Estimated Tax Worksheet - City Of Springfield

ADVERTISEMENT

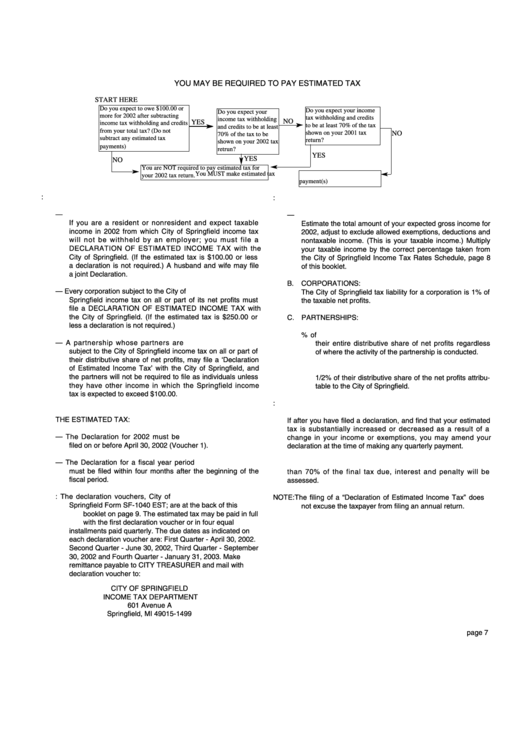

YOU MAY BE REQUIRED TO PAY ESTIMATED TAX

START HERE

Do you expect to owe $100.00 or

Do you expect your income

Do you expect your

more for 2002 after subtracting

tax withholding and credits

income tax withholding

NO

YES

income tax withholding and credits

to be at least 70% of the tax

and credits to be at least

from your total tax? (Do not

shown on your 2001 tax

NO

70% of the tax to be

subtract any estimated tax

return?

shown on your 2002 tax

payments)

retrun?

YES

YES

NO

You are NOT required to pay estimated tax for

You MUST make estimated tax

your 2002 tax return.

payment(s)

1.

WHO MUST MAKE A DECLARATION:

3.

HOW TO CALCULATE YOUR ESTIMATED INCOME TAX:

A.

INDIVIDUALS AND UNINCORPORATED BUSINESSES —

A.

INDIVIDUAL OR UNINCORPORATED BUSINESS —

If you are a resident or nonresident and expect taxable

Estimate the total amount of your expected gross income for

income in 2002 from which City of Springfield income tax

2002, adjust to exclude allowed exemptions, deductions and

will not be withheld by an employer ; you must file a

nontaxable income. (This is your taxable income.) Multiply

DECLARATION OF ESTIMATED INCOME TAX with the

your taxable income by the correct percentage taken from

City of Springfield. (If the estimated tax is $100.00 or less

the City of Springfield Income Tax Rates Schedule, page 8

a declaration is not required.) A husband and wife may file

of this booklet.

a joint Declaration.

B.

CORPORATIONS:

B.

CORPORATIONS — Every corporation subject to the City of

The City of Springfield tax liability for a corporation is 1% of

Springfield income tax on all or part of its net profits must

the taxable net profits.

file a DECLARATION OF ESTIMATED INCOME TAX with

the City of Springfield. (If the estimated tax is $250.00 or

C. PARTNERSHIPS:

less a declaration is not required.)

1.

Tax Liability for a RESIDENT PARTNER is for 1% of

C. PARTNERSHIPS — A partnership whose partners are

their entire distributive share of net profits regardless

subject to the City of Springfield income tax on all or part of

of where the activity of the partnership is conducted.

their distributive share of net profits, may file a ‘Declaration

of Estimated Income Tax’ with the City of Springfield, and

2.

Tax Liability for a NONRESIDENT PARTNER is

the partners will not be required to file as individuals unless

1/2% of their distributive share of the net profits attribu-

they have other income in which the Springfield income

table to the City of Springfield.

tax is expected to exceed $100.00.

4.

AMENDED DECLARATION:

2.

WHEN AND WHERE TO FILE THE DECLARATION AND PAY

THE ESTIMATED TAX:

If after you have filed a declaration, and find that your estimated

tax is substantially increased or decreased as a result of a

A.

CALENDAR YEAR — The Declaration for 2002 must be

change in your income or exemptions, you may amend your

filed on or before April 30, 2002 (Voucher 1).

declaration at the time of making any quarterly payment.

B.

FISCAL YEAR — The Declaration for a fiscal year period

5.

If the total amount of tax withheld or paid by declaration is less

must be filed within four months after the beginning of the

than 70% of the final tax due, interest and penalty will be

fiscal period.

assessed.

C. FILING and PAYMENT: The declaration vouchers, City of

NOTE: The filing of a “Declaration of Estimated Income Tax” does

Springfield Form SF-1040 EST; are at the back of this

not excuse the taxpayer from filing an annual return.

booklet on page 9. The estimated tax may be paid in full

with the first declaration voucher or in four equal

installments paid quarterly. The due dates as indicated on

each declaration voucher are: First Quarter - April 30, 2002.

Second Quarter - June 30, 2002, Third Quarter - September

30, 2002 and Fourth Quarter - January 31, 2003. Make

remittance payable to CITY TREASURER and mail with

declaration voucher to:

CITY OF SPRINGFIELD

INCOME TAX DEPARTMENT

601 Avenue A

Springfield, MI 49015-1499

page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2