Form As 2640.1-Subchapter N Corporation Election-Instructions For Subchapter N Corporation Election

ADVERTISEMENT

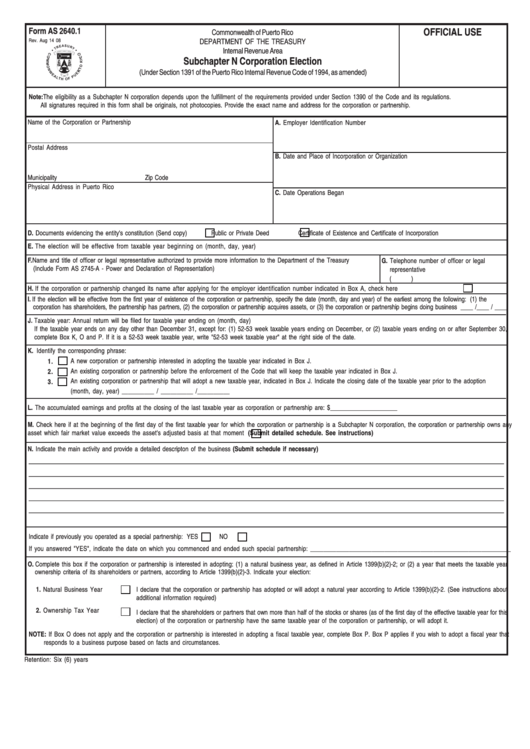

Form AS 2640.1

OFFICIAL USE

Commonwealth of Puerto Rico

DEPARTMENT OF THE TREASURY

Rev. Aug 14 08

Internal Revenue Area

Subchapter N Corporation Election

(Under Section 1391 of the Puerto Rico Internal Revenue Code of 1994, as amended)

Note:The eligibility as a Subchapter N corporation depends upon the fulfillment of the requirements provided under Section 1390 of the Code and its regulations.

All signatures required in this form shall be originals, not photocopies. Provide the exact name and address for the corporation or partnership.

Name of the Corporation or Partnership

A. Employer Identification Number

Postal Address

B. Date and Place of Incorporation or Organization

Municipality

Zip Code

Physical Address in Puerto Rico

C. Date Operations Began

D. Documents evidencing the entity's constitution (Send copy)

Public or Private Deed

Certificate of Existence and Certificate of Incorporation

E. The election will be effective from taxable year beginning on (month, day, year) ............................................................................. __________ / __________ / __________

F. Name and title of officer or legal representative authorized to provide more information to the Department of the Treasury

G. Telephone number of officer or legal

(Include Form AS 2745-A - Power and Declaration of Representation)

representative

(

)

H. If the corporation or partnership changed its name after applying for the employer identification number indicated in Box A, check here ........................................

I. If the election will be effective from the first year of existence of the corporation or partnership, specify the date (month, day and year) of the earliest among the following: (1) the

corporation has shareholders, the partnership has partners, (2) the corporation or partnership acquires assets, or (3) the corporation or partnership begins doing business ____ /____ / ____

J. Taxable year: Annual return will be filed for taxable year ending on (month, day).......... __________/__________

If the taxable year ends on any day other than December 31, except for: (1) 52-53 week taxable years ending on December, or (2) taxable years ending on or after September 30,

complete Box K, O and P. If it is a 52-53 week taxable year, write "52-53 week taxable year" at the right side of the date.

K. Identify the corresponding phrase:

A new corporation or partnership interested in adopting the taxable year indicated in Box J.

1.

An existing corporation or partnership before the enforcement of the Code that will keep the taxable year indicated in Box J.

2.

An existing corporation or partnership that will adopt a new taxable year, indicated in Box J. Indicate the closing date of the taxable year prior to the adoption

3.

(month, day, year) __________ / __________ /__________

L. The accumulated earnings and profits at the closing of the last taxable year as corporation or partnership are: $_____________________

M. Check here if at the beginning of the first day of the first taxable year for which the corporation or partnership is a Subchapter N corporation, the corporation or partnership owns any

asset which fair market value exceeds the asset's adjusted basis at that moment ....

(Submit detailed schedule. See instructions)

N. Indicate the main activity and provide a detailed descripton of the business (Submit schedule if necessary)

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Indicate if previously you operated as a special partnership: YES

NO

If you answered "YES", indicate the date on which you commenced and ended such special partnership: ______________________________________________________________

O. Complete this box if the corporation or partnership is interested in adopting: (1) a natural business year, as defined in Article 1399(b)(2)-2; or (2) a year that meets the taxable year

ownership criteria of its shareholders or partners, according to Article 1399(b)(2)-3. Indicate your election:

1. Natural Business Year

I declare that the corporation or partnership has adopted or will adopt a natural year according to Article 1399(b)(2)-2. (See instructions about

additional information required)

2. Ownership Tax Year

I declare that the shareholders or partners that own more than half of the stocks or shares (as of the first day of the effective taxable year for this

election) of the corporation or partnership have the same taxable year of the corporation or partnership, or will adopt it.

NOTE: If Box O does not apply and the corporation or partnership is interested in adopting a fiscal taxable year, complete Box P. Box P applies if you wish to adopt a fiscal year that

responds to a business purpose based on facts and circumstances.

Retention: Six (6) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4