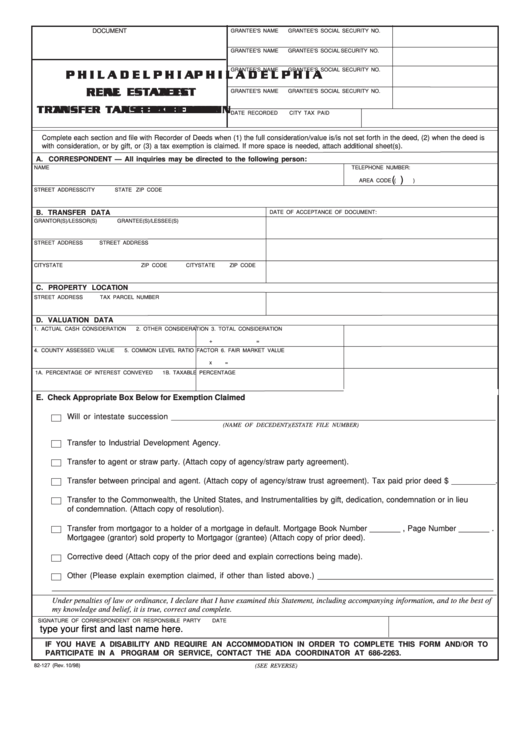

DOCUMENT I.D. NUMBER

GRANTEE'S NAME

GRANTEE'S SOCIAL SECURITY NO.

GRANTEE'S NAME

GRANTEE'S SOCIAL SECURITY NO.

GRANTEE'S NAME

GRANTEE'S SOCIAL SECURITY NO.

P H I L A D E L P H I A

P H I L A D E L P H I A

P H I L A D E L P H I A

P H I L A D E L P H I A

P H I L A D E L P H I A

RE

RE

AL EST

AL EST

AL ESTA A A A A TE

TE

TE

RE

RE

REAL EST

AL EST

TE

TE

GRANTEE'S NAME

GRANTEE'S SOCIAL SECURITY NO.

TR

TR

ANSFER T

ANSFER T

ANSFER TA A A A A X CER

X CER

X CER

TIFIC

TIFIC

TIFICA A A A A TI

TI TI

TI TIO O O O O N N N N N

TR

TRANSFER T

TR

ANSFER T

X CER

X CERTIFIC

TIFIC

DATE RECORDED

CITY TAX PAID

Complete each section and file with Recorder of Deeds when (1) the full consideration/value is/is not set forth in the deed, (2) when the deed is

with consideration, or by gift, or (3) a tax exemption is claimed. If more space is needed, attach additional sheet(s).

A. CORRESPONDENT — All inquiries may be directed to the following person:

NAME

TELEPHONE NUMBER:

( )

AREA CODE (

)

STREET ADDRESS

CITY

STATE

ZIP CODE

B. TRANSFER DATA

DATE OF ACCEPTANCE OF DOCUMENT:

GRANTOR(S)/LESSOR(S)

GRANTEE(S)/LESSEE(S)

STREET ADDRESS

STREET ADDRESS

CITY

STATE

ZIP CODE

CITY

STATE

ZIP CODE

C. PROPERTY LOCATION

STREET ADDRESS

TAX PARCEL NUMBER

D. VALUATION DATA

1. ACTUAL CASH CONSIDERATION

2. OTHER CONSIDERATION

3. TOTAL CONSIDERATION

+

=

4. COUNTY ASSESSED VALUE

5. COMMON LEVEL RATIO FACTOR

6. FAIR MARKET VALUE

x

=

1A. PERCENTAGE OF INTEREST CONVEYED

1B. TAXABLE PERCENTAGE

E. Check Appropriate Box Below for Exemption Claimed

Will or intestate succession ________________________________________________________________________

(NAME OF DECEDENT)

(ESTATE FILE NUMBER)

Transfer to Industrial Development Agency.

Transfer to agent or straw party. (Attach copy of agency/straw party agreement).

Transfer between principal and agent. (Attach copy of agency/straw trust agreement). Tax paid prior deed $ __________.

Transfer to the Commonwealth, the United States, and Instrumentalities by gift, dedication, condemnation or in lieu

of condemnation. (Attach copy of resolution).

Transfer from mortgagor to a holder of a mortgage in default. Mortgage Book Number _______ , Page Number _______ .

Mortgagee (grantor) sold property to Mortgagor (grantee) (Attach copy of prior deed).

Corrective deed (Attach copy of the prior deed and explain corrections being made).

Other (Please explain exemption claimed, if other than listed above.) ________________________________________

________________________________________________________________________________________________

Under penalties of law or ordinance, I declare that I have examined this Statement, including accompanying information, and to the best of

my knowledge and belief, it is true, correct and complete.

SIGNATURE OF CORRESPONDENT OR RESPONSIBLE PARTY

DATE

type your first and last name here.

IF YOU HAVE A DISABILITY AND REQUIRE AN ACCOMMODATION IN ORDER TO COMPLETE THIS FORM AND/OR TO

PARTICIPATE IN A PROGRAM OR SERVICE, CONTACT THE ADA COORDINATOR AT 686-2263.

82-127 (Rev. 10/98)

(SEE REVERSE)

reset

print

1

1 2

2