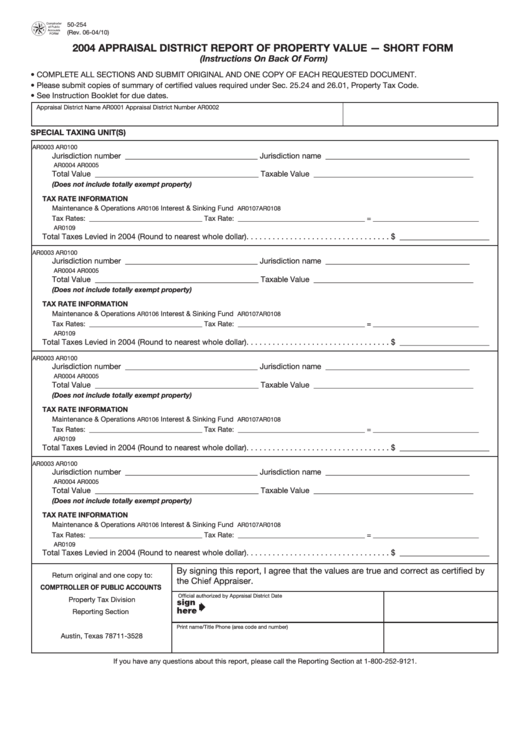

Form 50-254 - 2004 Appraisal District Report Of Property Value Short Form

ADVERTISEMENT

50-254

(Rev. 06-04/10)

2004 APPRAISAL DISTRICT REPORT OF PROPERTY VALUE — SHORT FORM

(Instructions On Back Of Form)

• COMPLETE ALL SECTIONS AND SUBMIT ORIGINAL AND ONE COPY OF EACH REQUESTED DOCUMENT.

• Please submit copies of summary of certified values required under Sec. 25.24 and 26.01, Property Tax Code.

• See Instruction Booklet for due dates.

Appraisal District Name

AR0001

Appraisal District Number

AR0002

SPECIAL TAXING UNIT(S)

AR0003

AR0100

Jurisdiction number __________________________________

Jurisdiction name _____________________________________

AR0004

AR0005

Total Value __________________________________________

Taxable Value _________________________________________

(Does not include totally exempt property)

TAX RATE INFORMATION

Maintenance & Operations

Interest & Sinking Fund

AR0106

AR0107

AR0108

Tax Rates: ________________________________

Tax Rate: ____________________________________

=

______________________________

AR0109

Total Taxes Levied in 2004 (Round to nearest whole dollar). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

AR0003

AR0100

Jurisdiction number __________________________________

Jurisdiction name _____________________________________

AR0004

AR0005

Total Value __________________________________________

Taxable Value _________________________________________

(Does not include totally exempt property)

TAX RATE INFORMATION

Maintenance & Operations

Interest & Sinking Fund

AR0106

AR0107

AR0108

Tax Rates: ________________________________

Tax Rate: ____________________________________

=

______________________________

AR0109

Total Taxes Levied in 2004 (Round to nearest whole dollar). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

AR0003

AR0100

Jurisdiction number __________________________________

Jurisdiction name _____________________________________

AR0004

AR0005

Total Value __________________________________________

Taxable Value _________________________________________

(Does not include totally exempt property)

TAX RATE INFORMATION

Maintenance & Operations

Interest & Sinking Fund

AR0106

AR0107

AR0108

Tax Rates: ________________________________

Tax Rate: ____________________________________

=

______________________________

AR0109

Total Taxes Levied in 2004 (Round to nearest whole dollar). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

AR0003

AR0100

Jurisdiction number __________________________________

Jurisdiction name _____________________________________

AR0004

AR0005

Total Value __________________________________________

Taxable Value _________________________________________

(Does not include totally exempt property)

TAX RATE INFORMATION

Maintenance & Operations

Interest & Sinking Fund

AR0106

AR0107

AR0108

Tax Rates: ________________________________

Tax Rate: ____________________________________

=

______________________________

AR0109

Total Taxes Levied in 2004 (Round to nearest whole dollar). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________

By signing this report, I agree that the values are true and correct as certified by

Return original and one copy to:

the Chief Appraiser.

COMPTROLLER OF PUBLIC ACCOUNTS

Official authorized by Appraisal District

Date

Property Tax Division

Reporting Section

P.O. Box 13528

Print name/Title

Phone (area code and number)

Austin, Texas 78711-3528

If you have any questions about this report, please call the Reporting Section at 1-800-252-9121.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2