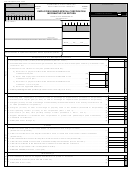

Form 480.20(Cpt) - Employees Owned Special Corporation Informative Tax Return Page 2

ADVERTISEMENT

Employees Owned Special Corporation - Page 2

Form 480.20(CPT) Rev. 03.99

00

1.

Net sales........................................................................................................................

(1)

Less: Costs of goods sold or direct costs of production:

2.

Inventory at the beginning of the year

"C"

"C" or "MV"

(2a)

00

(a)

Materials .............................................................................

(2b)

00

(b)

Goods in process ...............................................................

00

(c)

Finished goods or merchandise ...........................................

(2c)

00

3.

Purchase of materials or merchandise .......................................

(3)

00

4.

Direct wages .....................................................................................

(4)

00

5.

Other direct costs (Detail on Part VII) ...........................................

(5)

00

6.

Total cost goods available for sale (Add lines 2 through 5) ....

(6)

7.

Less: Inventory at the end of the year

"C"

"C" or "MV"

00

(a)

Materials ..........................................

(7a)

(b)

Goods in process ............................

00

(7b)

(c)

Finished goods or merchandise ......

00

00

00

(7c)

00

8.

Gross profit on sales or production ..................................................................................................................

(8)

00

9.

Loss from the sale or exchange of property used in business ..........................................................................

(9)

00

10.

Rent ................................................................................................................................................................

(10)

00

11.

Interest ..........................................................................................................................................................

(11)

12.

Commissions ..................................................................................................................................................

00

(12)

00

13.

Miscellaneous income ..................................................................................................................................

(13)

00

14.

Total Gross Income (Add lines 8 through 13)..................................................................................

(14)

00

15.

Salaries or income advance earned (Submit Schedule ET) .......................................

(15)

00

16.

Salaries, commissions and bonuses to employees .....................................................

(16)

00

17.

Commissions to businesses ........................................................................................

(17)

00

18.

Social security tax (FICA) ............................................................................................

(18)

00

19.

Unemployment tax .......................................................................................................

(19)

00

20.

State Insurance Fund premiums ...................................................................................

(20)

00

21.

Medical or hospitalization insurance ............................................................................

(21)

00

22.

Insurance .....................................................................................................................

(22)

00

23.

Interest .........................................................................................................................

(23)

00

24.

Rent ..............................................................................................................................

(24)

00

25.

Property tax: (a) Personal ___________(b) Real __________ .................................

(25)

00

26.

Other taxes, patents and licenses (Submit detail) .......................................................

(26)

00

27.

Losses from fire, storm, other casualties or theft ......................................................

(27)

00

28.

Motor vehicle expenses ...............................................................................................

(28)

00

29.

Meal and entertainment expenses (Total _______________).....................................

(29)

00

30.

Travel expenses ...........................................................................................................

(30)

00

31.

Professional services ...................................................................................................

(31)

00

32.

Contributions to pensions and other qualified plans ....................................................

(32)

00

33.

Current depreciation and amortization (Submit Schedule E Corporation) ...................

(33)

00

34.

Flexible depreciation (Submit Schedule E Corporation) ..............................................

(34)

00

35.

Accelerated depreciation (Submit Schedule E Corporation) .......................................

(35)

00

36.

Bad debts (See instructions) .........................................................................................

(36)

00

37.

Organization and syndication .......................................................................................

(37)

00

38.

Deduction for employers who employ handicapped persons ......................................

(38)

00

39.

Other deductions (Submit detail) .................................................................................

(39)

40.

Total deductions (Add lines 15 through 39) ..................................................................................................

00

(40)

Net operating income (or loss) (Subtract line 40 from line 14. Enter on Part I, line 1).................................

41.

00

(41)

00

1.

00

Salaries, wages and bonuses ...........

Repairs ..................................................................

8.

(1)

(8)

2.

00

00

Social security tax (FICA) ..................

9.

Utilities ...................................................................

(2)

(9)

00

3.

00

Unemployment tax ...........................

Current depreciation (Submit Schedule E).....

10.

(3)

(10)

00

4.

00

State Insurance Fund premiums .........

Flexible depreciation (Submit Schedule E)....

11.

(4)

(11)

5.

00

00

Medical or hospitalization insurance ..

12.

Accelerated depreciation (Submit Schedule E)

(5)

(12)

00

6.

00

Other insurance .................................

Other expenses (Submit detail) ......................

13.

(6)

(13)

00

7.

Excise taxes ......................................

14.

Total other direct costs (Add lines 1 through

(7)

13. Same as Part V, line 5) ..............................

(14)

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4