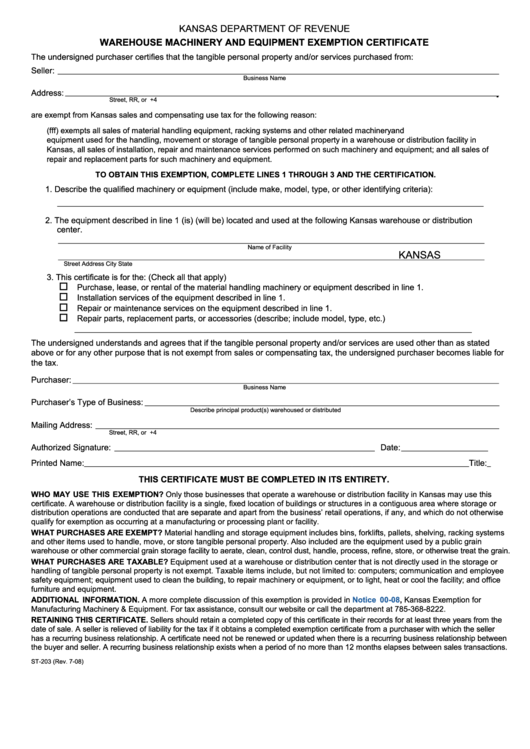

KANSAS DEPARTMENT OF REVENUE

WAREHOUSE MACHINERY AND EQUIPMENT EXEMPTION CERTIFICATE

The undersigned purchaser certifies that the tangible personal property and/or services purchased from:

Seller: _____________________________________________________________________________________________________________________

Business Name

___________________________________________________________________________________________________________________

Address:

Street, RR, or P.O. Box

City

State

ZIP+4

are exempt from Kansas sales and compensating use tax for the following reason:

K.S.A. 79-3606(fff) exempts all sales of material handling equipment, racking systems and other related machinery and

equipment used for the handling, movement or storage of tangible personal property in a warehouse or distribution facility in

Kansas, all sales of installation, repair and maintenance services performed on such machinery and equipment; and all sales of

repair and replacement parts for such machinery and equipment.

TO OBTAIN THIS EXEMPTION, COMPLETE LINES 1 THROUGH 3 AND THE CERTIFICATION.

1. Describe the qualified machinery or equipment (include make, model, type, or other identifying criteria):

_________________________________________________________________________________________________________________

2. The equipment described in line 1 (is) (will be) located and used at the following Kansas warehouse or distribution

center.

_________________________________________________________________________________________________________________

Name of Facility

KANSAS

_________________________________________________________________________________________________________________

Street Address

City

State

3. This certificate is for the: (Check all that apply)

o

Purchase, lease, or rental of the material handling machinery or equipment described in line 1.

o

Installation services of the equipment described in line 1.

o

Repair or maintenance services on the equipment described in line 1.

o

Repair parts, replacement parts, or accessories (describe; include model, type, etc.)

______________________________________________________________________________________________________

The undersigned understands and agrees that if the tangible personal property and/or services are used other than as stated

above or for any other purpose that is not exempt from sales or compensating tax, the undersigned purchaser becomes liable for

the tax.

_________________________________________________________________________________________________________________

Purchaser:

Business Name

Purchaser’s Type of Business: ______________________________________________________________________________________________

Describe principal product(s) warehoused or distributed

Mailing Address: ___________________________________________________________________________________________________________

Street, RR, or P.O. Box

City

State

ZIP+4

Authorized Signature: _____________________________________________________________________

Date: _______________________

Title: _

_______________________________

Printed Name:_______________________________________________________________________

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

WHO MAY USE THIS EXEMPTION? Only those businesses that operate a warehouse or distribution facility in Kansas may use this

certificate. A warehouse or distribution facility is a single, fixed location of buildings or structures in a contiguous area where storage or

distribution operations are conducted that are separate and apart from the business’ retail operations, if any, and which do not otherwise

qualify for exemption as occurring at a manufacturing or processing plant or facility.

WHAT PURCHASES ARE EXEMPT? Material handling and storage equipment includes bins, forklifts, pallets, shelving, racking systems

and other items used to handle, move, or store tangible personal property. Also included are the equipment used by a public grain

warehouse or other commercial grain storage facility to aerate, clean, control dust, handle, process, refine, store, or otherwise treat the grain.

WHAT PURCHASES ARE TAXABLE? Equipment used at a warehouse or distribution center that is not directly used in the storage or

handling of tangible personal property is not exempt. Taxable items include, but not limited to: computers; communication and employee

safety equipment; equipment used to clean the building, to repair machinery or equipment, or to light, heat or cool the facility; and office

furniture and equipment.

ADDITIONAL INFORMATION. A more complete discussion of this exemption is provided in

Notice

00-08, Kansas Exemption for

Manufacturing Machinery & Equipment. For tax assistance, consult our website or call the department at 785-368-8222.

RETAINING THIS CERTIFICATE. Sellers should retain a completed copy of this certificate in their records for at least three years from the

date of sale. A seller is relieved of liability for the tax if it obtains a completed exemption certificate from a purchaser with which the seller

has a recurring business relationship. A certificate need not be renewed or updated when there is a recurring business relationship between

the buyer and seller. A recurring business relationship exists when a period of no more than 12 months elapses between sales transactions.

ST-203 (Rev. 7-08)

1

1