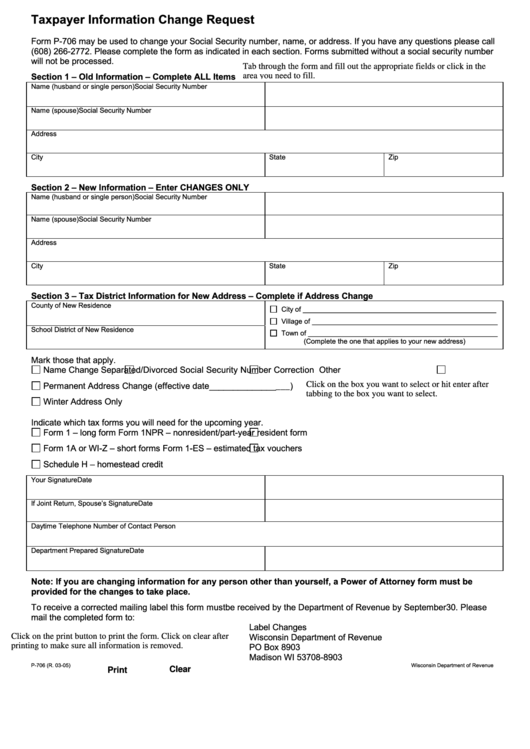

Taxpayer Information Change Request

Form P-706 may be used to change your Social Security number, name, or address. If you have any questions please call

(608) 266-2772. Please complete the form as indicated in each section. Forms submitted without a social security number

will not be processed.

Tab through the form and fill out the appropriate fields or click in the

Section 1 – Old Information – Complete ALL Items

area you need to fill.

Name (husband or single person)

Social Security Number

Name (spouse)

Social Security Number

Address

City

State

Zip

Section 2 – New Information – Enter CHANGES ONLY

Name (husband or single person)

Social Security Number

Name (spouse)

Social Security Number

Address

City

State

Zip

Section 3 – Tax District Information for New Address – Complete if Address Change

County of New Residence

City of __________________________________________________

Village of ________________________________________________

School District of New Residence

Town of _________________________________________________

(Complete the one that applies to your new address)

Mark those that apply.

Name Change

Separated/Divorced

Social Security Number Correction

Other

Permanent Address Change (effective date_________________)

Click on the box you want to select or hit enter after

tabbing to the box you want to select.

Winter Address Only

Indicate which tax forms you will need for the upcoming year.

Form 1 – long form

Form 1NPR – nonresident/part-year resident form

Form 1A or WI-Z – short forms

Form 1-ES – estimated tax vouchers

Schedule H – homestead credit

Your Signature

Date

If Joint Return, Spouse’s Signature

Date

Daytime Telephone Number of Contact Person

Department Prepared Signature

Date

Note: If you are changing information for any person other than yourself, a Power of Attorney form must be

provided for the changes to take place.

To receive a corrected mailing label this form must be received by the Department of Revenue by September 30. Please

mail the completed form to:

Label Changes

Wisconsin Department of Revenue

Click on the print button to print the form. Click on clear after

printing to make sure all information is removed.

PO Box 8903

Madison WI 53708-8903

P-706 (R. 03-05)

Wisconsin Department of Revenue

Print

Clear

1

1