

•

1. Gross Sales

Acct. No.

Period

00

2. Sales to other licensed dealers for resale

•

3. Line 1 less line 2 (Enter this amount on line 4 in all applicable columns)

4. Net Taxable Sales for each Tax

•

00

(4)

00

00

00

(4)

(4)

(4)

COUNTY

CITY

RTD/CD/BD

STATE

5.

Name of event & city and/or county &

County: : : : :

City:

tax rate where sale was made.

Tax rate: .008

Tax rate: .03

(See reverse side.)

Tax rate:

Tax rate:

event

6. Total tax (line 4 x line 5)

00

00

00

00

7. Service fee rate

.0333

.0333

8. Service fee allowed vendor

•

00

00

00

(8)

00

(8)

(8)

(8)

(line 6 x line 7)

9. Sales Tax Due (line 6 minus line 8)

(100)

00

(11)

00

00

00

(11)

(11)

(11)

10. Penalty (.10 x line 9)

00

(200)

(12)

00

00

00

(12)

(12)

(12)

11. Interest

% per Month

00

(13)

00

00

00

(300)

(13)

(13)

(13)

12. Total Each Tax (add lines 9, 10 & 11)

Make check payable to

TOTAL AMOUNT PAID (355)

13.

DO NOT WRITE BELOW THIS LINE

Colorado Department of Revenue.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5