Instructions For De 1p Registration Form For Employers Depositing Only Personal Income Tax Withholding

ADVERTISEMENT

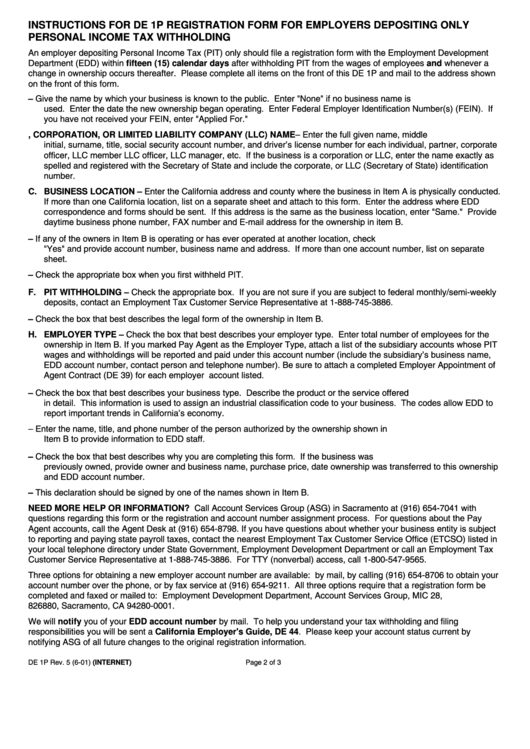

INSTRUCTIONS FOR DE 1P REGISTRATION FORM FOR EMPLOYERS DEPOSITING ONLY

PERSONAL INCOME TAX WITHHOLDING

An employer depositing Personal Income Tax (PIT) only should file a registration form with the Employment Development

Department (EDD) within fifteen (15) calendar days after withholding PIT from the wages of employees and whenever a

change in ownership occurs thereafter. Please complete all items on the front of this DE 1P and mail to the address shown

on the front of this form.

A. BUSINESS NAME – Give the name by which your business is known to the public. Enter "None" if no business name is

used. Enter the date the new ownership began operating. Enter Federal Employer Identification Number(s) (FEIN). If

you have not received your FEIN, enter "Applied For."

B. OWNER, CORPORATION, OR LIMITED LIABILITY COMPANY (LLC) NAME – Enter the full given name, middle

initial, surname, title, social security account number, and driver’s license number for each individual, partner, corporate

officer, LLC member LLC officer, LLC manager, etc. If the business is a corporation or LLC, enter the name exactly as

spelled and registered with the Secretary of State and include the corporate, or LLC (Secretary of State) identification

number.

C. BUSINESS LOCATION – Enter the California address and county where the business in Item A is physically conducted.

If more than one California location, list on a separate sheet and attach to this form. Enter the address where EDD

correspondence and forms should be sent. If this address is the same as the business location, enter "Same." Provide

daytime business phone number, FAX number and E-mail address for the ownership in item B.

D. PRIOR REGISTRATION – If any of the owners in Item B is operating or has ever operated at another location, check

"Yes" and provide account number, business name and address. If more than one account number, list on separate

sheet.

E. FIRST QUARTER PIT WITHHELD – Check the appropriate box when you first withheld PIT.

F. PIT WITHHOLDING – Check the appropriate box. If you are not sure if you are subject to federal monthly/semi-weekly

deposits, contact an Employment Tax Customer Service Representative at 1-888-745-3886.

G. ORGANIZATION TYPE – Check the box that best describes the legal form of the ownership in Item B.

H. EMPLOYER TYPE – Check the box that best describes your employer type. Enter total number of employees for the

ownership in Item B. If you marked Pay Agent as the Employer Type, attach a list of the subsidiary accounts whose PIT

wages and withholdings will be reported and paid under this account number (include the subsidiary’s business name,

EDD account number, contact person and telephone number). Be sure to attach a completed Employer Appointment of

Agent Contract (DE 39) for each employer account listed.

I.

BUSINESS TYPE – Check the box that best describes your business type. Describe the product or the service offered

in detail. This information is used to assign an industrial classification code to your business. The codes allow EDD to

report important trends in California’s economy.

J. CONTACT PERSON – Enter the name, title, and phone number of the person authorized by the ownership shown in

Item B to provide information to EDD staff.

K. STATUS OF BUSINESS – Check the box that best describes why you are completing this form. If the business was

previously owned, provide owner and business name, purchase price, date ownership was transferred to this ownership

and EDD account number.

L. DECLARATION – This declaration should be signed by one of the names shown in Item B.

NEED MORE HELP OR INFORMATION? Call Account Services Group (ASG) in Sacramento at (916) 654-7041 with

questions regarding this form or the registration and account number assignment process. For questions about the Pay

Agent accounts, call the Agent Desk at (916) 654-8798. If you have questions about whether your business entity is subject

to reporting and paying state payroll taxes, contact the nearest Employment Tax Customer Service Office (ETCSO) listed in

your local telephone directory under State Government, Employment Development Department or call an Employment Tax

Customer Service Representative at 1-888-745-3886. For TTY (nonverbal) access, call 1-800-547-9565.

Three options for obtaining a new employer account number are available: by mail, by calling (916) 654-8706 to obtain your

account number over the phone, or by fax service at (916) 654-9211. All three options require that a registration form be

completed and faxed or mailed to: Employment Development Department, Account Services Group, MIC 28, P.O. Box

826880, Sacramento, CA 94280-0001.

We will notify you of your EDD account number by mail. To help you understand your tax withholding and filing

responsibilities you will be sent a California Employer's Guide, DE 44. Please keep your account status current by

notifying ASG of all future changes to the original registration information.

DE 1P Rev. 5 (6-01) (INTERNET)

Page 2 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2