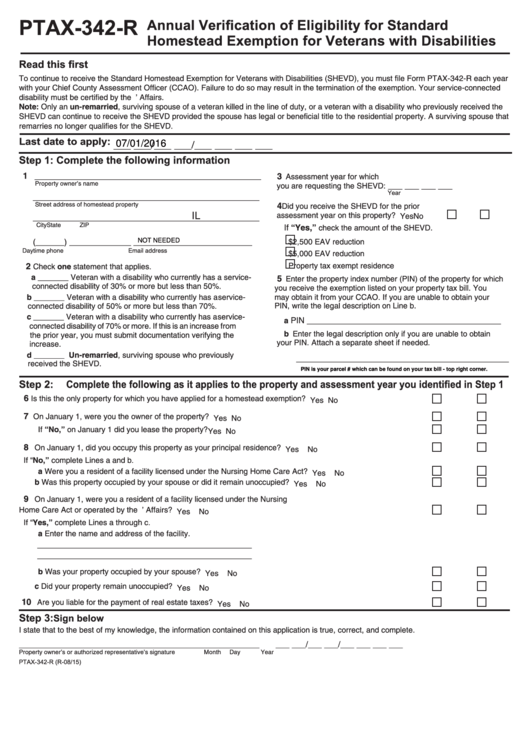

PTAX-342-R

Annual Verification of Eligibility for Standard

Homestead Exemption for Veterans with Disabilities

Read this first

To continue to receive the Standard Homestead Exemption for Veterans with Disabilities (SHEVD), you must file Form PTAX-342-R each year

with your Chief County Assessment Officer (CCAO). Failure to do so may result in the termination of the exemption. Your service-connected

disability must be certified by the U.S. Department of Veterans’ Affairs.

Note: Only an un-remarried, surviving spouse of a veteran killed in the line of duty, or a veteran with a disability who previously received the

SHEVD can continue to receive the SHEVD provided the spouse has legal or beneficial title to the residential property. A surviving spouse that

remarries no longer qualifies for the SHEVD.

Last date to apply: ___ ___/___ ___/___ ___ ___ ___

07/01/2016

Step 1:

Complete the following information

1

_________________________________________________

3

Assessment year for which

Property owner’s name

___ ___ ___ ___

you are requesting the SHEVD:

Year

_________________________________________________

4

Street address of homestead property

Did you receive the SHEVD for the prior

IL

assessment year on this property?

Yes

No

_________________________________________________

City

State

ZIP

If “Yes,”

check the amount of the SHEVD.

______

_____________ _________________________

$2,500 EAV reduction

(

)

NOT NEEDED

Daytime phone

Email address

$5,000 EAV reduction

2

Property tax exempt residence

Check one statement that applies.

a _______ Veteran with a disability who currently has a service-

5

Enter the property index number (PIN) of the property for which

connected disability of 30% or more but less than 50%.

you receive the exemption listed on your property tax bill. You

b _______ Veteran with a disability who currently has a service-

may obtain it from your CCAO. If you are unable to obtain your

connected disability of 50% or more but less than 70%.

PIN, write the legal description on Line b.

c _______ Veteran with a disability who currently has a service-

PIN __________________________________________

a

connected disability of 70% or more. If this is an increase from

b Enter the legal description only if you are unable to obtain

the prior year, you must submit documentation verifying the

your PIN. Attach a separate sheet if needed.

increase.

d _______ Un-remarried, surviving spouse who previously

______________________________________________

received the SHEVD.

PIN is your parcel # which can be found on your tax bill - top right corner.

Step 2:

Complete the following as it applies to the property and assessment year you identified in Step 1

6

Is this the only property for which you have applied for a homestead exemption?

Yes

No

7

On January 1, were you the owner of the property?

Yes

No

If “No,” on January 1 did you lease the property?

Yes

No

8

On January 1, did you occupy this property as your principal residence?

Yes

No

If “No,” complete Lines a and b.

a Were you a resident of a facility licensed under the Nursing Home Care Act?

Yes

No

b Was this property occupied by your spouse or did it remain unoccupied?

Yes

No

9

On January 1, were you a resident of a facility licensed under the Nursing

Home Care Act or operated by the U.S. Department of Veterans’ Affairs?

Yes

No

If “Yes,” complete Lines a through c.

a Enter the name and address of the facility.

_________________________________________________

_________________________________________________

b Was your property occupied by your spouse?

Yes

No

c Did your property remain unoccupied?

Yes

No

10

Are you liable for the payment of real estate taxes?

Yes

No

Step 3:

Sign below

I state that to the best of my knowledge, the information contained on this application is true, correct, and complete.

____________________________________________________

___ ___/___ ___/___ ___ ___ ___

Property owner’s or authorized representative’s signature

Month

Day

Year

PTAX-342-R (R-08/15)

1

1 2

2