Estimated Tax Worksheet - City Of Perrysburg Income Tax Division 2006

ADVERTISEMENT

C

P

.

.

.

.

/

/

.

WWW

CI

PERRYSBURG

OH

US

FINANCE

INCOMETAX

HTML

ITY OF

ERRYSBURG

E-

: I

@

.

.

.

MAIL

TAX

CI

PERRYSBURG

OH

US

F

419 872-8037

I

T

D

ACSIMILE

NCOME

AX

IVISION

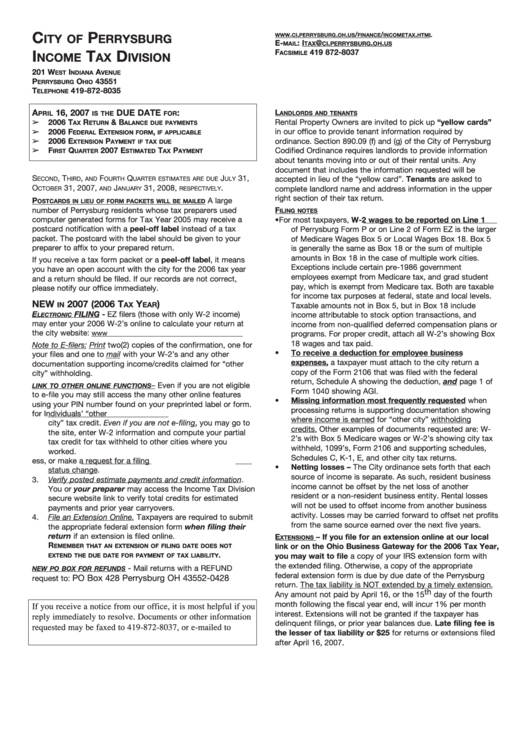

201 W

I

A

EST

NDIANA

VENUE

P

O

43551

ERRYSBURG

HIO

T

419-872-8035

ELEPHONE

A

16, 2007

DUE DATE

:

L

ANDLORDS AND TENANTS

PRIL

IS THE

FOR

➢

2006 T

R

& B

Rental Property Owners are invited to pick up “yellow cards”

AX

ETURN

ALANCE DUE PAYMENTS

➢

in our office to provide tenant information required by

2006 F

E

,

EDERAL

XTENSION FORM

IF APPLICABLE

➢

2006 E

P

ordinance. Section 890.09 (f) and (g) of the City of Perrysburg

XTENSION

AYMENT IF TAX DUE

➢

F

Q

2007 E

T

P

Codified Ordinance requires landlords to provide information

IRST

UARTER

STIMATED

AX

AYMENT

about tenants moving into or out of their rental units. Any

document that includes the information requested will be

S

, T

,

F

Q

J

31,

accepted in lieu of the “yellow card”. Tenants are asked to

ECOND

HIRD

AND

OURTH

UARTER ESTIMATES ARE DUE

ULY

O

31, 2007,

J

31, 2008,

.

complete landlord name and address information in the upper

CTOBER

AND

ANUARY

RESPECTIVELY

right section of their tax return.

P

A large

OSTCARDS IN LIEU OF FORM PACKETS WILL BE MAILED

number of Perrysburg residents whose tax preparers used

F

ILING NOTES

computer generated forms for Tax Year 2005 may receive a

•

For most taxpayers, W-2 wages to be reported on Line 1

postcard notification with a peel-off label instead of a tax

of Perrysburg Form P or on Line 2 of Form EZ is the larger

packet. The postcard with the label should be given to your

of Medicare Wages Box 5 or Local Wages Box 18. Box 5

preparer to affix to your prepared return.

is generally the same as Box 18 or the sum of multiple

amounts in Box 18 in the case of multiple work cities.

If you receive a tax form packet or a peel-off label, it means

Exceptions include certain pre-1986 government

you have an open account with the city for the 2006 tax year

employees exempt from Medicare tax, and grad student

and a return should be filed. If our records are not correct,

pay, which is exempt from Medicare tax. Both are taxable

please notify our office immediately.

for income tax purposes at federal, state and local levels.

NEW

2007 (2006 T

Y

)

IN

AX

EAR

Taxable amounts not in Box 5, but in Box 18 include

E

FILING - EZ filers (those with only W-2 income)

income attributable to stock option transactions, and

LECTRONIC

may enter your 2006 W-2’s online to calculate your return at

income from non-qualified deferred compensation plans or

the city website:

programs. For proper credit, attach all W-2’s showing Box

18 wages and tax paid.

Note to E-filers: Print two(2) copies of the confirmation, one for

•

To receive a deduction for employee business

your files and one to mail with your W-2’s and any other

expenses, a taxpayer must attach to the city return a

documentation supporting income/credits claimed for “other

copy of the Form 2106 that was filed with the federal

city” withholding.

return, Schedule A showing the deduction, and page 1 of

– Even if you are not eligible

LINK TO OTHER ONLINE FUNCTIONS

Form 1040 showing AGI.

to e-file you may still access the many other online features

•

Missing information most frequently requested when

using your PIN number found on your preprinted label or form.

processing returns is supporting documentation showing

1.

Use E-file link as a calculation tool for Individuals’ “other

where income is earned for “other city” withholding

city” tax credit. Even if you are not e-filing, you may go to

credits. Other examples of documents requested are: W-

the site, enter W-2 information and compute your partial

2’s with Box 5 Medicare wages or W-2’s showing city tax

tax credit for tax withheld to other cities where you

withheld, 1099’s, Form 2106 and supporting schedules,

worked.

Schedules C, K-1, E, and other city tax returns.

2.

Submit a change of address, or make a request for a filing

•

Netting losses – The City ordinance sets forth that each

status change.

source of income is separate. As such, resident business

3.

Verify posted estimate payments and credit information.

income cannot be offset by the net loss of another

You or your preparer may access the Income Tax Division

resident or a non-resident business entity. Rental losses

secure website link to verify total credits for estimated

will not be used to offset income from another business

payments and prior year carryovers.

activity. Losses may be carried forward to offset net profits

4.

File an Extension Online. Taxpayers are required to submit

from the same source earned over the next five years.

the appropriate federal extension form when filing their

return if an extension is filed online.

E

– If you file for an extension online at our local

XTENSIONS

R

link or on the Ohio Business Gateway for the 2006 Tax Year,

EMEMBER THAT AN EXTENSION OF FILING DATE DOES NOT

.

you may wait to file a copy of your IRS extension form with

EXTEND THE DUE DATE FOR PAYMENT OF TAX LIABILITY

the extended filing. Otherwise, a copy of the appropriate

- Mail returns with a REFUND

NEW PO BOX FOR REFUNDS

federal extension form is due by due date of the Perrysburg

PO Box 428 Perrysburg OH 43552-0428

request to:

return. The tax liability is NOT extended by a timely extension.

Any amount not paid by April 16, or the 15 th day of the fourth

month following the fiscal year end, will incur 1% per month

If you receive a notice from our office, it is most helpful if you

interest. Extensions will not be granted if the taxpayer has

reply immediately to resolve. Documents or other information

delinquent filings, or prior year balances due. Late filing fee is

requested may be faxed to 419-872-8037, or e-mailed to

the lesser of tax liability or $25 for returns or extensions filed

itax@ci.perrysburg.oh.us.

after April 16, 2007.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4