Form Txref - Application For Municipal Income Tax Refund-City Of Solon

ADVERTISEMENT

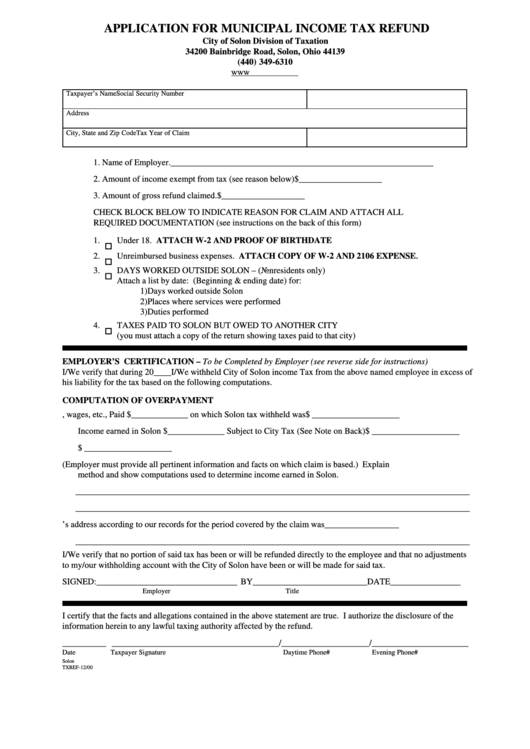

APPLICATION FOR MUNICIPAL INCOME TAX REFUND

City of Solon Division of Taxation

34200 Bainbridge Road, Solon, Ohio 44139

(440) 349-6310

Taxpayer’s Name

Social Security Number

Address

City, State and Zip Code

Tax Year of Claim

1. Name of Employer. ____________________________________________________________

2. Amount of income exempt from tax (see reason below)

$ ___________________

3. Amount of gross refund claimed.

$ ___________________

CHECK BLOCK BELOW TO INDICATE REASON FOR CLAIM AND ATTACH ALL

REQUIRED DOCUMENTATION (see instructions on the back of this form)

1.

Under 18. ATTACH W-2 AND PROOF OF BIRTHDATE

.

2.

Unreimbursed business expenses. ATTACH COPY OF W-2 AND 2106 EXPENSE

3.

DAYS WORKED OUTSIDE SOLON – (Nonresidents only)

Attach a list by date: (Beginning & ending date) for:

1) Days worked outside Solon

2) Places where services were performed

3) Duties performed

4.

TAXES PAID TO SOLON BUT OWED TO ANOTHER CITY

(you must attach a copy of the return showing taxes paid to that city)

EMPLOYER’S CERTIFICATION – To be Completed by Employer (see reverse side for instructions)

I/We verify that during 20____I/We withheld City of Solon income Tax from the above named employee in excess of

his liability for the tax based on the following computations.

COMPUTATION OF OVERPAYMENT

A. Salaries, wages, etc., Paid $_____________ on which Solon tax withheld was

$ ____________________

Income earned in Solon $_____________ Subject to City Tax (See Note on Back)

$ ____________________

Overpayment ................................................................................................................ $ ____________________

B. Basis for Refund (Employer must provide all pertinent information and facts on which claim is based.) Explain

method and show computations used to determine income earned in Solon.

__________________________________________________________________________________________

__________________________________________________________________________________________

C. The employee’s address according to our records for the period covered by the claim was _________________

__________________________________________________________________________________________

I/We verify that no portion of said tax has been or will be refunded directly to the employee and that no adjustments

to my/our withholding account with the City of Solon have been or will be made for said tax.

SIGNED:________________________________ BY__________________________DATE________________

Employer

Title

I certify that the facts and allegations contained in the above statement are true. I authorize the disclosure of the

information herein to any lawful taxing authority affected by the refund.

__________ ______________________________________/____________________/______________________

Date

Taxpayer Signature

Daytime Phone#

Evening Phone#

Solon

TXREF-12/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1