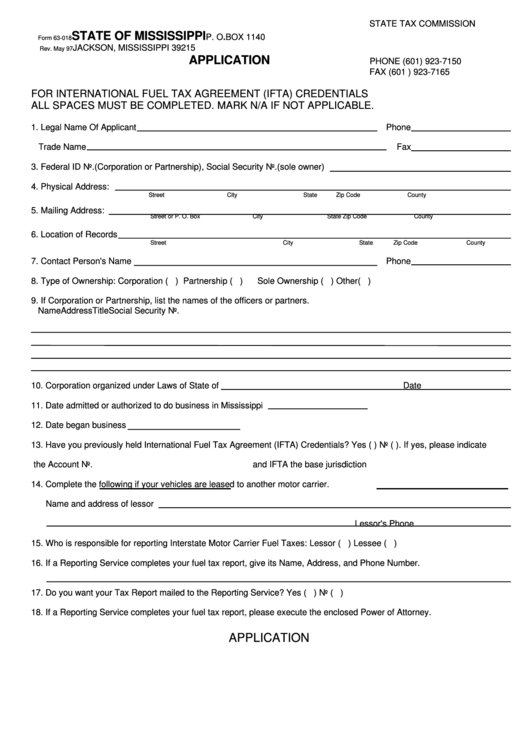

Form 63-018 - Application For International Fuel Tax Agreement (Ifta) Credentials 1997

ADVERTISEMENT

STATE TAX COMMISSION

STATE OF MISSISSIPPI

P. O.BOX 1140

Form 63-018

JACKSON, MISSISSIPPI 39215

Rev. May 97

APPLICATION

PHONE (601) 923-7150

FAX (601 ) 923-7165

FOR INTERNATIONAL FUEL TAX AGREEMENT (IFTA) CREDENTIALS

ALL SPACES MUST BE COMPLETED. MARK N/A IF NOT APPLICABLE.

1. Legal Name Of Applicant

Phone

Trade Name

Fax

3. Federal ID No.(Corporation or Partnership), Social Security No.(sole owner)

4. Physical Address:

Street

City

State

Zip Code

County

5. Mailing Address:

Street or P. O. Box

City

State

Zip Code

County

6. Location of Records

Street

City

State

Zip Code

County

7. Contact Person's Name

Phone

8. Type of Ownership:

Corporation ( )

Partnership ( )

Sole Ownership ( )

Other( )

9. If Corporation or Partnership, list the names of the officers or partners.

Name

Address

Title

Social Security No.

10. Corporation organized under Laws of State of

Date

11. Date admitted or authorized to do business in Mississippi

12. Date began business

13. Have you previously held International Fuel Tax Agreement (IFTA) Credentials? Yes ( ) No ( ). If yes, please indicate

the Account No.

and IFTA the base jurisdiction

14. Complete the following if your vehicles are leased to another motor carrier.

Name and address of lessor

Lessor's Phone

15. Who is responsible for reporting Interstate Motor Carrier Fuel Taxes: Lessor ( )

Lessee ( )

16. If a Reporting Service completes your fuel tax report, give its Name, Address, and Phone Number.

17. Do you want your Tax Report mailed to the Reporting Service?

Yes ( )

No ( )

18. If a Reporting Service completes your fuel tax report, please execute the enclosed Power of Attorney.

APPLICATION

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3