Computation Of Attorney Fees

Download a blank fillable Computation Of Attorney Fees in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Computation Of Attorney Fees with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

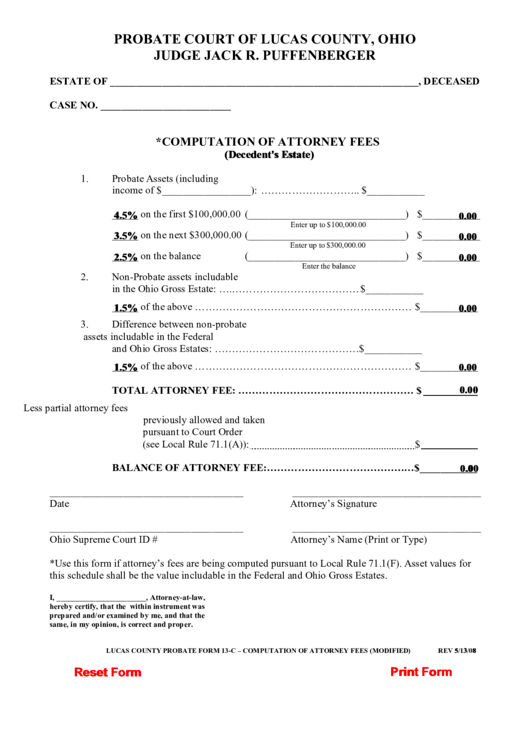

PROBATE COURT OF LUCAS COUNTY, OHIO

JUDGE JACK R. PUFFENBERGER

ESTATE OF ___________________________________________________________, DECEASED

CASE NO. _________________________

*COMPUTATION OF ATTORNEY FEES

(Decedent's Estate)

1.

Probate Assets (including

income of $_________________): ……………………….. $___________

_____ on the first $100,000.00 (______________________________) $___________

4.5%

0.00

Enter up to $100,000.00

_____ on the next $300,000.00 (______________________________) $___________

3.5%

0.00

Enter up to $300,000.00

_____ on the balance

(______________________________) $___________

2.5%

0.00

Enter the balance

2.

Non-Probate assets includable

in the Ohio Gross Estate: ….………………………………. $___________

_____ of the above ……………………………………………………… $___________

1.5%

0.00

3.

Difference between non-probate

assets includable in the Federal

and Ohio Gross Estates: ……………………………………$___________

_____ of the above ……………………………………………………… $___________

1.5%

0.00

TOTAL ATTORNEY FEE: …………………………………………… $

0.00

Less partial attorney fees

previously allowed and taken

pursuant to Court Order

(see Local Rule 71.1(A)):

$

BALANCE OF ATTORNEY FEE:………………………………….… $___________

0.00

_____________________________________

____________________________________

Date

Attorney’s Signature

_____________________________________

____________________________________

Ohio Supreme Court ID #

Attorney’s Name (Print or Type)

*Use this form if attorney’s fees are being computed pursuant to Local Rule 71.1(F). Asset values for

this schedule shall be the value includable in the Federal and Ohio Gross Estates.

I, _______________________, Attorney-at-law,

hereby certify, that the within instrument was

prepared and/or examined by me, and that the

same, in my opinion, is correct and proper.

LUCAS COUNTY PROBATE FORM 13-C – COMPUTATION OF ATTORNEY FEES (MODIFIED)

REV 5/13/08

Print Form

Reset Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1