Form 50-294 - Statement Of Unpaid Taxes On Manufactured Home

ADVERTISEMENT

Comptroller

50-294 (12/01/2)

T

E

of Public

S

X

Accounts

[32.03]

A

FORM

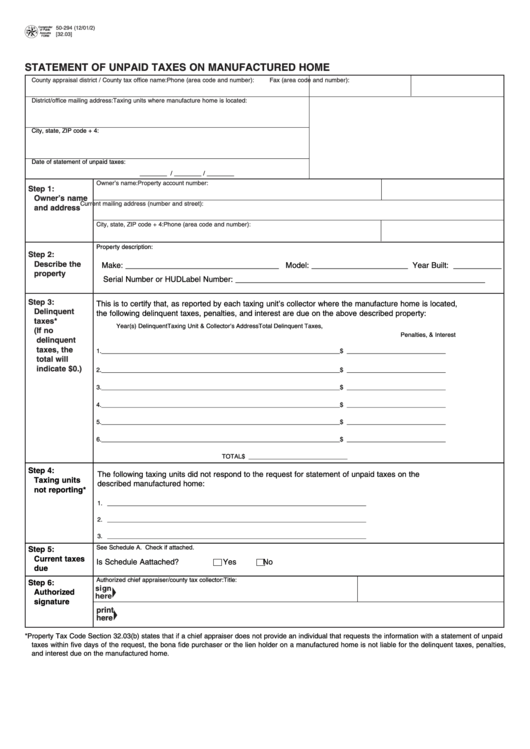

STATEMENT OF UNPAID TAXES ON MANUFACTURED HOME

County appraisal district / County tax office name:

Phone (area code and number):

Fax (area code and number):

District/office mailing address:

Taxing units where manufacture home is located:

City, state, ZIP code + 4:

Date of statement of unpaid taxes:

________ / ________ / ________

Owner’s name:

Property account number:

Step 1:

Owner’s name

Current mailing address (number and street):

and address

City, state, ZIP code + 4:

Phone (area code and number):

Property description:

Step 2:

Describe the

Make: ___________________________________ Model: ______________________ Year Built: ___________

property

Serial Number or HUD Label Number: _________________________________________________________

Step 3:

This is to certify that, as reported by each taxing unit’s collector where the manufacture home is located,

Delinquent

the following delinquent taxes, penalties, and interest are due on the above described property:

taxes*

Year(s) Delinquent

Taxing Unit & Collector’s Address

Total Delinquent Taxes,

(If no

Penalties, & Interest

delinquent

taxes, the

1. _______________________

_______________________________________________

$ _____________________________

total will

indicate $0.)

2. _______________________

_______________________________________________

$ _____________________________

3. _______________________

_______________________________________________

$ _____________________________

4. _______________________

_______________________________________________

$ _____________________________

5. _______________________

_______________________________________________

$ _____________________________

6. _______________________

_______________________________________________

$ _____________________________

TOTAL

$ _____________________________

Step 4:

The following taxing units did not respond to the request for statement of unpaid taxes on the

Taxing units

described manufactured home:

not reporting*

1. ____________________________________________________________________________

2. ____________________________________________________________________________

3. ____________________________________________________________________________

See Schedule A. Check if attached.

Step 5:

Current taxes

Is Schedule A attached?

Yes

No

due

Authorized chief appraiser/county tax collector:

Title:

Step 6:

Authorized

signature

print

here

* Property Tax Code Section 32.03(b) states that if a chief appraiser does not provide an individual that requests the information with a statement of unpaid

taxes within five days of the request, the bona fide purchaser or the lien holder on a manufactured home is not liable for the delinquent taxes, penalties,

and interest due on the manufactured home.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1