Transaction Privilege Tax Changes And News Form - 2004

ADVERTISEMENT

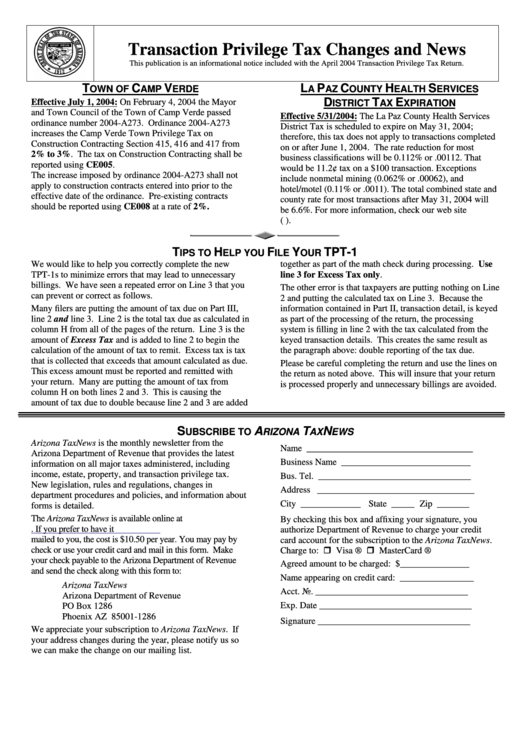

Transaction Privilege Tax Changes and News

This publication is an informational notice included with the April 2004 Transaction Privilege Tax Return.

T

C

V

L

P

C

H

S

OWN OF

AMP

ERDE

A

AZ

OUNTY

EALTH

ERVICES

D

T

E

Effective July 1, 2004: On February 4, 2004 the Mayor

ISTRICT

AX

XPIRATION

and Town Council of the Town of Camp Verde passed

Effective 5/31/2004: The La Paz County Health Services

ordinance number 2004-A273. Ordinance 2004-A273

District Tax is scheduled to expire on May 31, 2004;

increases the Camp Verde Town Privilege Tax on

therefore, this tax does not apply to transactions completed

Construction Contracting Section 415, 416 and 417 from

on or after June 1, 2004. The rate reduction for most

2% to 3%. The tax on Construction Contracting shall be

business classifications will be 0.112% or .00112. That

reported using CE005.

would be 11.2¢ tax on a $100 transaction. Exceptions

The increase imposed by ordinance 2004-A273 shall not

include nonmetal mining (0.062% or .00062), and

apply to construction contracts entered into prior to the

hotel/motel (0.11% or .0011). The total combined state and

effective date of the ordinance. Pre-existing contracts

county rate for most transactions after May 31, 2004 will

should be reported using CE008 at a rate of 2%.

be 6.6%. For more information, check our web site

( ).

T

H

F

Y

TPT-1

IPS TO

ELP YOU

ILE

OUR

We would like to help you correctly complete the new

together as part of the math check during processing. Use

TPT-1s to minimize errors that may lead to unnecessary

line 3 for Excess Tax only.

billings. We have seen a repeated error on Line 3 that you

The other error is that taxpayers are putting nothing on Line

can prevent or correct as follows.

2 and putting the calculated tax on Line 3. Because the

Many filers are putting the amount of tax due on Part III,

information contained in Part II, transaction detail, is keyed

line 2 and line 3. Line 2 is the total tax due as calculated in

as part of the processing of the return, the processing

column H from all of the pages of the return. Line 3 is the

system is filling in line 2 with the tax calculated from the

amount of Excess Tax and is added to line 2 to begin the

keyed transaction details. This creates the same result as

calculation of the amount of tax to remit. Excess tax is tax

the paragraph above: double reporting of the tax due.

that is collected that exceeds that amount calculated as due.

Please be careful completing the return and use the lines on

This excess amount must be reported and remitted with

the return as noted above. This will insure that your return

your return. Many are putting the amount of tax from

is processed properly and unnecessary billings are avoided.

column H on both lines 2 and 3. This is causing the

amount of tax due to double because line 2 and 3 are added

S

A

T

N

UBSCRIBE TO

RIZONA

AX

EWS

Arizona TaxNews is the monthly newsletter from the

Name ____________________________________

Arizona Department of Revenue that provides the latest

Business Name ____________________________

information on all major taxes administered, including

income, estate, property, and transaction privilege tax.

Bus. Tel. _________________________________

New legislation, rules and regulations, changes in

Address __________________________________

department procedures and policies, and information about

City _____________ State _____ Zip _______

forms is detailed.

The Arizona TaxNews is available online at

By checking this box and affixing your signature, you

/txnews.htm. If you prefer to have it

authorize Department of Revenue to charge your credit

mailed to you, the cost is $10.50 per year. You may pay by

card account for the subscription to the Arizona TaxNews.

Charge to: r Visa ® r MasterCard ®

check or use your credit card and mail in this form. Make

your check payable to the Arizona Department of Revenue

Agreed amount to be charged: $ _______________

and send the check along with this form to:

Name appearing on credit card: ________________

Arizona TaxNews

Acct. No. _________________________________

Arizona Department of Revenue

Exp. Date _________________________________

PO Box 1286

Phoenix AZ 85001-1286

Signature _________________________________

We appreciate your subscription to Arizona TaxNews. If

your address changes during the year, please notify us so

we can make the change on our mailing list.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2