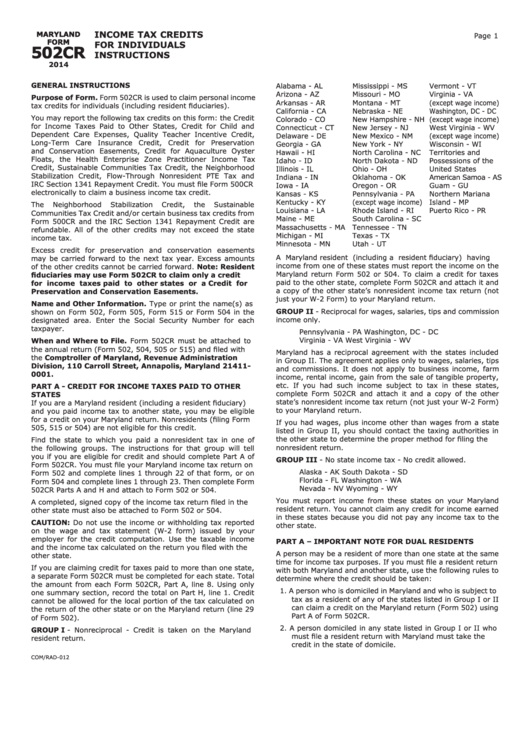

Instructions For Maryland Form 502cr - Income Tax Credits For Individuals - 2014

ADVERTISEMENT

INCOME TAX CREDITS

MARYLAND

MARYLAND

Page 1

FORM

FORM

FOR INDIVIDUALS

502CR

502CR

INSTRUCTIONS

2014

GENERAL INSTRUCTIONS

Alabama - AL

Mississippi - MS

Vermont - VT

Arizona - AZ

Missouri - MO

Virginia - VA

Purpose of Form. Form 502CR is used to claim personal income

Arkansas - AR

Montana - MT

(except wage income)

tax credits for individuals (including resident fiduciaries).

California - CA

Nebraska - NE

Washington, DC - DC

You may report the following tax credits on this form: the Credit

Colorado - CO

New Hampshire - NH

(except wage income)

for Income Taxes Paid to Other States, Credit for Child and

Connecticut - CT

New Jersey - NJ

West Virginia - WV

Dependent Care Expenses, Quality Teacher Incentive Credit,

Delaware - DE

New Mexico - NM

(except wage income)

Long-Term Care Insurance Credit, Credit for Preservation

Georgia - GA

New York - NY

Wisconsin - WI

and Conservation Easements, Credit for Aquaculture Oyster

Hawaii - HI

North Carolina - NC

Territories and

Floats, the Health Enterprise Zone Practitioner Income Tax

Idaho - ID

North Dakota - ND

Possessions of the

Credit, Sustainable Communities Tax Credit, the Neighborhood

Illinois - IL

Ohio - OH

United States

Stabilization Credit, Flow-Through Nonresident PTE Tax and

Indiana - IN

Oklahoma - OK

American Samoa - AS

IRC Section 1341 Repayment Credit. You must file Form 500CR

Iowa - IA

Oregon - OR

Guam - GU

electronically to claim a business income tax credit .

Kansas - KS

Pennsylvania - PA

Northern Mariana

Kentucky - KY

(except wage income)

Island - MP

The

Neighborhood

Stabilization

Credit,

the

Sustainable

Louisiana - LA

Rhode Island - RI

Puerto Rico - PR

Communities Tax Credit and/or certain business tax credits from

Maine - ME

South Carolina - SC

U .S . Virgin Islands - VI

Form 500CR and the IRC Section 1341 Repayment Credit are

Massachusetts - MA

Tennessee - TN

refundable . All of the other credits may not exceed the state

Michigan - MI

Texas - TX

income tax .

Minnesota - MN

Utah - UT

Excess credit for preservation and conservation easements

A Maryland resident (including a resident fiduciary) having

may be carried forward to the next tax year . Excess amounts

income from one of these states must report the income on the

of the other credits cannot be carried forward . Note: Resident

Maryland return Form 502 or 504 . To claim a credit for taxes

fiduciaries may use Form 502CR to claim only a credit

paid to the other state, complete Form 502CR and attach it and

for income taxes paid to other states or a Credit for

a copy of the other state’s nonresident income tax return (not

Preservation and Conservation Easements.

just your W-2 Form) to your Maryland return .

Name and Other Information. Type or print the name(s) as

GROUP II - Reciprocal for wages, salaries, tips and commission

shown on Form 502, Form 505, Form 515 or Form 504 in the

income only .

designated area . Enter the Social Security Number for each

taxpayer .

Pennsylvania - PA

Washington, DC - DC

Virginia - VA

West Virginia - WV

When and Where to File. Form 502CR must be attached to

the annual return (Form 502, 504, 505 or 515) and filed with

Maryland has a reciprocal agreement with the states included

the Comptroller of Maryland, Revenue Administration

in Group II . The agreement applies only to wages, salaries, tips

Division, 110 Carroll Street, Annapolis, Maryland 21411-

and commissions . It does not apply to business income, farm

0001.

income, rental income, gain from the sale of tangible property,

etc . If you had such income subject to tax in these states,

PART A - CREDIT FOR INCOME TAXES PAID TO OTHER

complete Form 502CR and attach it and a copy of the other

STATES

state’s nonresident income tax return (not just your W-2 Form)

If you are a Maryland resident (including a resident fiduciary)

to your Maryland return .

and you paid income tax to another state, you may be eligible

for a credit on your Maryland return. Nonresidents (filing Form

If you had wages, plus income other than wages from a state

505, 515 or 504) are not eligible for this credit .

listed in Group II, you should contact the taxing authorities in

the other state to determine the proper method for filing the

Find the state to which you paid a nonresident tax in one of

nonresident return .

the following groups . The instructions for that group will tell

you if you are eligible for credit and should complete Part A of

GROUP III - No state income tax - No credit allowed .

Form 502CR. You must file your Maryland income tax return on

Alaska - AK

South Dakota - SD

Form 502 and complete lines 1 through 22 of that form, or on

Florida - FL

Washington - WA

Form 504 and complete lines 1 through 23 . Then complete Form

Nevada - NV

Wyoming - WY

502CR Parts A and H and attach to Form 502 or 504 .

You must report income from these states on your Maryland

A completed, signed copy of the income tax return filed in the

resident return . You cannot claim any credit for income earned

other state must also be attached to Form 502 or 504 .

in these states because you did not pay any income tax to the

CAUTION: Do not use the income or withholding tax reported

other state .

on the wage and tax statement (W-2 form) issued by your

employer for the credit computation . Use the taxable income

PART A – IMPORTANT NOTE FOR DUAL RESIDENTS

and the income tax calculated on the return you filed with the

A person may be a resident of more than one state at the same

other state .

time for income tax purposes. If you must file a resident return

If you are claiming credit for taxes paid to more than one state,

with both Maryland and another state, use the following rules to

a separate Form 502CR must be completed for each state . Total

determine where the credit should be taken:

the amount from each Form 502CR, Part A, line 8 . Using only

1 . A person who is domiciled in Maryland and who is subject to

one summary section, record the total on Part H, line 1 . Credit

tax as a resident of any of the states listed in Group I or II

cannot be allowed for the local portion of the tax calculated on

can claim a credit on the Maryland return (Form 502) using

the return of the other state or on the Maryland return (line 29

Part A of Form 502CR .

of Form 502) .

2 . A person domiciled in any state listed in Group I or II who

GROUP I - Nonreciprocal - Credit is taken on the Maryland

must file a resident return with Maryland must take the

resident return .

credit in the state of domicile .

COM/RAD-012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4