Print

Clear

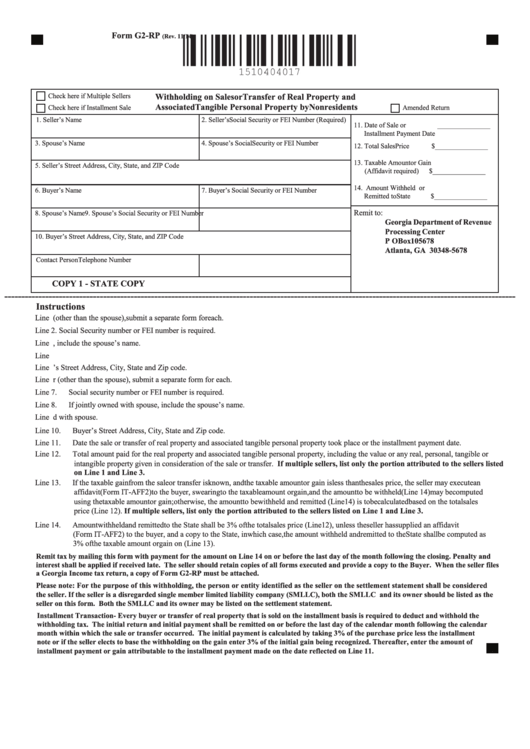

Form G2-RP

(Rev. 11/14)

Check here if Multiple Sellers

Withholding on Sales or Transfer of Real Property and

Associated Tangible Personal Property by Nonresidents

Check here if Installment Sale

Amended Return

1. Seller’s Name

2. Seller’s Social Security or FEI Number (Required)

11. Date of Sale or

_______________

Installment Payment Date

3. Spouse’s Name

4. Spouse’s Social Security or FEI Number

12. Total Sales Price

$_______________

13. Taxable Amount or Gain

5. Seller’s Street Address, City, State, and ZIP Code

(Affidavit required)

$_______________

14. Amount Withheld or

6. Buyer’s Name

7. Buyer’s Social Security or FEI Number

Remitted to State

$_______________

Remit to:

8. Spouse’s Name

9. Spouse’s Social Security or FEI Number

Georgia Department of Revenue

Processing Center

10. Buyer’s Street Address, City, State, and ZIP Code

P O Box 105678

Atlanta, GA 30348-5678

Contact Person

Telephone Number

COPY 1 - STATE COPY

------------------------------------------------------------------------------------------------------------------------------------------------------

Instructions

Line 1.

If more than one seller (other than the spouse), submit a separate form for each.

Line 2.

Social Security number or FEI number is required.

Line 3.

If jointly owned with spouse, include the spouse’s name.

Line 4.

Include the Social Security number of spouse if jointly owned with spouse.

Line 5.

Seller’s Street Address, City, State and Zip code.

Line 6.

If more than one buyer (other than the spouse), submit a separate form for each.

Line 7.

Social security number or FEI number is required.

Line 8.

If jointly owned with spouse, include the spouse’s name.

Line 9.

Include the Social Security number of spouse if jointly owned with spouse.

Line 10.

Buyer’s Street Address, City, State and Zip code.

Line 11.

Date the sale or transfer of real property and associated tangible personal property took place or the installment payment date.

Line 12.

Total amount paid for the real property and associated tangible personal property, including the value or any real, personal, tangible or

intangible property given in consideration of the sale or transfer. If multiple sellers, list only the portion attributed to the sellers listed

on Line 1 and Line 3.

Line 13.

If the taxable gain from the sale or transfer is known, and the taxable amount or gain is less than the sales price, the seller may execute an

affidavit (Form IT-AFF2) to the buyer, swearing to the taxable amount or gain, and the amount to be withheld (Line 14) may be computed

using the taxable amount or gain; otherwise, the amount to be withheld and remitted (Line 14) is to be calculated based on the total sales

price (Line 12). If multiple sellers, list only the portion attributed to the sellers listed on Line 1 and Line 3.

Line 14.

Amount withheld and remitted to the State shall be 3% of the total sales price (Line 12), unless the seller has supplied an affidavit

(Form IT-AFF2) to the buyer, and a copy to the State, in which case, the amount withheld and remitted to the State shall be computed as

3% of the taxable amount or gain on (Line 13).

Remit tax by mailing this form with payment for the amount on Line 14 on or before the last day of the month following the closing. Penalty and

interest shall be applied if received late. The seller should retain copies of all forms executed and provide a copy to the Buyer. When the seller files

a Georgia Income tax return, a copy of Form G2-RP must be attached.

Please note: For the purpose of this withholding, the person or entity identified as the seller on the settlement statement shall be considered

the seller. If the seller is a disregarded single member limited liability company (SMLLC), both the SMLLC and its owner should be listed as the

seller on this form. Both the SMLLC and its owner may be listed on the settlement statement.

Installment Transaction- Every buyer or transfer of real property that is sold on the installment basis is required to deduct and withhold the

withholding tax. The initial return and initial payment shall be remitted on or before the last day of the calendar month following the calendar

month within which the sale or transfer occurred. The initial payment is calculated by taking 3% of the purchase price less the installment

note or if the seller elects to base the withholding on the gain enter 3% of the initial gain being recognized. Thereafter, enter the amount of

installment payment or gain attributable to the installment payment made on the date reflected on Line 11.

1

1