Vec Fc-20-C-Virginia Employment Commission Form 2006

ADVERTISEMENT

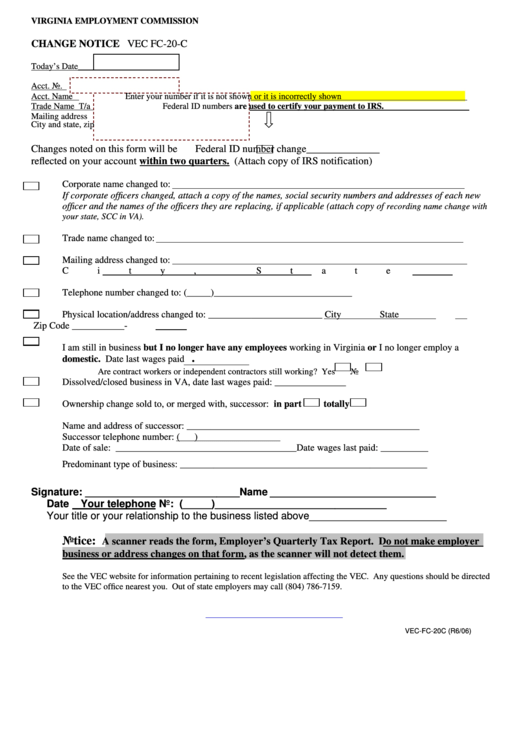

VIRGINIA EMPLOYMENT COMMISSION

CHANGE NOTICE VEC FC-20-C

Today’s Date______________

Acct. No.

Acct. Name

Enter your number if it is not shown or it is incorrectly shown

Trade Name T/a

Federal ID numbers are used to certify your payment to IRS.

Mailing address

City and state, zip

Changes noted on this form will be

Federal ID number change______________

reflected on your account within two quarters.

(Attach copy of IRS notification)

Corporate name changed to:

If corporate officers changed, attach a copy of the names, social security numbers and addresses of each new

officer and the names of the officers they are replacing, if applicable (attach copy of

recording name change with

your state, SCC in VA).

Trade name changed to:

Mailing address changed to:

City, State

Zip Code ___________-

Telephone number changed to: (_____)_____________________________

Physical location/address changed to: ________________________ City

State

Zip Code ___________-

I am still in business but I no longer have any employees working in Virginia or I no longer employ a

.

domestic. Date last wages paid

Are contract workers or independent contractors still working? Yes

No

Dissolved/closed business in VA, date last wages paid: _______________

Ownership change sold to, or merged with, successor: in part

totally

Name and address of successor: _________________________________________________

Successor telephone number: (

)

Date of sale: ______________________________________Date wages last paid: __________

Predominant type of business: ____________________________________________________

Signature: ___________________________Name

Date

Your telephone No: (_____)______________________________

Your title or your relationship to the business listed above________________________

Notice:

A scanner reads the form, Employer’s Quarterly Tax Report. Do not make employer

business or address changes on that form, as the scanner will not detect them.

See the VEC website for information pertaining to recent legislation affecting the VEC. Any questions should be directed

to the VEC office nearest you. Out of state employers may call (804) 786-7159.

VEC-FC-20C (R6/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1