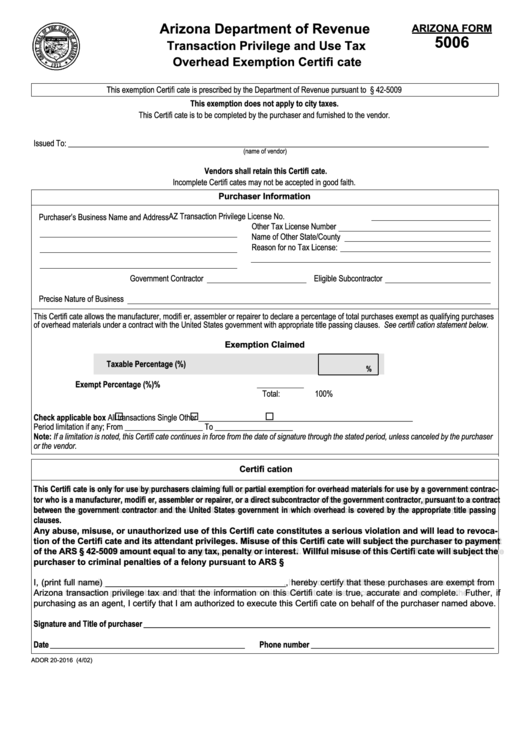

Arizona Department of Revenue

ARIZONA FORM

5006

Transaction Privilege and Use Tax

Overhead Exemption Certifi cate

This exemption Certifi cate is prescribed by the Department of Revenue pursuant to A.R.S. § 42-5009

This exemption does not apply to city taxes.

This Certifi cate is to be completed by the purchaser and furnished to the vendor.

Issued To: ____________________________________________________________________________________________________________

(name of vendor)

Vendors shall retain this Certifi cate.

Incomplete Certifi cates may not be accepted in good faith.

Purchaser Information

Purchaser Information

AZ Transaction Privilege License No.

Purchaser’s Business Name and Address

Other Tax License Number

Name of Other State/County

Reason for no Tax License:

Government Contractor

Eligible Subcontractor

Precise Nature of Business

This Certifi cate allows the manufacturer, modifi er, assembler or repairer to declare a percentage of total purchases exempt as qualifying purchases

of overhead materials under a contract with the United States government with appropriate title passing clauses. See certifi cation statement below.

Exemption Claimed

Exemption Claimed

Taxable Percentage (%)

%

Exempt Percentage (%)

%

Total:

100%

Check applicable box

All transactions

Single

Other _______________________________________________________

Period limitation if any; From ____________________

To ____________________

Note: If a limitation is noted, this Certifi cate continues in force from the date of signature through the stated period, unless canceled by the purchaser

or the vendor.

Certifi cation

Certifi cation

This Certifi cate is only for use by purchasers claiming full or partial exemption for overhead materials for use by a government contrac-

This Certifi cate is only for use by purchasers claiming full or partial exemption for overhead materials for use by a government contrac-

tor who is a manufacturer, modifi er, assembler or repairer, or a direct subcontractor of the government contractor, pursuant to a contract

tor who is a manufacturer, modifi er, assembler or repairer, or a direct subcontractor of the government contractor, pursuant to a contract

between the government contractor and the United States government in which overhead is covered by the appropriate title passing

between the government contractor and the United States government in which overhead is covered by the appropriate title passing

clauses.

clauses.

Any abuse, misuse, or unauthorized use of this Certifi cate constitutes a serious violation and will lead to revoca-

Any abuse, misuse, or unauthorized use of this Certifi cate constitutes a serious violation and will lead to revoca-

tion of the Certifi cate and its attendant privileges. Misuse of this Certifi cate will subject the purchaser to payment

tion of the Certifi cate and its attendant privileges. Misuse of this Certifi cate will subject the purchaser to payment

of the ARS § 42-5009 amount equal to any tax, penalty or interest. Willful misuse of this Certifi cate will subject the

of the ARS § 42-5009 amount equal to any tax, penalty or interest. Willful misuse of this Certifi cate will subject the

purchaser to criminal penalties of a felony pursuant to ARS § 42-1127.B.2.

purchaser to criminal penalties of a felony pursuant to ARS § 42-1127.B.2.

I, (print full name) ______________________________________, hereby certify that these purchases are exempt from

I, (print full name) ______________________________________, hereby certify that these purchases are exempt from

Arizona transaction privilege tax and that the information on this Certifi cate is true, accurate and complete. Futher, if

Arizona transaction privilege tax and that the information on this Certifi cate is true, accurate and complete. Futher, if

purchasing as an agent, I certify that I am authorized to execute this Certifi cate on behalf of the purchaser named above.

purchasing as an agent, I certify that I am authorized to execute this Certifi cate on behalf of the purchaser named above.

Signature and Title of purchaser

Signature and Title of purchaser _________________________________________________________________________________________

_________________________________________________________________________________________

Date

Date __________________________________________________

__________________________________________________

Phone number

Phone number _______________________________________________

_______________________________________________

ADOR 20-2016 (4/02)

1

1