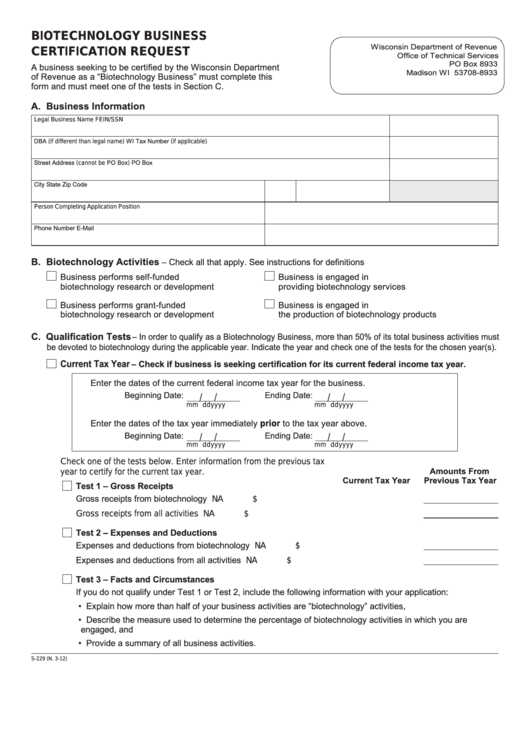

Form S-229 - Biotechnology Business Certification Request - Wisconsin Department Of Revenue

ADVERTISEMENT

BIOTECHNOLOGY BUSINESS

Wisconsin Department of Revenue

CERTIFICATION REQUEST

Office of Technical Services

PO Box 8933

A business seeking to be certified by the Wisconsin Department

Madison WI 53708-8933

of Revenue as a “Biotechnology Business” must complete this

DORISETechnicalServices@revenue.wi.gov

form and must meet one of the tests in Section C.

A. Business Information

Legal Business Name

FEIN/SSN

DBA (if different than legal name)

WI Tax Number (if applicable)

Street Address (cannot be PO Box)

PO Box

City

State

Zip Code

Person Completing Application

Position

Phone Number

E-Mail

B. Biotechnology Activities

– Check all that apply. See instructions for definitions

Business performs self-funded

Business is engaged in

biotechnology research or development

providing biotechnology services

Business performs grant-funded

Business is engaged in

biotechnology research or development

the production of biotechnology products

C. Qualification Tests

– In order to qualify as a Biotechnology Business, more than 50% of its total business activities must

be devoted to biotechnology during the applicable year. Indicate the year and check one of the tests for the chosen year(s).

Current Tax Year

– Check if business is seeking certification for its current federal income tax year.

Enter the dates of the current federal income tax year for the business.

Beginning Date:

Ending Date:

/

/

/

/

mm dd

yyyy

mm dd

yyyy

Enter the dates of the tax year immediately prior to the tax year above.

Beginning Date:

Ending Date:

/

/

/

/

mm dd

yyyy

mm dd

yyyy

Check one of the tests below. Enter information from the previous tax

Amounts From

year to certify for the current tax year.

Current Tax Year

Previous Tax Year

Test 1 – Gross Receipts

Gross receipts from biotechnology . . . . . . . . . . . . . . . . . . . . . . . . . . .

NA

$

Gross receipts from all activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NA

$

Test 2 – Expenses and Deductions

Expenses and deductions from biotechnology . . . . . . . . . . . . . . . . . .

NA

$

Expenses and deductions from all activities . . . . . . . . . . . . . . . . . . . .

NA

$

Test 3 – Facts and Circumstances

If you do not qualify under Test 1 or Test 2, include the following information with your application:

• Explain how more than half of your business activities are “biotechnology” activities,

• Describe the measure used to determine the percentage of biotechnology activities in which you are

engaged, and

• Provide a summary of all business activities.

S-229 (N. 3-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3