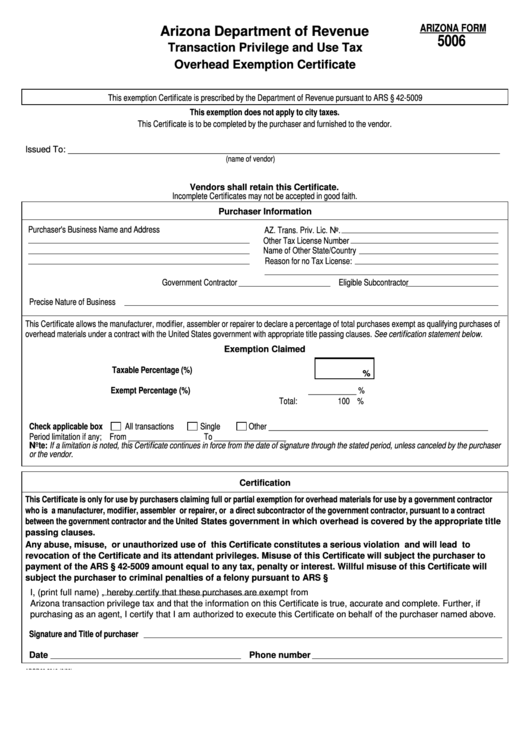

ARIZONA FORM

Arizona Department of Revenue

5006

Transaction Privilege and Use Tax

Overhead Exemption Certificate

This exemption Certificate is prescribed by the Department of Revenue pursuant to ARS § 42-5009

This exemption does not apply to city taxes.

This Certificate is to be completed by the purchaser and furnished to the vendor.

Issued To: __________________________________________________________________________________________

(name of vendor)

Vendors shall retain this Certificate.

Incomplete Certificates may not be accepted in good faith.

Purchaser Information

Purchaser's Business Name and Address

AZ. Trans. Priv. Lic. No.

Other Tax License Number

Name of Other State/Country

Reason for no Tax License:

Government Contractor

Eligible Subcontractor

Precise Nature of Business

This Certificate allows the manufacturer, modifier, assembler or repairer to declare a percentage of total purchases exempt as qualifying purchases of

overhead materials under a contract with the United States government with appropriate title passing clauses. See certification statement below.

Exemption Claimed

Taxable Percentage (%)

%

Exempt Percentage (%)

____________ %

Total:

100 %

Check applicable box

All transactions

Single

Other _______________________________________________________

Period limitation if any; From __________________ To __________________

Note: If a limitation is noted, this Certificate continues in force from the date of signature through the stated period, unless canceled by the purchaser

or the vendor.

Certification

This Certificate is only for use by purchasers claiming full or partial exemption for overhead materials for use by a government contractor

who is a manufacturer, modifier, assembler or repairer, or a direct subcontractor of the government contractor, pursuant to a contract

between the government contractor and the United States government in which overhead is covered by the appropriate title

passing clauses.

Any abuse, misuse, or unauthorized use of this Certificate constitutes a serious violation and will lead to

revocation of the Certificate and its attendant privileges. Misuse of this Certificate will subject the purchaser to

payment of the ARS § 42-5009 amount equal to any tax, penalty or interest. Willful misuse of this Certificate will

subject the purchaser to criminal penalties of a felony pursuant to ARS § 42-1127.B.2.

I, (print full name)

, hereby certify that these purchases are exempt from

Arizona transaction privilege tax and that the information on this Certificate is true, accurate and complete. Further, if

purchasing as an agent, I certify that I am authorized to execute this Certificate on behalf of the purchaser named above.

Signature and Title of purchaser

Date

Phone number

ADOR 60-2016 (9/99)

1

1 2

2