Business Privilege License/gross Receipts License Fee Return Form - City Of Radcliff

ADVERTISEMENT

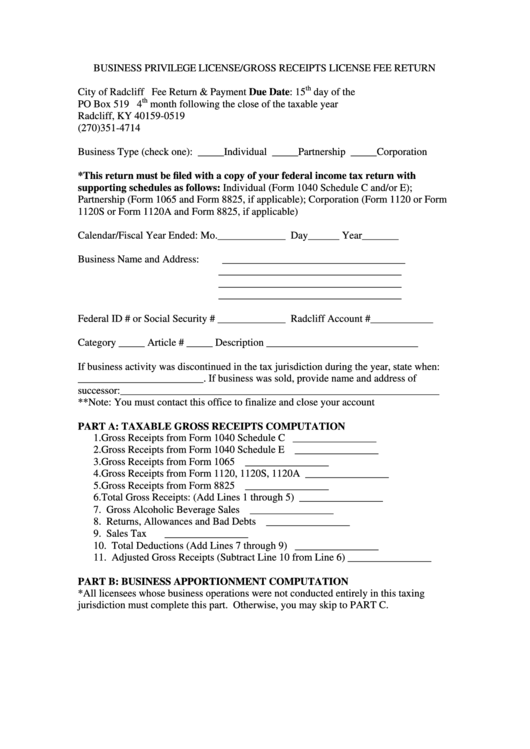

BUSINESS PRIVILEGE LICENSE/GROSS RECEIPTS LICENSE FEE RETURN

th

City of Radcliff

Fee Return & Payment Due Date: 15

day of the

th

PO Box 519

4

month following the close of the taxable year

Radcliff, KY 40159-0519

(270)351-4714

Business Type (check one): _____Individual _____Partnership _____Corporation

*This return must be filed with a copy of your federal income tax return with

supporting schedules as follows: Individual (Form 1040 Schedule C and/or E);

Partnership (Form 1065 and Form 8825, if applicable); Corporation (Form 1120 or Form

1120S or Form 1120A and Form 8825, if applicable)

Calendar/Fiscal Year Ended: Mo._____________ Day______ Year_______

Business Name and Address:

___________________________________

___________________________________

___________________________________

___________________________________

Federal ID # or Social Security # _____________ Radcliff Account #____________

Category _____ Article # _____

Description _____________________________

If business activity was discontinued in the tax jurisdiction during the year, state when:

________________________. If business was sold, provide name and address of

successor:_____________________________________________________________

**Note: You must contact this office to finalize and close your account

PART A: TAXABLE GROSS RECEIPTS COMPUTATION

1. Gross Receipts from Form 1040 Schedule C

________________

2. Gross Receipts from Form 1040 Schedule E

________________

3. Gross Receipts from Form 1065

________________

4. Gross Receipts from Form 1120, 1120S, 1120A

________________

5. Gross Receipts from Form 8825

________________

6. Total Gross Receipts: (Add Lines 1 through 5)

________________

7. Gross Alcoholic Beverage Sales

________________

8. Returns, Allowances and Bad Debts

________________

9. Sales Tax

________________

10. Total Deductions (Add Lines 7 through 9)

________________

11. Adjusted Gross Receipts (Subtract Line 10 from Line 6)

________________

PART B: BUSINESS APPORTIONMENT COMPUTATION

*All licensees whose business operations were not conducted entirely in this taxing

jurisdiction must complete this part. Otherwise, you may skip to PART C.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3