Form AEPC Instructions

What is the purpose of the Alternative Energy Production

Part I. Qualifications

Credit?

In order to qualify for this credit, you must have made at

The purpose of the Alternative Energy Production Credit is to

least a $5,000 investment in depreciable property that is a

encourage the development of the alternative energy industry

commercial or net metering system located in Montana that

in Montana without adversely affecting tax revenues. Because

generates energy by means of an alternate renewable energy

of the alternative energy potential in Montana, it is desirable

source, as defined in 15-6-225(2)(a), MCA. You must also

to encourage alternative energy generation for the purpose

have taxes due as a consequence of taxable or net income

of attracting alternative energy manufacturing industries to

produced by one of the following:

Montana. It is also desirable for a new or expanded industry to

manufacturing plants located in Montana that produce

●

secure alternatively generated electricity on a direct contract

alternative energy generating equipment;

sales basis without adversely affecting rates charged to other

electricity users.

a new business facility or the expanded portion of

●

an existing business facility for which the alternative

Am I eligible for other state energy incentives on my

energy generating equipment supplies, on a direct

investment if I am claiming this credit?

contract sales basis, the basic energy needed for the

If you claim this credit, you cannot claim any other state

facility (please include a copy of the contract); or

energy credit or state investment tax credit for this investment.

the alternative energy generating equipment in which

●

In addition, you cannot claim the property tax exemption for

the investment for which a credit is being claimed was

nonfossil energy property, allowed under 15-6-224, MCA, for

made.

the same property used to generate this credit.

If you do not meet these qualifications, you do not qualify for

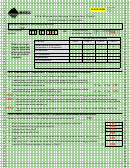

Which parts of Form AEPC do I have to complete?

this credit.

Then you need to complete:

Part II. Credit Calculation

If you are:

Part I

Part II

Part III Part IV

(This part is to be completed only by C corporations,

Receiving the credit

S corporations, partnerships, and individuals. Do not

complete this part if you are receiving the credit from a

from a partnership or

X

X

pass-through entity – skip to Part III.)

S corporation

An individual

X

X

X

Line 3 – Enter the amount of your eligible costs related to

the alternative energy equipment investment. Eligible costs

A C corporation

X

X

X

include only those costs that are associated with the purchase,

A partnership

X

X

*

installation, or upgrade of:

An S corporation

X

X

*

generating equipment,

●

* A partnership or S corporation with income from both

safety devices and storage components,

●

qualifying and nonqualifying sources will have to

complete the Income Allocation Worksheet, lines 18

transmission lines that are necessary to connect with

●

through 24, in Part IV.

existing transmission facilities, and

What information do I have to include with my return

transmission lines that are necessary to connect

●

when I claim this credit?

directly to the purchaser of the electricity when no

other transmission facilities are available.

Individuals. If you are filing a paper return, include a copy

of Form AEPC with your individual income tax return.

Line 4 – Enter the amount of any grants you received that

were provided by the state or federal government for the

C corporations. If you are filing a paper return, include a

system.

copy of Form AEPC with your corporate income tax return.

Line 5 – Subtract line 4 from line 3. This is your eligible costs

S corporations and partnerships. If you are filing a

less grants received.

paper return, include Form AEPC with your Montana

information return Form CLT-4S or PR-1 and include

Line 6 – Multiply line 5 by 35%. Your alternative energy

a separate statement identifying each owner and their

production credit is equal to 35% (0.35) of your eligible costs.

proportionate share.

However, the amount you can take in the current year may be

limited as calculated in Part IV.

You will need to complete a separate Form AEPC for each

source you are receiving the credit from. For example, if you

Line 7 – Enter any alternative energy production credit that

are a partner in one partnership that qualified for this credit,

you are carrying forward from previous years.

and you, as an individual, also qualify for this credit, you would

Line 8 – Add lines 6 and 7. This is your alternative energy

need to complete two forms.

production credit for the current year.

If you file electronically, you do not need to mail this form to us

unless we contact you for a copy.

1

1 2

2 3

3 4

4