Form Gtr04-Motor Vehicle Fuel (Gasoline) Tax Refund Request July 2000

ADVERTISEMENT

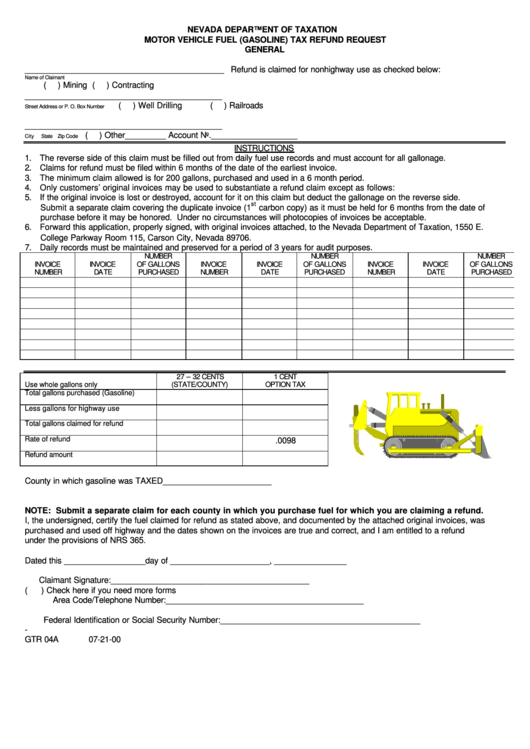

NEVADA DEPARTMENT OF TAXATION

MOTOR VEHICLE FUEL (GASOLINE) TAX REFUND REQUEST

GENERAL

____________________________________________ Refund is claimed for nonhighway use as checked below:

Name of Claimant

(

) Mining

(

) Contracting

____________________________________________

(

) Well Drilling

(

) Railroads

Street Address or P. O. Box Number

____________________________________________

(

) Other_________ Account No.___________________

City

State

Zip Code

INSTRUCTIONS

1. The reverse side of this claim must be filled out from daily fuel use records and must account for all gallonage.

2. Claims for refund must be filed within 6 months of the date of the earliest invoice.

3. The minimum claim allowed is for 200 gallons, purchased and used in a 6 month period.

4. Only customers’ original invoices may be used to substantiate a refund claim except as follows:

5. If the original invoice is lost or destroyed, account for it on this claim but deduct the gallonage on the reverse side.

st

Submit a separate claim covering the duplicate invoice (1

carbon copy) as it must be held for 6 months from the date of

purchase before it may be honored. Under no circumstances will photocopies of invoices be acceptable.

6. Forward this application, properly signed, with original invoices attached, to the Nevada Department of Taxation, 1550 E.

College Parkway Room 115, Carson City, Nevada 89706.

7. Daily records must be maintained and preserved for a period of 3 years for audit purposes.

NUMBER

NUMBER

NUMBER

INVOICE

INVOICE

OF GALLONS

INVOICE

INVOICE

OF GALLONS

INVOICE

INVOICE

OF GALLONS

NUMBER

DATE

PURCHASED

NUMBER

DATE

PURCHASED

NUMBER

DATE

PURCHASED

27 – 32 CENTS

1 CENT

Use whole gallons only

(STATE/COUNTY)

OPTION TAX

Total gallons purchased (Gasoline)

Less gallons for highway use

Total gallons claimed for refund

Rate of refund

.0098

Refund amount

County in which gasoline was TAXED________________________

NOTE: Submit a separate claim for each county in which you purchase fuel for which you are claiming a refund.

I, the undersigned, certify the fuel claimed for refund as stated above, and documented by the attached original invoices, was

purchased and used off highway and the dates shown on the invoices are true and correct, and I am entitled to a refund

under the provisions of NRS 365.

Dated this __________________day of ______________________, ________________

Claimant Signature:____________________________________________

(

) Check here if you need more forms

Area Code/Telephone Number:____________________________________________

Federal Identification or Social Security Number:____________________________________________

-

GTR 04A

07-21-00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2