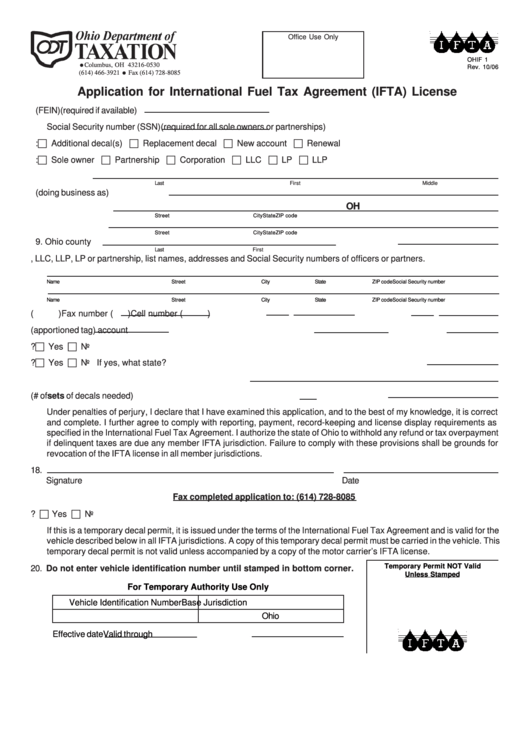

Form Ohif 1 - Application For International Fuel Tax Agreement (Ifta) License 2006

ADVERTISEMENT

Office Use Only

OHIF 1

P.O. Box 530

Columbus, OH 43216-0530

Rev. 10/06

(614) 466-3921

Fax (614) 728-8085

Application for International Fuel Tax Agreement (IFTA) License

1. Federal ID number (FEIN)

(required if available)

Social Security number (SSN)

(required for all sole owners or partnerships)

2. Reason for application:

Additional decal(s)

Replacement decal

New account

Renewal

3. Type of ownership:

Sole owner

Partnership

Corporation

LLC

LP

LLP

4. Legal name

Last

First

Middle

5. Trade name (doing business as)

OH

6. Physical address

Street

City

State

ZIP code

7. Mailing address

Street

City

State

ZIP code

8. Contact name

9. Ohio county

Last

First

10. If corporation, LLC, LLP, LP or partnership, list names, addresses and Social Security numbers of officers or partners.

Name

Street

City

State

ZIP code

Social Security number

Name

Street

City

State

ZIP code

Social Security number

11. Business number (

)

Fax number (

)

Cell number (

)

12. US DOT no.

13. IRP (apportioned tag) account no.

IRP base state

14. Will you be traveling outside the state of Ohio?

Yes

No

15. Have you ever had an IFTA license from a state other than Ohio?

Yes

No If yes, what state?

16. List all states in which you maintain bulk fuel storage

17. Number of qualified vehicles that will be traveling outside Ohio (# of sets of decals needed)

Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge, it is correct

and complete. I further agree to comply with reporting, payment, record-keeping and license display requirements as

specified in the International Fuel Tax Agreement. I authorize the state of Ohio to withhold any refund or tax overpayment

if delinquent taxes are due any member IFTA jurisdiction. Failure to comply with these provisions shall be grounds for

revocation of the IFTA license in all member jurisdictions.

18.

Signature

Date

Fax completed application to: (614) 728-8085

19. Do you wish to have a temporary authority faxed to you?

Yes

No

If this is a temporary decal permit, it is issued under the terms of the International Fuel Tax Agreement and is valid for the

vehicle described below in all IFTA jurisdictions. A copy of this temporary decal permit must be carried in the vehicle. This

temporary decal permit is not valid unless accompanied by a copy of the motor carrier’s IFTA license.

Temporary Permit NOT Valid

20. Do not enter vehicle identification number until stamped in bottom corner.

Unless Stamped

For Temporary Authority Use Only

Vehicle Identification Number

Base Jurisdiction

Ohio

Effective date

Valid through

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2