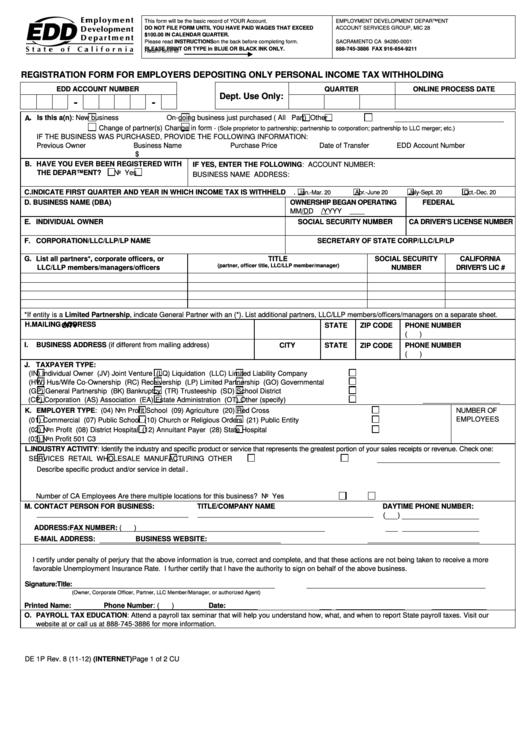

This form will be the basic record of YOUR Account.

EMPLOYMENT DEVELOPMENT DEPARTMENT

DO NOT FILE FORM UNTIL YOU HAVE PAID WAGES THAT EXCEED

ACCOUNT SERVICES GROUP, MIC 28

$100.00 IN CALENDAR QUARTER.

P.O. BOX 826880

Please read INSTRUCTIONS on the back before completing form.

SACRAMENTO CA 94280-0001

PLEASE PRINT OR TYPE in BLUE OR BLACK INK ONLY.

888-745-3886 FAX 916-654-9211

Return form to

REGISTRATION FORM FOR EMPLOYERS DEPOSITING ONLY PERSONAL INCOME TAX WITHHOLDING

EDD ACCOUNT NUMBER

QUARTER

ONLINE PROCESS DATE

Dept. Use Only:

-

-

.

A

Is this a(n):

New business

On-going business just purchased (

All

Part)

Other

Change of partner(s)

Change in form

- (Sole proprietor to partnership; partnership to corporation; partnership to LLC merger; etc.)

IF THE BUSINESS WAS PURCHASED, PROVIDE THE FOLLOWING INFORMATION:

Previous Owner

Business Name

Purchase Price

Date of Transfer

EDD Account Number

$

B. HAVE YOU EVER BEEN REGISTERED WITH

IF YES, ENTER THE FOLLOWING: ACCOUNT NUMBER:

THE DEPARTMENT?

No

Yes

BUSINESS NAME

ADDRESS:

C. INDICATE FIRST QUARTER AND YEAR IN WHICH INCOME TAX IS WITHHELD.

Jan.-Mar. 20

Apr.-June 20

July-Sept. 20

Oct.-Dec. 20

D. BUSINESS NAME (DBA)

OWNERSHIP BEGAN OPERATING

FEDERAL I.D. NUMBER

MM

/DD

/YYYY

E. INDIVIDUAL OWNER

SOCIAL SECURITY NUMBER

CA DRIVER'S LICENSE NUMBER

F. CORPORATION/LLC/LLP/LP NAME

SECRETARY OF STATE CORP/LLC/LP/LP I.D. NO.

G. List all partners*, corporate officers, or

TITLE

SOCIAL SECURITY

CALIFORNIA

LLC/LLP members/managers/officers

(partner, officer title, LLC/LLP member/manager)

NUMBER

DRIVER'S LIC #

*If entity is a Limited Partnership, indicate General Partner with an (*). List additional partners, LLC/LLP members/officers/managers on a separate sheet.

H. MAILING ADDRESS

CITY

STATE

ZIP CODE

PHONE NUMBER

(

)

I.

BUSINESS ADDRESS (if different from mailing address)

CITY

STATE

ZIP CODE

PHONE NUMBER

(

)

J. TAXPAYER TYPE:

(IN) Individual Owner

(JV) Joint Venture

(LQ) Liquidation

(LLC) Limited Liability Company

(HW) Hus/Wife Co-Ownership

(RC) Receivership

(LP) Limited Partnership

(GO) Governmental

(GP) General Partnership

(BK) Bankruptcy

(TR) Trusteeship

(SD) School District

(CP) Corporation

(AS) Association

(EA) Estate Administration

(OT) Other (specify)

K. EMPLOYER TYPE:

(04) Non Profit School

(09) Agriculture

(20) Red Cross

NUMBER OF

EMPLOYEES

(01) Commercial

(07) Public School

(10) Church or Religious Orders

(21) Public Entity

(02) Non Profit

(08) District Hospital

(12) Annuitant Payer

(28) State Hospital

(03) Non Profit 501 C3

L. INDUSTRY ACTIVITY: Identify the industry and specific product or service that represents the greatest portion of your sales receipts or revenue. Check one:

SERVICES

RETAIL

WHOLESALE

MANUFACTURING

OTHER

Describe specific product and/or service in detail.

Number of CA Employees

Are there multiple locations for this business?

No

Yes

M. CONTACT PERSON FOR BUSINESS:

TITLE/COMPANY NAME

DAYTIME PHONE NUMBER:

(

)

ADDRESS:

FAX NUMBER: (

)

E-MAIL ADDRESS:

BUSINESS WEBSITE:

N. DECLARATION

I certify under penalty of perjury that the above information is true, correct and complete, and that these actions are not being taken to receive a more

favorable Unemployment Insurance Rate. I further certify that I have the authority to sign on behalf of the above business.

Signature:

Title:

(Owner, Corporate Officer, Partner, LLC Member/Manager, or authorized Agent)

Printed Name:

Phone Number: (

)

Date:

O. PAYROLL TAX EDUCATION: Attend a payroll tax seminar that will help you understand how, what, and when to report State payroll taxes. Visit our

website at /Payroll_Tax_Seminars/ or call us at 888-745-3886 for more information.

DE 1P Rev. 8 (11-12) (INTERNET)

Page 1 of 2

CU

1

1