Standard Verification

ADVERTISEMENT

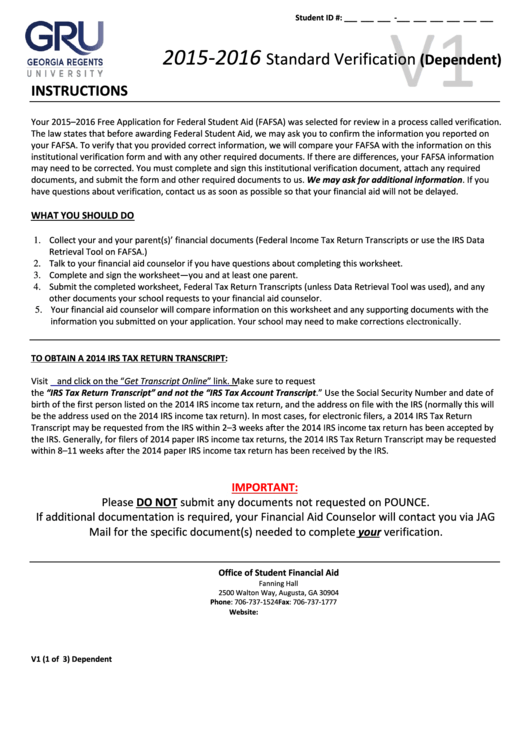

Student ID #: ___ ___ ___ - ___ ___ ___ ___ ___ ___

2015-2016

Standard Verification

(Dependent)

INSTRUCTIONS

Your 2015–2016 Free Application for Federal Student Aid (FAFSA) was selected for review in a process called verification.

The law states that before awarding Federal Student Aid, we may ask you to confirm the information you reported on

your FAFSA. To verify that you provided correct information, we will compare your FAFSA with the information on this

institutional verification form and with any other required documents. If there are differences, your FAFSA information

may need to be corrected. You must complete and sign this institutional verification document, attach any required

documents, and submit the form and other required documents to us. We may ask for additional information. If you

have questions about verification, contact us as soon as possible so that your financial aid will not be delayed.

WHAT YOU SHOULD DO

1. Collect your and your parent(s)’ financial documents (Federal Income Tax Return Transcripts or use the IRS Data

Retrieval Tool on FAFSA.)

2. Talk to your financial aid counselor if you have questions about completing this worksheet.

3. Complete and sign the worksheet—you and at least one parent.

4. Submit the completed worksheet, Federal Tax Return Transcripts (unless Data Retrieval Tool was used), and any

other documents your school requests to your financial aid counselor.

5. Your financial aid counselor will compare information on this worksheet and any supporting documents with the

information you submitted on your application. Your school may need to make corrections electronically.

TO OBTAIN A 2014 IRS TAX RETURN TRANSCRIPT:

Visit

and click on the “Get Transcript Online” link. Make sure to request

the “IRS Tax Return Transcript” and not the “IRS Tax Account Transcript.” Use the Social Security Number and date of

birth of the first person listed on the 2014 IRS income tax return, and the address on file with the IRS (normally this will

be the address used on the 2014 IRS income tax return). In most cases, for electronic filers, a 2014 IRS Tax Return

Transcript may be requested from the IRS within 2–3 weeks after the 2014 IRS income tax return has been accepted by

the IRS. Generally, for filers of 2014 paper IRS income tax returns, the 2014 IRS Tax Return Transcript may be requested

within 8–11 weeks after the 2014 paper IRS income tax return has been received by the IRS.

IMPORTANT:

Please DO NOT submit any documents not requested on POUNCE.

If additional documentation is required, your Financial Aid Counselor will contact you via JAG

Mail for the specific document(s) needed to complete your verification.

Office of Student Financial Aid

Fanning Hall

2500 Walton Way, Augusta, GA 30904

Phone: 706-737-1524

Fax: 706-737-1777

Website:

V1 (1 of 3) Dependent

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3