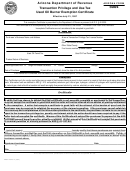

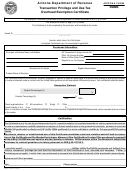

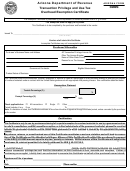

Form Ador 91-5420 - Arizona Tax Amnesty Application - Transaction Privilege And Use Tax

ADVERTISEMENT

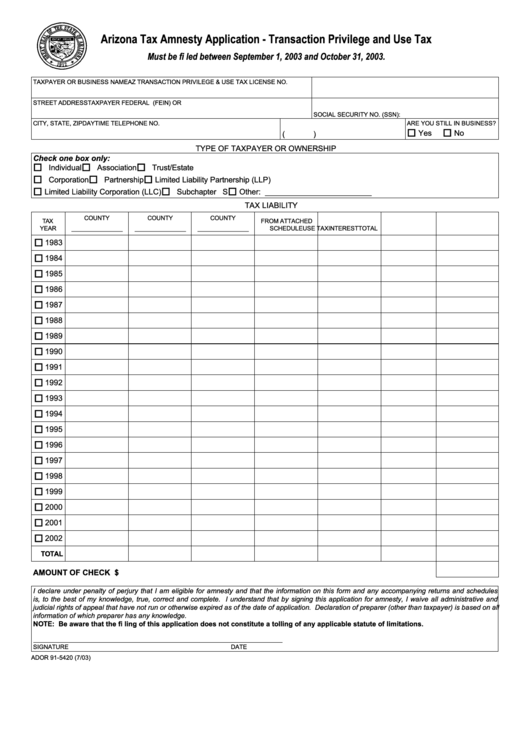

Arizona Tax Amnesty Application - Transaction Privilege and Use Tax

Must be fi led between September 1, 2003 and October 31, 2003.

TAXPAYER OR BUSINESS NAME

AZ TRANSACTION PRIVILEGE & USE TAX LICENSE NO.

STREET ADDRESS

TAXPAYER FEDERAL I.D. NO. (FEIN) OR

SOCIAL SECURITY NO. (SSN):

CITY, STATE, ZIP

DAYTIME TELEPHONE NO.

ARE YOU STILL IN BUSINESS?

Yes

No

(

)

TYPE OF TAXPAYER OR OWNERSHIP

Check one box only:

Individual

Association

Trust/Estate

Corporation

Partnership

Limited Liability Partnership (LLP)

Limited Liability Corporation (LLC)

Subchapter S

Other: _________________________

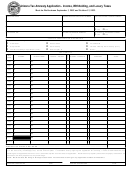

TAX LIABILITY

COUNTY

COUNTY

COUNTY

TAX

FROM ATTACHED

YEAR

_______________

_______________

_______________

SCHEDULE

USE TAX

INTEREST

TOTAL

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

TOTAL

AMOUNT OF CHECK ENCLOSED.............................................................................................................................

$

I declare under penalty of perjury that I am eligible for amnesty and that the information on this form and any accompanying returns and schedules

is, to the best of my knowledge, true, correct and complete. I understand that by signing this application for amnesty, I waive all administrative and

judicial rights of appeal that have not run or otherwise expired as of the date of application. Declaration of preparer (other than taxpayer) is based on all

information of which preparer has any knowledge.

NOTE: Be aware that the fi ling of this application does not constitute a tolling of any applicable statute of limitations.

SIGNATURE

DATE

ADOR 91-5420 (7/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2