City of Perrysburg Income Tax Division

201 West Indiana Avenue

Perrysburg, Ohio 43551

Phone: 419-872-8035

Fax: 419-872-8037

Email:

itax@ci.perrysburg.oh.us

T

E

I

– K

.

AX

STIMATE

NSTRUCTIONS

EEP FOR YOUR RECORDS

Required for individuals or business entities with annual net tax liability greater than $200, usually the following:

Residents who work outside the City of Perrysburg and do not have taxes withheld for Perrysburg,

Residents who have income other than salaries and wages,

Landlords, S Corp shareholders, owners/partners in LLCs, LLPs, sole proprietors,

Resident and non-resident entities doing business in the city,

Income tax is due as you earn income throughout the year. To avoid penalty and interest for the current tax year, the city

ordinance requires that you pay an amount equal to 100% of your prior year tax that is due after withholding, or at least 90%

of your current year net tax liability, in four equal installments on or before April 15, June 15, September 15, and December

15. Fiscal year filers should adjust these dates to correspond to their fiscal year end. The penalty for not paying timely or

sufficient estimates is 15% on the unpaid balance of the estimated tax due. Interest rate for 2017 is 6% per annum on the

same tax balance. If your income is notably uneven throughout the year, estimates may be adjusted quarterly, but you are

required by ordinance to file evidence of income per quarter with your return.

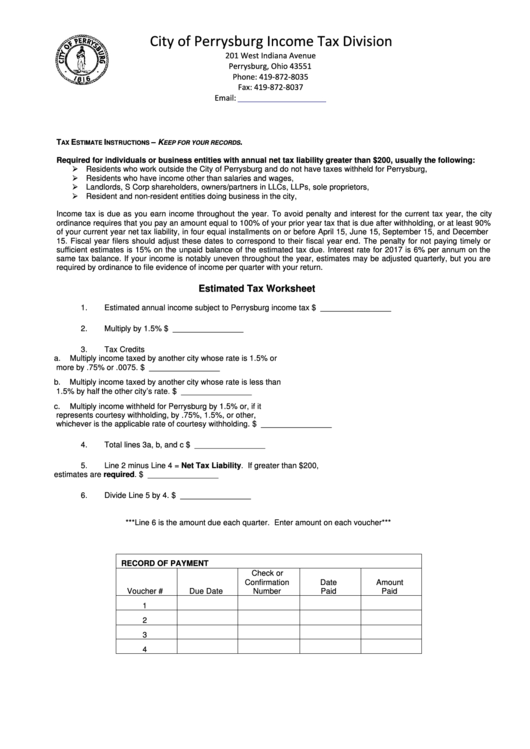

Estimated Tax Worksheet

1.

Estimated annual income subject to Perrysburg income tax

$ ________________

2.

Multiply by 1.5%

$ ________________

3.

Tax Credits

a.

Multiply income taxed by another city whose rate is 1.5% or

more by .75% or .0075.

$ ________________

b.

Multiply income taxed by another city whose rate is less than

1.5% by half the other city’s rate.

$ ________________

c.

Multiply income withheld for Perrysburg by 1.5% or, if it

represents courtesy withholding, by .75%, 1.5%, or other,

whichever is the applicable rate of courtesy withholding.

$ ________________

4.

Total lines 3a, b, and c

$ ________________

5.

Line 2 minus Line 4 = Net Tax Liability. If greater than $200,

estimates are required.

$ ________________

6.

Divide Line 5 by 4.

$ ________________

***Line 6 is the amount due each quarter. Enter amount on each voucher***

RECORD OF PAYMENT

Check or

Confirmation

Date

Amount

Voucher #

Due Date

Number

Paid

Paid

1

2

3

4

1

1