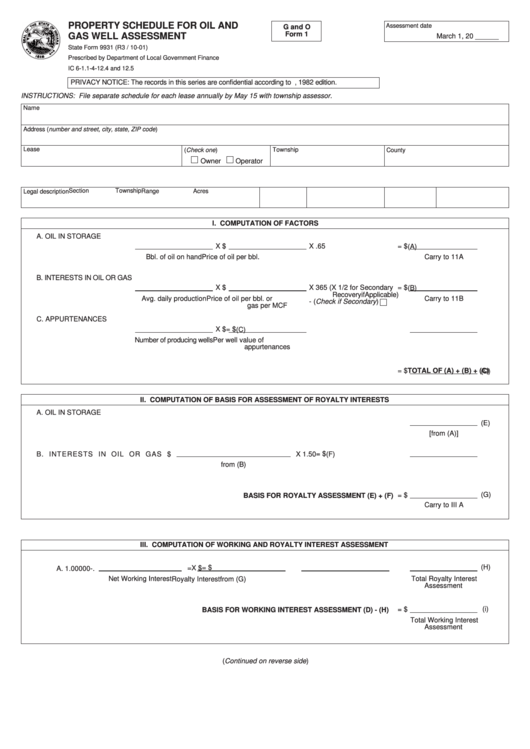

State Form 9931 - Property Schedule For Oil And Gas Well Assessment - 2001

ADVERTISEMENT

PROPERTY SCHEDULE FOR OIL AND

Assessment date

G and O

Form 1

GAS WELL ASSESSMENT

March 1, 20 ______

State Form 9931 (R3 / 10-01)

Prescribed by Department of Local Government Finance

IC 6-1.1-4-12.4 and 12.5

PRIVACY NOTICE: The records in this series are confidential according to I.C. 6-1.1-35-9, 1982 edition.

INSTRUCTIONS: File separate schedule for each lease annually by May 15 with township assessor.

Name

Address (number and street, city, state, ZIP code)

Lease

Township

(Check one)

County

Owner

Operator

Section

Township

Range

Acres

Legal description

I. COMPUTATION OF FACTORS

A. OIL IN STORAGE

X $

X .65

= $

(A)

Bbl. of oil on hand

Price of oil per bbl.

Carry to 11A

B. INTERESTS IN OIL OR GAS

X $

X 365 (X 1/2 for Secondary

= $

(B)

RecoveryifApplicable)

Avg. daily production

Price of oil per bbl. or

Carry to 11B

- (Check if Secondary)

gas per MCF

C. APPURTENANCES

X $

= $

(C)

Number of producing wells

Per well value of

appurtenances

TOTAL OF (A) + (B) + (C)

= $

(D)

II. COMPUTATION OF BASIS FOR ASSESSMENT OF ROYALTY INTERESTS

A. OIL IN STORAGE

(E)

[from (A)]

= $

B. INTERESTS IN OIL OR GAS $

X 1.50

(F)

from (B)

(G)

= $

BASIS FOR ROYALTY ASSESSMENT (E) + (F)

Carry to III A

III. COMPUTATION OF WORKING AND ROYALTY INTEREST ASSESSMENT

(H)

= $

=

X $

A. 1.00000-.

Net Working Interest

Royalty Interest

from (G)

Total Royalty Interest

Assessment

(i)

= $

BASIS FOR WORKING INTEREST ASSESSMENT (D) - (H)

Total Working Interest

Assessment

(Continued on reverse side)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2