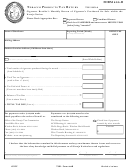

Cigarette Deductions From Inventory

Cigarettes (Number of Individual cigarettes)

a.

Sales outside of North Dakota ...............................................................................................................................................................

b.

Return of unsalable cigarette products to manufacturer .......................................................................................................................

c.

Cigarettes sold for resale to Native American retailers on a reservation..............................................................................................

d.

Cigarettes donated to Veterans Home or North Dakota State Hospital................................................................................................

e.

Other (Please specify)...........................................................................................................................................................................

19.

Total number of individual nontaxable cigarettes (Add Lines a through e)...................................................................................................

Column A

Column B

Column C

Tobacco Product Deductions

28% Tobacco

Snuff

Chewing & Plug

(Purchase Price)

(Ounces)

Tobacco (Ounces)

a.

Sales outside of North Dakota ................................................................................

$

b.

Sales to military base exchanges ............................................................................

c.

Tobacco sold for resale to Native American retailers on a reservation .................

d.

Tobacco sold for resale to other licensed distributors............................................

e.

Tobacco products donated to Veterans Home or North Dakota State Hospital ....

f.

Return of unsalable tobacco products other than cigarettes to the manufacturer ..

g.

Other (please specify) ............................................................................................

20.

Total Deductions of nontaxable tobacco products (Add lines a through g) ....................

$

Instructions

Line 1 -

Number of individual cigarettes on hand (Line 1e from previous month).

Line 1b -

Total ounces of roll your own product divided by .09 to determine cigarettes available. Always round up to next whole number.

Line 1e -

Number of individual cigarettes on hand end of month (Use on Line 1, Form 44CT next month)

Line 4 -

The return must be filed and paid on time to take compensation. Compensation may not exceed $100.

Line 6 -

Enter on Line 6 any approved cigarette tax credit for which the North Dakota Office of State Tax Commissioner issued you a credit memo. You must attach a

copy of the credit memo to return. Tobacco tax credits may not be used on this line.

Line 7 -

If you are filing or paying your return late, there will be added to the tax due a penalty of 5% or a minimum of $5.00 for the first month late, plus 1% interest

for each month or fraction of a month thereafter. Figure penalty and interest separately for Cigarette and Tobacco.

Line 9 -

Value of Tobacco Products purchased from supporting schedule 3A. Include all purchases of cigars, pipe tobacco, snuff, chewing and plug tobacco. Use whole

ounces to report purchases of snuff and chewing and plug tobacco. Does not include roll your own cigarette tobacco.

Line 10 -

See itemized detail above (tobacco products)

Line 15 -

Enter on line 15 any approved tobacco tax credit for which the North Dakota Office of State Tax Commissioner issued you a credit memo. You must attach a

copy of the credit memo to the return. Cigarette tax credits may not be used on this line.

Line 16 -

If you are filing or paying your return late, there will be added to the tax due a penalty of 5% or a minimum of $5.00 for the first month late, plus 1% interest

for each month or fraction of a month thereafter. Figure penalty and interest separately for Cigarette and Tobacco.

Line 18 -

Total of Line 8 plus Line 17. This amount should be remitted with return. Make check or money order payable to North Dakota Tax Commissioner.

NOTE: This Return Must Be Filed By Each Licensee Even If No Cigarettes Were Sold Or No Tobacco Products Were

Imported Or Acquired During The Month Being Reported.

1

1 2

2 3

3 4

4