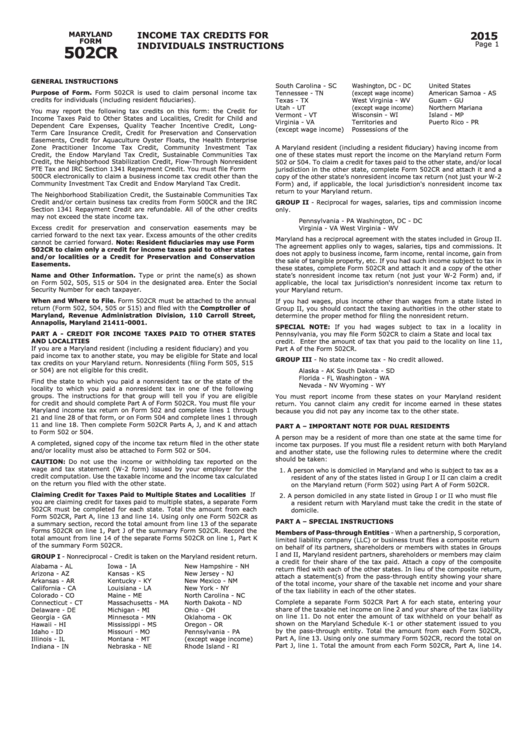

Instructions For Maryland Form 502cr - Income Tax Credits For Individuals - 2015

ADVERTISEMENT

2015

MARYLAND

INCOME TAX CREDITS FOR

FORM

Page 1

INDIVIDUALS INSTRUCTIONS

502CR

GENERAL INSTRUCTIONS

South Carolina - SC

Washington, DC - DC

United States

Purpose of Form. Form 502CR is used to claim personal income tax

Tennessee - TN

(except wage income)

American Samoa - AS

credits for individuals (including resident fiduciaries).

Texas - TX

West Virginia - WV

Guam - GU

Utah - UT

(except wage income)

Northern Mariana

You may report the following tax credits on this form: the Credit for

Vermont - VT

Wisconsin - WI

Island - MP

Income Taxes Paid to Other States and Localities, Credit for Child and

Virginia - VA

Territories and

Puerto Rico - PR

Dependent Care Expenses, Quality Teacher Incentive Credit, Long-

(except wage income)

Possessions of the

U.S. Virgin Islands - VI

Term Care Insurance Credit, Credit for Preservation and Conservation

Easements, Credit for Aquaculture Oyster Floats, the Health Enterprise

Zone Practitioner Income Tax Credit, Community Investment Tax

A Maryland resident (including a resident fiduciary) having income from

Credit, the Endow Maryland Tax Credit, Sustainable Communities Tax

one of these states must report the income on the Maryland return Form

Credit, the Neighborhood Stabilization Credit, Flow-Through Nonresident

502 or 504. To claim a credit for taxes paid to the other state, and/or local

PTE Tax and IRC Section 1341 Repayment Credit. You must file Form

jurisdiction in the other state, complete Form 502CR and attach it and a

500CR electronically to claim a business income tax credit other than the

copy of the other state’s nonresident income tax return (not just your W-2

Community Investment Tax Credit and Endow Maryland Tax Credit.

Form) and, if applicable, the local jurisdiction's nonresident income tax

return to your Maryland return.

The Neighborhood Stabilization Credit, the Sustainable Communities Tax

Credit and/or certain business tax credits from Form 500CR and the IRC

GROUP II - Reciprocal for wages, salaries, tips and commission income

Section 1341 Repayment Credit are refundable. All of the other credits

only.

may not exceed the state income tax.

Pennsylvania - PA

Washington, DC - DC

Excess credit for preservation and conservation easements may be

Virginia - VA

West Virginia - WV

carried forward to the next tax year. Excess amounts of the other credits

Maryland has a reciprocal agreement with the states included in Group II.

cannot be carried forward. Note: Resident fiduciaries may use Form

The agreement applies only to wages, salaries, tips and commissions. It

502CR to claim only a credit for income taxes paid to other states

does not apply to business income, farm income, rental income, gain from

and/or localities or a Credit for Preservation and Conservation

the sale of tangible property, etc. If you had such income subject to tax in

Easements.

these states, complete Form 502CR and attach it and a copy of the other

Name and Other Information. Type or print the name(s) as shown

state’s nonresident income tax return (not just your W-2 Form) and, if

on Form 502, 505, 515 or 504 in the designated area. Enter the Social

applicable, the local tax jurisdiction's nonresident income tax return to

Security Number for each taxpayer.

your Maryland return.

When and Where to File. Form 502CR must be attached to the annual

If you had wages, plus income other than wages from a state listed in

return (Form 502, 504, 505 or 515) and filed with the Comptroller of

Group II, you should contact the taxing authorities in the other state to

Maryland, Revenue Administration Division, 110 Carroll Street,

determine the proper method for filing the nonresident return.

Annapolis, Maryland 21411-0001.

SPECIAL NOTE: If you had wages subject to tax in a locality in

PART A - CREDIT FOR INCOME TAXES PAID TO OTHER STATES

Pennsylvania, you may file Form 502CR to claim a State and local tax

AND LOCALITIES

credit. Enter the amount of tax that you paid to the locality on line 11,

If you are a Maryland resident (including a resident fiduciary) and you

Part A of the Form 502CR.

paid income tax to another state, you may be eligible for State and local

GROUP III - No state income tax - No credit allowed.

tax credits on your Maryland return. Nonresidents (filing Form 505, 515

or 504) are not eligible for this credit.

Alaska - AK

South Dakota - SD

Florida - FL

Washington - WA

Find the state to which you paid a nonresident tax or the state of the

Nevada - NV

Wyoming - WY

locality to which you paid a nonresident tax in one of the following

groups. The instructions for that group will tell you if you are eligible

You must report income from these states on your Maryland resident

for credit and should complete Part A of Form 502CR. You must file your

return. You cannot claim any credit for income earned in these states

Maryland income tax return on Form 502 and complete lines 1 through

because you did not pay any income tax to the other state.

21 and line 28 of that form, or on Form 504 and complete lines 1 through

11 and line 18. Then complete Form 502CR Parts A, J, and K and attach

PART A – IMPORTANT NOTE FOR DUAL RESIDENTS

to Form 502 or 504.

A person may be a resident of more than one state at the same time for

A completed, signed copy of the income tax return filed in the other state

income tax purposes. If you must file a resident return with both Maryland

and/or locality must also be attached to Form 502 or 504.

and another state, use the following rules to determine where the credit

should be taken:

CAUTION: Do not use the income or withholding tax reported on the

wage and tax statement (W-2 form) issued by your employer for the

1. A person who is domiciled in Maryland and who is subject to tax as a

credit computation. Use the taxable income and the income tax calculated

resident of any of the states listed in Group I or II can claim a credit

on the return you filed with the other state.

on the Maryland return (Form 502) using Part A of Form 502CR.

Claiming Credit for Taxes Paid to Multiple States and Localities If

2. A person domiciled in any state listed in Group I or II who must file

you are claiming credit for taxes paid to multiple states, a separate Form

a resident return with Maryland must take the credit in the state of

502CR must be completed for each state. Total the amount from each

domicile.

Form 502CR, Part A, line 13 and line 14. Using only one Form 502CR as

PART A – SPECIAL INSTRUCTIONS

a summary section, record the total amount from line 13 of the separate

Forms 502CR on line 1, Part J of the summary Form 502CR. Record the

Members of Pass-through Entities - When a partnership, S corporation,

total amount from line 14 of the separate Forms 502CR on line 1, Part K

limited liability company (LLC) or business trust files a composite return

of the summary Form 502CR.

on behalf of its partners, shareholders or members with states in Groups

I and II, Maryland resident partners, shareholders or members may claim

GROUP I - Nonreciprocal - Credit is taken on the Maryland resident return.

a credit for their share of the tax paid. Attach a copy of the composite

Alabama - AL

Iowa - IA

New Hampshire - NH

return filed with each of the other states. In lieu of the composite return,

Arizona - AZ

Kansas - KS

New Jersey - NJ

attach a statement(s) from the pass-through entity showing your share

Arkansas - AR

Kentucky - KY

New Mexico - NM

of the total income, your share of the taxable net income and your share

California - CA

Louisiana - LA

New York - NY

of the tax liability in each of the other states.

Colorado - CO

Maine - ME

North Carolina - NC

Complete a separate Form 502CR Part A for each state, entering your

Connecticut - CT

Massachusetts - MA

North Dakota - ND

share of the taxable net income on line 2 and your share of the tax liability

Delaware - DE

Michigan - MI

Ohio - OH

on line 11. Do not enter the amount of tax withheld on your behalf as

Georgia - GA

Minnesota - MN

Oklahoma - OK

shown on the Maryland Schedule K-1 or other statement issued to you

Hawaii - HI

Mississippi - MS

Oregon - OR

by the pass-through entity. Total the amount from each Form 502CR,

Idaho - ID

Missouri - MO

Pennsylvania - PA

Part A, line 13. Using only one summary Form 502CR, record the total on

Illinois - IL

Montana - MT

(except wage income)

Part J, line 1. Total the amount from each Form 502CR, Part A, line 14.

Indiana - IN

Nebraska - NE

Rhode Island - RI

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4