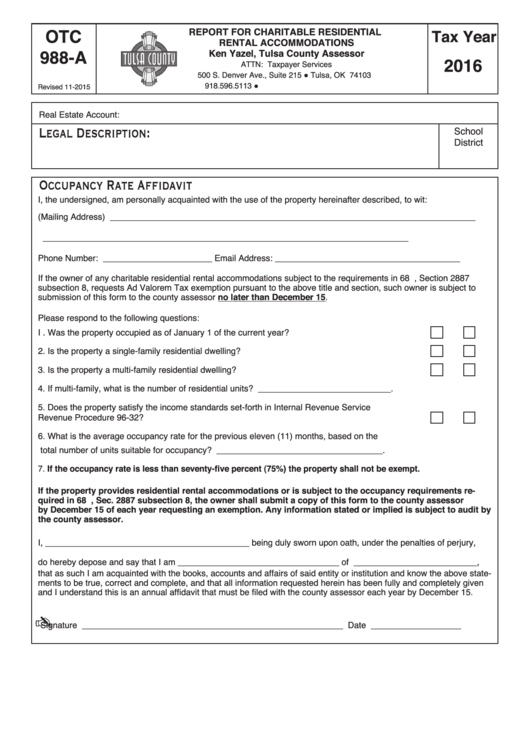

OTC

REPORT FOR CHARITABLE RESIDENTIAL

Tax Year

RENTAL ACCOMMODATIONS

988-A

Ken Yazel, Tulsa County Assessor

2016

ATTN: Taxpayer Services

500 S. Denver Ave., Suite 215 ● Tulsa, OK 74103

918.596.5113 ●

Revised 11-2015

Real Estate Account:

Legal Description:

School

District

Occupancy Rate Affidavit

I, the undersigned, am personally acquainted with the use of the property hereinafter described, to wit:

(Mailing Address) _____________________________________________________________________________

_____________________________________________________________________________

Phone Number:

_______________________

Email Address: _______________________________________

If the owner of any charitable residential rental accommodations subject to the requirements in 68 O.S., Section 2887

subsection 8, requests Ad Valorem Tax exemption pursuant to the above title and section, such owner is subject to

submission of this form to the county assessor no later than December 15.

Please respond to the following questions:

I . Was the property occupied as of January 1 of the current year? .......................................................

Yes

No

2. Is the property a single-family residential dwelling? ...........................................................................

Yes

No

3. Is the property a multi-family residential dwelling? ............................................................................

Yes

No

4. If multi-family, what is the number of residential units? ____________________________ .

5. Does the property satisfy the income standards set-forth in Internal Revenue Service

Revenue Procedure 96-32? ...............................................................................................................

Yes

No

6. What is the average occupancy rate for the previous eleven (11) months, based on the

total number of units suitable for occupancy? ___________________________________ .

7. If the occupancy rate is less than seventy-five percent (75%) the property shall not be exempt.

If the property provides residential rental accommodations or is subject to the occupancy requirements re-

quired in 68 O.S. , Sec. 2887 subsection 8, the owner shall submit a copy of this form to the county assessor

by December 15 of each year requesting an exemption. Any information stated or implied is subject to audit by

the county assessor.

I, ___________________________________________ being duly sworn upon oath, under the penalties of perjury,

do hereby depose and say that I am __________________________________ of __________________________,

that as such I am acquainted with the books, accounts and affairs of said entity or institution and know the above state-

ments to be true, correct and complete, and that all information requested herein has been fully and completely given

and I understand this is an annual affidavit that must be filed with the county assessor each year by December 15.

✍

Signature _______________________________________________________ Date ___________________

1

1