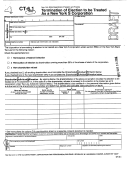

Form As 2640.1-Subchapter N Corporation Election-Instructions For Subchapter N Corporation Election Page 2

ADVERTISEMENT

Form AS 2640.1 - Page 2

Rev. Aug 14 08

P. Facts and circumstances: To request a fiscal taxable year for which a business purpose based on facts and circumstances is established, check the corresponding

Box(es). (See instructions)

Check here if the fiscal year indicated in Box J, is requested under Article 1399(b)(2)-1(c). Include with this Form a statement explaining the tax and non tax factors

1.

on which the request is based. (See instructions)

Check here in case that the business purpose is not approved and the corporation or partnership accepts to adopt a natural taxable year, if required by the Department

2.

of the Treasury to approve your election as a Subchapter N corporation.

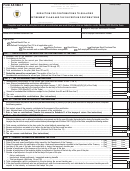

R. Shareholder's or partner's consent statement:

S. Stocks or shares

T. Social

Q.

Name and individual address (physical and postal) of each

U. Date in which

acquired

security or

shareholder or partner and spouse if they own proprietary

the shareholder's

Under the penalties of perjury, we declare our consent

employer

interest over the stocks or shares. When determining the

or partner's

to the election for this corporation or partnership to be

identification

number of shareholders or partners, husband and wife are

taxable year

considered as a Subchapter N corporation under

number

ends (month,

considered as one shareholder or partner.

Section 1391 of the Code.

day)

We have examined this statement including its

schedules, and according to our best knowledge and

belief, it is considered true, correct and complete.

(Shareholders or partners shall sign and specify the

date)*

Number of

Acquisition

Signature

Date

stocks or

date

shares

* The validity of this election depends upon the consent of each shareholder or partner including spouse with proprietary interest in the stocks or partnership's shares. This consent shall

be stated on this Form or on a separate schedule. See instructions for Box R regarding supplementary sheets or separate consent.

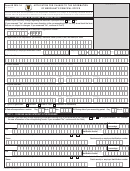

V. Eligible Trusts as Shareholders or Partners under Section 1390(e)(2)**

Beneficiary's name and address

Social Security Number

Trust's name and address

Employer Identification Number

Date on which the corporation's stocks or partnership's shares were transferred to the trust (month, day, year) ............. __________ / __________ / __________

By this mean I make the election under Section 1399(e)(2) so that the trust can be a shareholder or partner of the Subchapter N corporation. I declare under penalty of perjury, that the

trust meets all the eligibility requirements of Section 1390(e)(3) and the information provided in this Box is true, correct and complete.

Signature of beneficiary, legal representative or person authorized to make the

Position

Date

election (in these last two cases, specify position)

**

This Box applies only to stocks or shares transferred to the trust on or before the moment in which the corporation or partnership makes the election for Subchapter N corporation.

Otherwise, the eligible trust election shall be presented separately.

I declare under penalty of perjury, that I have examined this Form, including its schedules, and according to the best of my knowledge and belief, it is true, correct and complete.

Official's signature __________________________________________

Position __________________________________________

Date ________ / ________ / ________

Retention: Six (6) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4