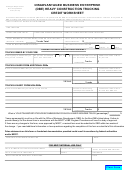

Form 310-For Storage Omly Calculation Worksheet Page 2

ADVERTISEMENT

Tax Form 310

Rev. 8/01

Page 2

Merchandise or Agricultural Product

For Storage Only

“Merchandise” or agricultural product (inventory) shipped into Ohio from outside Ohio, which are: (1)

held in a place of storage, (2) subsequently shipped outside of this state, (3) and while in Ohio are not

further manufactured or processed, are not “used in business” and therefore not taxable tangible per-

sonal property, R.C. 5701.08, Ohio Administrative Code 5703-3-21.

Outside

Source

Ohio

• Taxable •

Y

Warehouse

U

Customer

or Self

• Taxable •

Customer

or Self

• Exempt •

“Merchandise” or agricultural product, shipped into Ohio for storage only and subsequently shipped out

of Ohio to anyone, is not used in business and therefore not taxable tangible personal property, R.C.

5701.08, Rule 5703-3-21, O.A.C.

Notes:

“Merchandise” includes all items of property in salable form.

“Customer” as used herein includes all persons with whom a taxpayer normally and usually

deals as a matter of established business practice or policy. The term, however, does not

include consignees or bailees.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2