Form 480.20(Cpt) - Employees Owned Special Corporation Informative Tax Return

ADVERTISEMENT

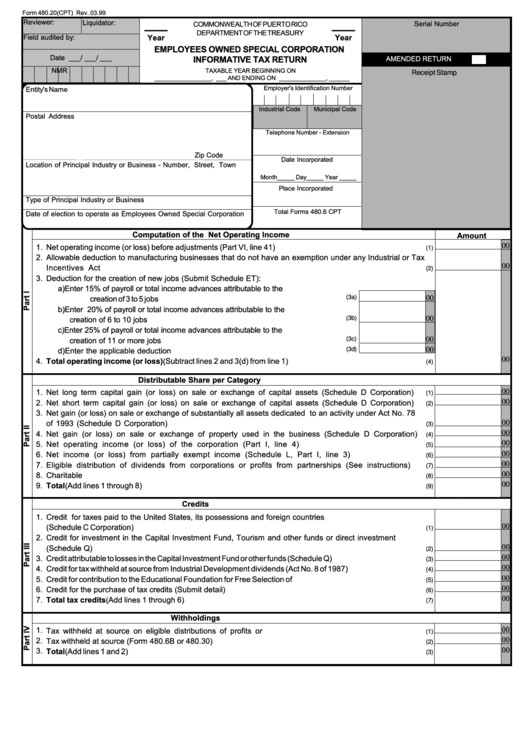

Form 480.20(CPT) Rev. 03.99

___

___

Reviewer:

Liquidator:

Serial Number

COMMONWEALTH OF PUERTO RICO

DEPARTMENT OF THE TREASURY

Field audited by:

Year

Year

EMPLOYEES OWNED SPECIAL CORPORATION

Date ___/ ___/ ___

INFORMATIVE TAX RETURN

AMENDED RETURN

R

M

N

TAXABLE YEAR BEGINNING ON

Receipt Stamp

_________________, ___ AND ENDING ON ______________, ______

Employer's Identification Number

Entity's Name

Industrial Code

Municipal Code

Postal Address

Telephone Number - Extension

Zip Code

Date Incorporated

Location of Principal Industry or Business - Number, Street, Town

Month_____ Day_____ Year _____

Place Incorporated

Type of Principal Industry or Business

Total Forms 480.6 CPT

Date of election to operate as Employees Owned Special Corporation

Computation of the Net Operating Income

Amount

00

1.

Net operating income (or loss) before adjustments (Part VI, line 41)......................................................................

(1)

2.

Allowable deduction to manufacturing businesses that do not have an exemption under any Industrial or Tax

00

Incentives Act ......................................................................................................................................

(2)

3.

Deduction for the creation of new jobs (Submit Schedule ET):

a) Enter 15% of payroll or total income advances attributable to the

00

creation of 3 to 5 jobs ..............................................................................................

(3a)

b) Enter 20% of payroll or total income advances attributable to the

02

00

creation of 6 to 10 jobs ...........................................................................................

(3b)

c) Enter 25% of payroll or total income advances attributable to the

00

creation of 11 or more jobs .....................................................................................

(3c)

00

d) Enter the applicable deduction .............................................................................

(3d)

00

4.

Total operating income (or loss) (Subtract lines 2 and 3(d) from line 1)...............................................................

(4)

Distributable Share per Category

00

1.

Net long term capital gain (or loss) on sale or exchange of capital assets (Schedule D Corporation) ....

(1)

00

2.

Net short term capital gain (or loss) on sale or exchange of capital assets (Schedule D Corporation) ....

(2)

3.

Net gain (or loss) on sale or exchange of substantially all assets dedicated to an activity under Act No. 78

00

of 1993 (Schedule D Corporation).......................................................................................................................

(3)

00

4.

Net gain (or loss) on sale or exchange of property used in the business (Schedule D Corporation)....

(4)

00

5.

Net operating income (or loss) of the corporation (Part I, line 4)......................................................

(5)

00

6.

Net income (or loss) from partially exempt income (Schedule L, Part I, line 3).................................

(6)

00

7.

Eligible distribution of dividends from corporations or profits from partnerships (See instructions).......

(7)

00

8.

Charitable contributions....................................................................................................................................

(8)

00

9.

Total (Add lines 1 through 8)..................................................................................................................................

(9)

Credits

1.

Credit for taxes paid to the United States, its possessions and foreign countries

00

(Schedule C Corporation)......................................................................................................................................

(1)

2.

Credit for investment in the Capital Investment Fund, Tourism and other funds or direct investment

00

(Schedule Q).........................................................................................................................................................

(2)

00

3.

Credit attributable to losses in the Capital Investment Fund or other funds (Schedule Q)............................................

(3)

00

4.

Credit for tax withheld at source from Industrial Development dividends (Act No. 8 of 1987)....................................

(4)

00

5.

Credit for contribution to the Educational Foundation for Free Selection of Schools................................................

(5)

00

6.

Credit for the purchase of tax credits (Submit detail)............................................................................................

(6)

00

7.

Total tax credits (Add lines 1 through 6)..............................................................................................................

(7)

Withholdings

00

1.

Tax withheld at source on eligible distributions of profits or dividends..........................................................

(1)

00

2.

Tax withheld at source (Form 480.6B or 480.30)..................................................................................................

(2)

00

3.

Total (Add lines 1 and 2)........................................................................................................................................

(3)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4