Business Income Tax Return Form - City Of Wooster - 2005

ADVERTISEMENT

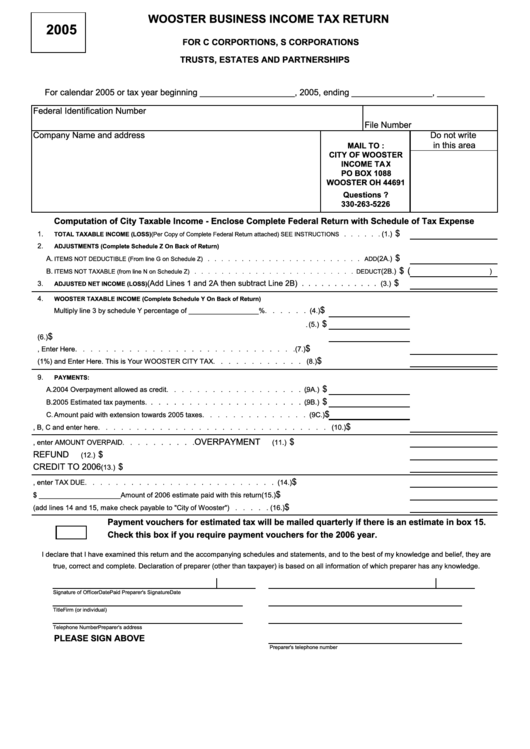

WOOSTER BUSINESS INCOME TAX RETURN

2005

FOR C CORPORTIONS, S CORPORATIONS

TRUSTS, ESTATES AND PARTNERSHIPS

For calendar 2005 or tax year beginning ____________________, 2005, ending _________________, __________

Federal Identification Number

File Number

Company Name and address

Do not write

in this area

MAIL TO :

CITY OF WOOSTER

INCOME TAX

PO BOX 1088

WOOSTER OH 44691

Questions ?

330-263-5226

Computation of City Taxable Income - Enclose Complete Federal Return with Schedule of Tax Expense

$

1.

(1.)

TOTAL TAXABLE INCOME (LOSS) (Per Copy of Complete Federal Return attached) SEE INSTRUCTIONS . . . . . .

2.

ADJUSTMENTS (Complete Schedule Z On Back of Return)

$

A.

(2A.)

ITEMS NOT DEDUCTIBLE (From line G on Schedule Z) . . . . . . . . . . . . . . . . . . . . . . . ADD

$ (

B.

(2B.)

)

ITEMS NOT TAXABLE (from line N on Schedule Z) . . . . . . . . . . . . . . . . . . . . . . . . DEDUCT

$

(Add Lines 1 and 2A then subtract Line 2B) . . . . . . . . . . . .

3.

(3.)

ADJUSTED NET INCOME (LOSS)

4.

WOOSTER TAXABLE INCOME (Complete Schedule Y On Back of Return)

$

Multiply line 3 by schedule Y percentage of __________________%. . . . . . (4.)

$

5.

Net Operating Loss Carry Forward Applicable to City of Wooster. . . . . . . . (5.)

$

6.

Subtract Line 5 from 4. . . . . . . . . . . . . . . . . . . . . . . . (6.)

$

7.

If Line 6 is Greater than 0, Enter Here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7.)

$

8.

Multiply Line 7 by .01 (1%) and Enter Here. This is Your WOOSTER CITY TAX. . . . . . . . . . . . (8.)

9.

PAYMENTS:

$

A. 2004 Overpayment allowed as credit. . . . . . . . . . . . . . . . . . . (9A.)

$

B. 2005 Estimated tax payments. . . . . . . . . . . . . . . . . . . . . . (9B.)

$

C. Amount paid with extension towards 2005 taxes. . . . . . . . . . . . . . (9C.)

$

10.

Add lines 9A, B, C and enter here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10.)

OVERPAYMENT

$

11.

If line 10 is greater than line 8, enter AMOUNT OVERPAID. . . . . . . . . .

(11.)

REFUND

$

12.

Amount of line 11 to be refunded. . . . . . . . . . . . . . . . . . . . . . . .

(12.)

CREDIT TO 2006

$

13.

Amount of line 11 to be applied towards 2006 estimated taxes. . . . . . . . . .

(13.)

$

14.

If line 8 is greater than line 10, enter TAX DUE. . . . . . . . . . . . . . . . . . . . . . . . . (14.)

$

15.

TOTAL 2006 estimate $ _____________________

Amount of 2006 estimate paid with this return

(15.)

$

16.

AMOUNT DUE WITH RETURN (add lines 14 and 15, make check payable to "City of Wooster") . . . . . (16.)

Payment vouchers for estimated tax will be mailed quarterly if there is an estimate in box 15.

Check this box if you require payment vouchers for the 2006 year.

I declare that I have examined this return and the accompanying schedules and statements, and to the best of my knowledge and belief, they are

true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature of Officer

Date

Paid Preparer's Signature

Date

Title

Firm (or individual)

Telephone Number

Preparer's address

PLEASE SIGN ABOVE

Preparer's telephone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2