Instructions For Form 502cr - Income Tax Credits For Individuals - 2011

ADVERTISEMENT

2011

INCOME TAX CREDITS FOR INDIVIDUALS

INSTRUCTIONS FOR

FORM 502CR

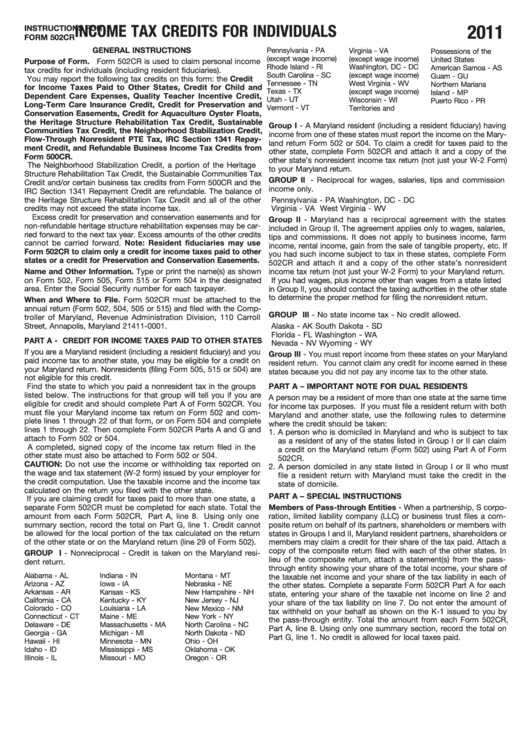

GENERAL INSTRUCTIONS

Pennsylvania - PA

Virginia - VA

Possessions of the

(except wage income)

(except wage income)

United States

Purpose of Form. Form 502CR is used to claim personal income

Rhode Island - RI

Washington, DC - DC

American Samoa - AS

tax credits for individuals (including resident fiduciaries).

South Carolina - SC

(except wage income)

Guam - GU

You may report the following tax credits on this form: the Credit

Tennessee - TN

West Virginia - WV

Northern Mariana

for Income Taxes Paid to Other States, Credit for Child and

Texas - TX

(except wage income)

Island - MP

Dependent Care Expenses, Quality Teacher Incentive Credit,

Utah - UT

Wisconsin - WI

Puerto Rico - PR

Long-Term Care Insurance Credit, Credit for Preservation and

Vermont - VT

Territories and

U.S. Virgin Islands - VI

Conservation Easements, Credit for Aquaculture Oyster Floats,

the Heritage Structure Rehabilitation Tax Credit, Sustainable

Group I - A Maryland resident (including a resident fiduciary) having

Communities Tax Credit, the Neighborhood Stabilization Credit,

income from one of these states must report the income on the Mary-

Flow-Through Nonresident PTE Tax, IRC Section 1341 Repay-

land return Form 502 or 504. To claim a credit for taxes paid to the

ment Credit, and Refundable Business Income Tax Credits from

other state, complete Form 502CR and attach it and a copy of the

Form 500CR.

other state’s nonresident income tax return (not just your W-2 Form)

The Neighborhood Stabilization Credit, a portion of the Heritage

to your Maryland return.

Structure Rehabilitation Tax Credit, the Sustainable Communities Tax

GROUP II - Reciprocal for wages, salaries, tips and commission

Credit and/or certain business tax credits from Form 500CR and the

income only.

IRC Section 1341 Repayment Credit are refundable. The balance of

the Heritage Structure Rehabilitation Tax Credit and all of the other

Pennsylvania - PA

Washington, DC - DC

credits may not exceed the state income tax.

Virginia - VA

West Virginia - WV

Excess credit for preservation and conservation easements and for

Group II - Maryland has a reciprocal agreement with the states

non-refundable heritage structure rehabilitation expenses may be car-

included in Group II. The agreement applies only to wages, salaries,

ried forward to the next tax year. Excess amounts of the other credits

tips and commissions. It does not apply to business income, farm

cannot be carried forward. Note: Resident fiduciaries may use

income, rental income, gain from the sale of tangible property, etc. If

Form 502CR to claim only a credit for income taxes paid to other

you had such income subject to tax in these states, complete Form

states or a credit for Preservation and Conservation Easements.

502CR and attach it and a copy of the other state’s nonresident

Name and Other Information. Type or print the name(s) as shown

income tax return (not just your W-2 Form) to your Maryland return.

on Form 502, Form 505, Form 515 or Form 504 in the designated

If you had wages, plus income other than wages from a state listed

area. Enter the Social Security number for each taxpayer.

in Group II, you should contact the taxing authorities in the other state

to determine the proper method for filing the nonresident return.

When and Where to File. Form 502CR must be attached to the

annual return (Form 502, 504, 505 or 515) and filed with the Comp-

GROUP III - No state income tax - No credit allowed.

troller of Maryland, Revenue Administration Division, 110 Carroll

Street, Annapolis, Maryland 21411-0001.

Alaska - AK

South Dakota - SD

Florida - FL

Washington - WA

PART A - CREDIT FOR INCOME TAXES PAID TO OTHER STATES

Nevada - NV

Wyoming - WY

If you are a Maryland resident (including a resident fiduciary) and you

Group III - You must report income from these states on your Maryland

paid income tax to another state, you may be eligible for a credit on

resident return. You cannot claim any credit for income earned in these

your Maryland return. Nonresidents (filing Form 505, 515 or 504) are

states because you did not pay any income tax to the other state.

not eligible for this credit.

Find the state to which you paid a nonresident tax in the groups

PART A – IMPORTANT NOTE FOR DUAL RESIDENTS

listed below. The instructions for that group will tell you if you are

A person may be a resident of more than one state at the same time

eligible for credit and should complete Part A of Form 502CR. You

for income tax purposes. If you must file a resident return with both

must file your Maryland income tax return on Form 502 and com-

Maryland and another state, use the following rules to determine

plete lines 1 through 22 of that form, or on Form 504 and complete

where the credit should be taken:

lines 1 through 22. Then complete Form 502CR Parts A and G and

1. A person who is domiciled in Maryland and who is subject to tax

attach to Form 502 or 504.

as a resident of any of the states listed in Group I or II can claim

A completed, signed copy of the income tax return filed in the

a credit on the Maryland return (Form 502) using Part A of Form

other state must also be attached to Form 502 or 504.

502CR.

CAUTION: Do not use the income or withholding tax reported on

2. A person domiciled in any state listed in Group I or II who must

the wage and tax statement (W-2 form) issued by your employer for

file a resident return with Maryland must take the credit in the

the credit computation. Use the taxable income and the income tax

state of domicile.

calculated on the return you filed with the other state.

PART A – SPECIAL INSTRUCTIONS

If you are claiming credit for taxes paid to more than one state, a

separate Form 502CR must be completed for each state. Total the

Members of Pass-through Entities - When a partnership, S corpo-

amount from each Form 502CR, Part A, line 8. Using only one

ration, limited liability company (LLC) or business trust files a com-

summary section, record the total on Part G, line 1. Credit cannot

posite return on behalf of its partners, shareholders or members with

be allowed for the local portion of the tax calculated on the return

states in Groups I and II, Maryland resident partners, shareholders or

of the other state or on the Maryland return (line 29 of Form 502).

members may claim a credit for their share of the tax paid. Attach a

copy of the composite return filed with each of the other states. In

GROUP I - Nonreciprocal - Credit is taken on the Maryland resi-

lieu of the composite return, attach a statement(s) from the pass-

dent return.

through entity showing your share of the total income, your share of

Alabama - AL

Indiana - IN

Montana - MT

the taxable net income and your share of the tax liability in each of

Arizona - AZ

Iowa - IA

Nebraska - NE

the other states. Complete a separate Form 502CR Part A for each

Arkansas - AR

Kansas - KS

New Hampshire - NH

state, entering your share of the taxable net income on line 2 and

California - CA

Kentucky - KY

New Jersey - NJ

your share of the tax liability on line 7. Do not enter the amount of

Colorado - CO

Louisiana - LA

New Mexico - NM

tax withheld on your behalf as shown on the K-1 issued to you by

Connecticut - CT

Maine - ME

New York - NY

the pass-through entity. Total the amount from each Form 502CR,

Delaware - DE

Massachusetts - MA

North Carolina - NC

Part A, line 8. Using only one summary section, record the total on

Georgia - GA

Michigan - MI

North Dakota - ND

Part G, line 1. No credit is allowed for local taxes paid.

Hawaii - HI

Minnesota - MN

Ohio - OH

Idaho - ID

Mississippi - MS

Oklahoma - OK

Illinois - IL

Missouri - MO

Oregon - OR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3