Form Ptax-342-R - Annual Verification Of Eligibility For Disabled Veterans' Standard Homestead Exemption

ADVERTISEMENT

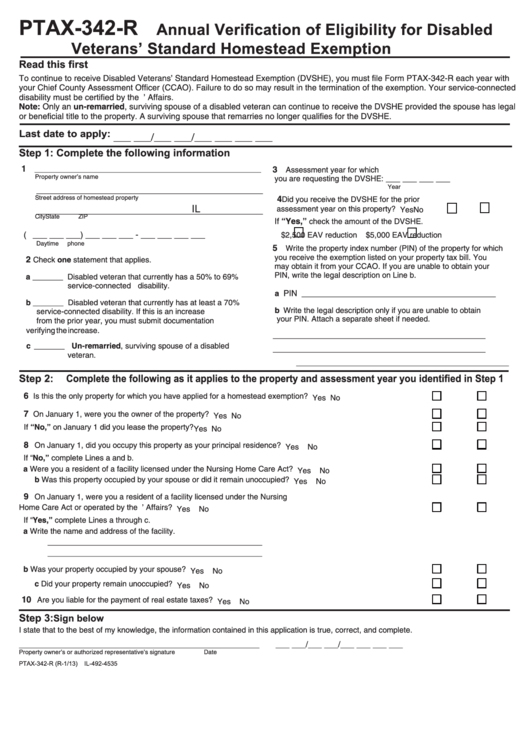

PTAX-342-R

$QQXDO 9HUL¿FDWLRQ RI (OLJLELOLW\ IRU 'LVDEOHG

9HWHUDQV¶ 6WDQGDUG +RPHVWHDG ([HPSWLRQ

5HDG WKLV ¿UVW

To continue to receive Disabled Veterans’ Standard Homestead Exemption (DVSHE), you must file Form PTAX-342-R each year with

your Chief County Assessment Officer (CCAO). Failure to do so may result in the termination of the exemption. Your service-connected

disability must be certified by the U.S. Department of Veterans’ Affairs.

Note: Only an un-remarried, surviving spouse of a disabled veteran can continue to receive the DVSHE provided the spouse has legal

or beneficial title to the property. A surviving spouse that remarries no longer qualifies for the DVSHE.

/DVW GDWH WR DSSO\

___ ___/___ ___/___ ___ ___ ___

Step 1:

Complete the following information

1

_________________________________________________

3

Assessment year for which

Property owner’s name

___ ___ ___ ___

you are requesting the DVSHE:

Year

_________________________________________________

Street address of homestead property

4

Did you receive the DVSHE for the prior

IL

assessment year on this property?

Yes

No

_________________________________________________

City

State

ZIP

If “Yes,”

check the amount of the DVSHE.

___ ___ ___

___ ___ ___ - ___ ___ ___ ___

(

)

$2,500 EAV reduction

$5,000 EAV reduction

Daytime phone

5

Write the property index number (PIN) of the property for which

you receive the exemption listed on your property tax bill. You

2

Check one statement that applies.

may obtain it from your CCAO. If you are unable to obtain your

PIN, write the legal description on Line b.

a _______ Disabled veteran that currently has a 50% to 69%

service-connected disability.

PIN __________________________________________

a

b _______ Disabled veteran that currently has at least a 70%

b Write the legal description only if you are unable to obtain

service-connected disability. If this is an increase

your PIN. Attach a separate sheet if needed.

from the prior year, you must submit documentation

verifying the increase.

______________________________________________

c _______ Un-remarried, surviving spouse of a disabled

______________________________________________

veteran.

______________________________________________

Step 2:

&RPSOHWH WKH IROORZLQJ DV LW DSSOLHV WR WKH SURSHUW\ DQG DVVHVVPHQW \HDU \RX LGHQWL¿HG LQ 6WHS

6

Is this the only property for which you have applied for a homestead exemption?

Yes

No

7

On January 1, were you the owner of the property?

Yes

No

If “No,” on January 1 did you lease the property?

Yes

No

8

On January 1, did you occupy this property as your principal residence?

Yes

No

If “No,” complete Lines a and b.

a Were you a resident of a facility licensed under the Nursing Home Care Act?

Yes

No

b Was this property occupied by your spouse or did it remain unoccupied?

Yes

No

9

On January 1, were you a resident of a facility licensed under the Nursing

Home Care Act or operated by the U.S. Department of Veterans’ Affairs?

Yes

No

If “Yes,” complete Lines a through c.

a Write the name and address of the facility.

_________________________________________________

_________________________________________________

b Was your property occupied by your spouse?

Yes

No

c Did your property remain unoccupied?

Yes

No

10

Are you liable for the payment of real estate taxes?

Yes

No

Step 3:

6LJQ EHORZ

I state that to the best of my knowledge, the information contained in this application is true, correct, and complete.

____________________________________________________

___ ___/___ ___/___ ___ ___ ___

Property owner’s or authorized representative’s signature

Date

PTAX-342-R (R-1/13)

IL-492-4535

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1