MONTANA

Clear Form

HI

Rev. 11-07

2007 Health Insurance for Uninsured Montanans Credit

15-30-129 and 15-31-132, MCA

Name (as it appears on your tax return) _______________________________________________________

Your Social Security Number or Federal Employer Identifi cation Number _____________________________

If this credit is a pass-through to you from a partnership or S corporation enter the name, FEIN and your

percentage of ownership in the partnership or S corporation.

Name ____________________________________ FEIN ____________________ % of Ownership _______

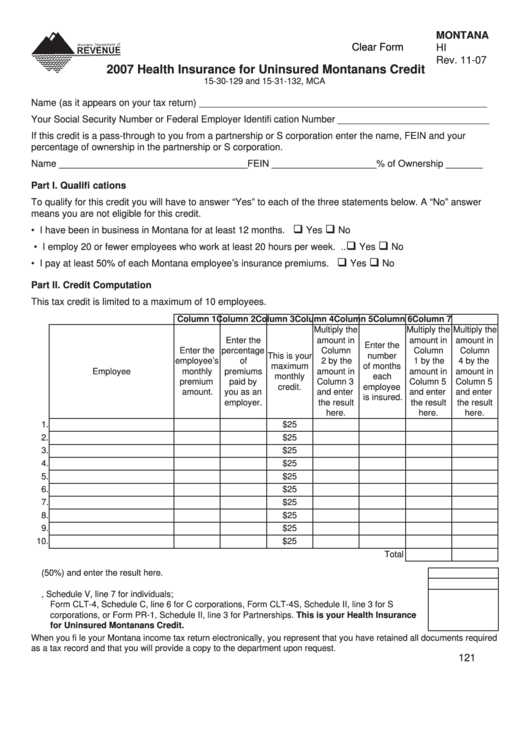

Part I. Qualifi cations

To qualify for this credit you will have to answer “Yes” to each of the three statements below. A “No” answer

means you are not eligible for this credit.

• I have been in business in Montana for at least 12 months. ....................

Yes

No

• I employ 20 or fewer employees who work at least 20 hours per week. ..

Yes

No

• I pay at least 50% of each Montana employee’s insurance premiums. ....

Yes

No

Part II. Credit Computation

This tax credit is limited to a maximum of 10 employees.

Column 1 Column 2 Column 3 Column 4 Column 5 Column 6 Column 7

Multiply the

Multiply the

Multiply the

Enter the

amount in

amount in

amount in

Enter the

Enter the

percentage

Column

Column

Column

This is your

number

employee’s

of

2 by the

1 by the

4 by the

maximum

of months

Employee

monthly

premiums

amount in

amount in

amount in

monthly

each

premium

paid by

Column 3

Column 5

Column 5

credit.

employee

amount.

you as an

and enter

and enter

and enter

is insured.

employer.

the result

the result

the result

here.

here.

here.

1.

$25

2.

$25

3.

$25

4.

$25

5.

$25

6.

$25

7.

$25

8.

$25

9.

$25

10.

$25

Total

1. Multiply the total of column 6 by .50 (50%) and enter the result here. ........................................... 1.

2. Enter the total of column 7 here. .................................................................................................... 2.

3. Enter the smaller of line 1 or line 2 here and on Form 2, Schedule V, line 7 for individuals;

Form CLT-4, Schedule C, line 6 for C corporations, Form CLT-4S, Schedule II, line 3 for S

corporations, or Form PR-1, Schedule II, line 3 for Partnerships. This is your Health Insurance

for Uninsured Montanans Credit. ................................................................................................ 3.

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required

as a tax record and that you will provide a copy to the department upon request.

121

1

1