Form Ow-9b - Withholding Tax Report

ADVERTISEMENT

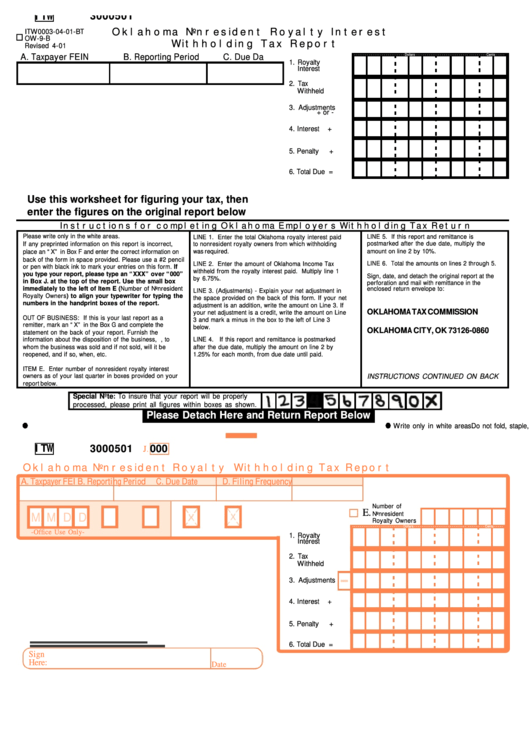

ITW

3000501

Oklahoma Nonresident Royalty Interest

ITW0003-04-01-BT

OW-9-B

Withholding Tax Report

Revised 4-01

A. Taxpayer FEIN

B. Reporting Period

C. Due Date

- - - - - - - - - - - - - - - - - - - - - - - - - - - Dollars - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Cents - - - - -

1. Royalty

Interest

2. Tax

Withheld

3. Adjustments

+ or -

4. Interest

+

5. Penalty

+

6. Total Due =

Use this worksheet for figuring your tax, then

enter the figures on the original report below

Instructions for completing Oklahoma Employers Withholding Tax Return

Please write only in the white areas.

LINE 5. If this report and remittance is

LINE 1. Enter the total Oklahoma royalty interest paid

If any preprinted information on this report is incorrect,

to nonresident royalty owners from which withholding

postmarked after the due date, multiply the

was required.

amount on line 2 by 10%.

place an “X” in Box F and enter the correct information on

back of the form in space provided. Please use a #2 pencil

LINE 6. Total the amounts on lines 2 through 5.

LINE 2. Enter the amount of Oklahoma Income Tax

or pen with black ink to mark your entries on this form. If

withheld from the royalty interest paid. Multiply line 1

you type your report, please type an “XXX” over “000”

Sign, date, and detach the original report at the

by 6.75%.

in Box J. at the top of the report. Use the small box

perforation and mail with remittance in the

immediately to the left of Item E (Number of Nonresident

enclosed return envelope to:

LINE 3. (Adjustments) - Explain your net adjustment in

Royalty Owners) to align your typewriter for typing the

the space provided on the back of this form. If your net

numbers in the handprint boxes of the report.

adjustment is an addition, write the amount on Line 3. If

OKLAHOMA TAX COMMISSION

your net adjustment is a credit, write the amount on Line

OUT OF BUSINESS: If this is your last report as a

3 and mark a minus in the box to the left of Line 3

P.O. BOX 26860

remitter, mark an “X” in the Box G and complete the

below.

OKLAHOMA CITY, OK 73126-0860

statement on the back of your report. Furnish the

information about the disposition of the business, i.e., to

LINE 4. If this report and remittance is postmarked

whom the business was sold and if not sold, will it be

after the due date, multiply the amount on line 2 by

reopened, and if so, when, etc.

1.25% for each month, from due date until paid.

ITEM E. Enter number of nonresident royalty interest

owners as of your last quarter in boxes provided on your

INSTRUCTIONS CONTINUED ON BACK

report below.

Special Note: To insure that your report will be properly

processed, please print all figures within boxes as shown.

Please Detach Here and Return Report Below

Do not fold, staple, or paper clip

Write only in white areas

ITW

3000501

000

J.

Oklahoma Nonresident Royalty Withholding Tax Report

A. Taxpayer FEI

B. Reporting Period

C. Due Date

D. Filing Frequency

Number of

E.

Nonresident

M M D D

Royalty Owners

- - - - - - - - - - - - - - - - - - - - - - - - - - - Dollars - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Cents - - - - -

-Office Use Only-

F.C.

P.T.

F. Change G. Out of Business

1. Royalty

Interest

2. Tax

Withheld

3. Adjustments

4. Interest

+

5. Penalty

+

6. Total Due =

Sign

Here:

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2