Instructions For Form 990-Pf - Return Of Private Foundation Or Section 4947(A)(1) Nonexempt Charitable Trust Treated As A Private Foundation - Return Of Private Foundation Or Section 4947(A)(1) Nonexempt Charitable Trust Treated As A Private Foundation -

ADVERTISEMENT

05

2 0

Department of the Treasury

Internal Revenue Service

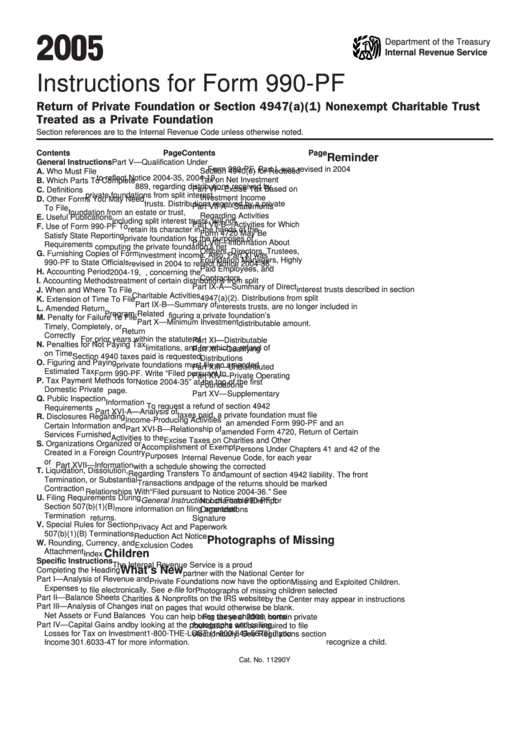

Instructions for Form 990-PF

Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust

Treated as a Private Foundation

Section references are to the Internal Revenue Code unless otherwise noted.

Contents

Page

Contents

Page

Reminder

General Instructions

Part V — Qualification Under

Form 990-PF, Part I, was revised in 2004

Section 4940(e) for Reduced

A. Who Must File . . . . . . . . . . . . . . . . 2

to reflect Notice 2004-35, 2004-19, I.R.B.

Tax on Net Investment Income . . . 18

B. Which Parts To Complete . . . . . . . . 2

889, regarding distributions received by

Part VI — Excise Tax Based on

C. Definitions . . . . . . . . . . . . . . . . . . . 2

private foundations from split interest

Investment Income . . . . . . . . . . . . 18

D. Other Forms You May Need

trusts. Distributions received by a private

Part VII-A — Statements

To File . . . . . . . . . . . . . . . . . . . . . . 3

foundation from an estate or trust,

Regarding Activities . . . . . . . . . . . 19

E. Useful Publications . . . . . . . . . . . . . 4

including split interest trusts, will not

Part VII-B — Activities for Which

F. Use of Form 990-PF To

retain its character in the hands of the

Form 4720 May Be Required . . . . . 20

Satisfy State Reporting

private foundation for the purposes of

Part VIII — Information About

Requirements . . . . . . . . . . . . . . . . . 4

computing the private foundation’s net

Officers, Directors, Trustees,

G. Furnishing Copies of Form

investment income. Also, Part XI was

Foundation Managers, Highly

990-PF to State Officials . . . . . . . . . 5

revised in 2004 to reflect Notice 2004-36,

Paid Employees, and

H. Accounting Period . . . . . . . . . . . . . 5

2004-19, I.R.B. 889, concerning the

Contractors . . . . . . . . . . . . . . . . . 21

I. Accounting Methods . . . . . . . . . . . . 5

treatment of certain distributions from split

Part IX-A — Summary of Direct

interest trusts described in section

J. When and Where To File . . . . . . . . 5

Charitable Activities . . . . . . . . . . . . 21

4947(a)(2). Distributions from split

K. Extension of Time To File . . . . . . . . 5

Part IX-B — Summary of

interests trusts, are no longer included in

L. Amended Return . . . . . . . . . . . . . . 5

Program-Related Investments

. . . 22

figuring a private foundation’s

M. Penalty for Failure To File

Part X — Minimum Investment

distributable amount.

Timely, Completely, or

Return . . . . . . . . . . . . . . . . . . . . . 22

Correctly . . . . . . . . . . . . . . . . . . . . 6

For prior years within the statute of

Part XI — Distributable Amount . . . . . 23

N. Penalties for Not Paying Tax

limitations, and for which a refund of

Part XII — Qualifying

on Time . . . . . . . . . . . . . . . . . . . . . 6

Section 4940 taxes paid is requested,

Distributions . . . . . . . . . . . . . . . . . 24

O. Figuring and Paying

private foundations must file an amended

Part XIII — Undistributed Income

. . . 24

Estimated Tax . . . . . . . . . . . . . . . . 6

Form 990-PF. Write “Filed pursuant to

Part XIV — Private Operating

P. Tax Payment Methods for

Notice 2004-35” at the top of the first

Foundations . . . . . . . . . . . . . . . . . 26

Domestic Private Foundations

. . . . 6

page.

Part XV — Supplementary

Q. Public Inspection

Information . . . . . . . . . . . . . . . . . . 26

To request a refund of section 4942

Requirements . . . . . . . . . . . . . . . . . 7

Part XVI-A — Analysis of

taxes paid, a private foundation must file

R. Disclosures Regarding

Income-Producing Activities . . . . . . 26

an amended Form 990-PF and an

Certain Information and

Part XVI-B — Relationship of

amended Form 4720, Return of Certain

Services Furnished . . . . . . . . . . . . . 9

Activities to the

Excise Taxes on Charities and Other

S. Organizations Organized or

Accomplishment of Exempt

Persons Under Chapters 41 and 42 of the

Created in a Foreign Country

Purposes . . . . . . . . . . . . . . . . . . . 27

Internal Revenue Code, for each year

or U.S. Possession . . . . . . . . . . . . . 9

Part XVII — Information

with a schedule showing the corrected

T. Liquidation, Dissolution,

Regarding Transfers To and

amount of section 4942 liability. The front

Termination, or Substantial

Transactions and

page of the returns should be marked

Contraction . . . . . . . . . . . . . . . . . . . 9

Relationships With

“Filed pursuant to Notice 2004-36.” See

U. Filing Requirements During

Noncharitable Exempt

General Instruction L of Form 990-PF for

Section 507(b)(1)(B)

more information on filing amended

Organizations . . . . . . . . . . . . . . . . 27

Termination . . . . . . . . . . . . . . . . . 10

returns.

Signature . . . . . . . . . . . . . . . . . . . . 28

V. Special Rules for Section

Privacy Act and Paperwork

507(b)(1)(B) Terminations . . . . . . . 10

Reduction Act Notice . . . . . . . . . . . 28

Photographs of Missing

W. Rounding, Currency, and

Exclusion Codes . . . . . . . . . . . . . . . 30

Attachments . . . . . . . . . . . . . . . . . 10

Children

Index . . . . . . . . . . . . . . . . . . . . . . . . 31

Specific Instructions

The Internal Revenue Service is a proud

What’s New

Completing the Heading . . . . . . . . . . 10

partner with the National Center for

Part I — Analysis of Revenue and

Private Foundations now have the option

Missing and Exploited Children.

Expenses . . . . . . . . . . . . . . . . . . . 11

to file electronically. See e-file for

Photographs of missing children selected

Part II — Balance Sheets . . . . . . . . . . 15

Charities & Nonprofits on the IRS website

by the Center may appear in instructions

Part III — Analysis of Changes in

at

on pages that would otherwise be blank.

Net Assets or Fund Balances . . . . . 17

You can help bring these children home

For tax year 2006, certain private

Part IV — Capital Gains and

by looking at the photographs and calling

foundations will be required to file

Losses for Tax on Investment

1-800-THE-LOST (1-800-843-5678) if you

electronically. See Regulations section

recognize a child.

Income . . . . . . . . . . . . . . . . . . . . . 17

301.6033-4T for more information.

Cat. No. 11290Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31