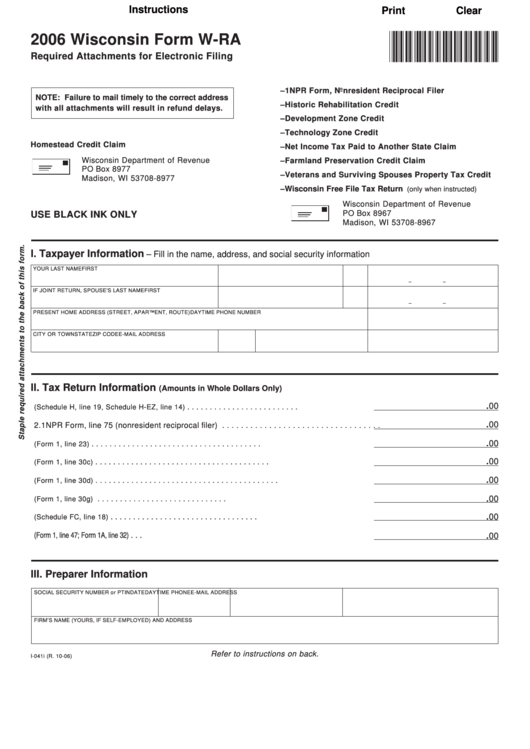

Instructions

Print

Clear

*I1RA06991*

2006 Wisconsin Form W-RA

Required Attachments for Electronic Filing

– 1NPR Form, Nonresident Reciprocal Filer

NOTE: Failure to mail timely to the correct address

– Historic Rehabilitation Credit

with all attachments will result in refund delays.

– Development Zone Credit

– Technology Zone Credit

Homestead Credit Claim

– Net Income Tax Paid to Another State Claim

Wisconsin Department of Revenue

– Farmland Preservation Credit Claim

PO Box 8977

– Veterans and Surviving Spouses Property Tax Credit

Madison, WI 53708-8977

– Wisconsin Free File Tax Return

(only when instructed)

Wisconsin Department of Revenue

PO Box 8967

USE BLACK INK ONLY

Madison, WI 53708-8967

I. Taxpayer Information

– Fill in the name, address, and social security information

YOUR LAST NAME

FIRST NAME

M.I.

SOCIAL SECURITY NUMBER

IF JOINT RETURN, SPOUSE'S LAST NAME

FIRST NAME

M.I.

SOCIAL SECURITY NUMBER

PRESENT HOME ADDRESS (STREET, APARTMENT, ROUTE)

DAYTIME PHONE NUMBER

CITY OR TOWN

STATE

ZIP CODE

E-MAIL ADDRESS

II. Tax Return Information

(Amounts in Whole Dollars Only)

.00

1. Homestead Credit

. . . . . . . . . . . . . . . . . . . . . . . . .

(Schedule H, line 19, Schedule H-EZ, line 14)

.00

2. 1NPR Form, line 75 (nonresident reciprocal filer) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

3. Historic Rehabilitation Credit

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Form 1, line 23)

.00

4. Development Zone Credit

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Form 1, line 30c)

.00

5. Technology Zone Credit

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Form 1, line 30d)

6. Net Income Tax Paid to Another State

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

(Form 1, line 30g)

7. Farmland Preservation Credit

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

(Schedule FC, line 18)

8. Eligible Veterans and Surviving Spouses Property Tax Credit (Form 1, line 47; Form 1A, line 32) . . .

.00

III. Preparer Information

SOCIAL SECURITY NUMBER or PTIN

DATE

DAYTIME PHONE

E-MAIL ADDRESS

FIRM’S NAME (YOURS, IF SELF-EMPLOYED) AND ADDRESS

Refer to instructions on back.

I-041i (R. 10-06)

1

1