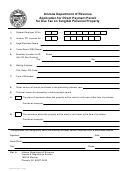

Texas Application

AP-101-3

(Rev.1-15/17)

Page 2

for Direct Payment Permit

• Please read instructions.

• Type or print.

• Do not write in shaded areas.

12. Legal name of owner (same as Item 2)

13. List all general partners, officers or managing members of your business. (Attach additional sheets, if necessary.)

If you are sole owner, skip Item 13.

Name

Phone (Area code and number)

Home address

City

State

ZIP code

SSN

FEIN

County (or country, if outside the U.S.)

Percent of

%

ownership

Position held:

General partner

Officer/Director

Managing member

Other

Name

Phone (Area code and number)

Home address

City

State

ZIP code

SSN

FEIN

County (or country, if outside the U.S.)

Percent of

%

ownership

Position held:

General partner

Officer/Director

Managing member

Other

14. Business name

Business phone (Area code and number)

15. Location of your principal place of business (Use street and number or directions - NOT P.O. Box or rural route number.)

City

State

ZIP code

County

16. Is your business located inside the city limits of the city named in Item 15? ..................................................................

YES

NO

17. Indicate your principal type of business.

Exploration/Production

Construction

Manufacturer/Processor

Service

Other

18. Describe your Texas business and the goods or services you sell. (See instructions.)

$

19. Enter the amount of your annual purchases subject to Texas Use Tax .....................................

20. On a separate sheet, describe the accounting method that you will use to differentiate between taxable purchases, exempt purchases,

tax-paid purchases and items purchased tax free for resale. (See instructions.)

21. List and describe all sites of major fixed assets permanently located within Texas. (Attach additional sheets, if necessary.)

The sole owner, all general partners, members, officers or an authorized representative

Month

Day

Year

must sign this application. Representative must submit a written power of attorney

with this application. (Attach additional sheets, if necessary.)

Date of signature

22. I (We) declare, under penalties prescribed by law, that the information in this document and any attachments is true and correct to the best

of my (our) knowledge and belief.

Legal cite: Tex. Penal Code Ann. Sec. 37.10

Type or print name of sole owner, partner or officer

Sole owner, partner or officer

Type or print name of partner or officer

Partner or officer

Type or print name of partner or officer

Partner or officer

WARNING. You may be required to obtain an additional permit or license from the State of Texas or from a local governmental entity to

conduct business. A listing of links relating to acquiring licenses, permits, and registrations from the State of Texas is available online

at You may also want to contact the municipality and county in which you will conduct business to determine

any local governmental requirements.

Field office or section number

Employee Name

USERID

Date

1

1 2

2