Business And Occupation Tax Return Instructions Form

ADVERTISEMENT

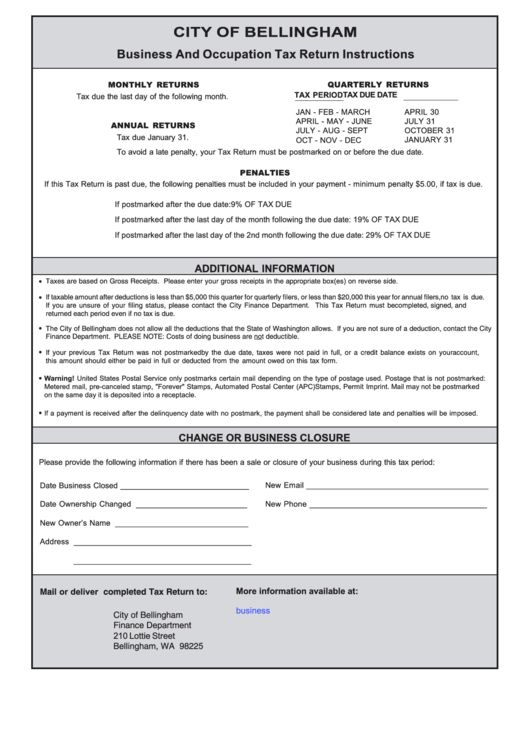

CITY OF BELLINGHAM

Business And Occupation Tax Return Instructions

QUARTERLY RETURNS

MONTHLY RETURNS

TAX PERIOD

TAX DUE DATE

Tax due the last day of the following month.

APRIL 30

JAN - FEB - MARCH

APRIL - MAY - JUNE

JULY 31

ANNUAL RETURNS

OCTOBER 31

JULY - AUG - SEPT

Tax due January 31.

OCT - NOV - DEC

JANUARY 31

To avoid a late penalty, your Tax Return must be postmarked on or before the due date.

PENALTIES

If this Tax Return is past due, the following penalties must be included in your payment - minimum penalty $5.00, if tax is due.

If postmarked after the due date: 9% OF TAX DUE

If postmarked after the last day of the month following the due date: 19% OF TAX DUE

If postmarked after the last day of the 2nd month following the due date: 29% OF TAX DUE

ADDITIONAL INFORMATION

•

Taxes are based on Gross Receipts. Please enter your gross receipts in the appropriate box(es) on reverse side.

•

If taxable amount after deductions is less than $5,000 this quarter for quarterly filers, or less than $20,000 this year for annual filers, no tax is due.

If you are unsure of your filing status, please contact the City Finance Department.

This Tax Return must be completed, signed, and

returned each period even if no tax is due.

•

The City of Bellingham does not allow all the deductions that the State of Washington allows. If you are not sure of a deduction, contact the City

Finance Department. PLEASE NOTE: Costs of doing business are not deductible.

If your previous Tax Return was not postmarked by the due date, taxes were not paid in full, or a credit balance exists on your account,

•

this amount should either be paid in full or deducted from the amount owed on this tax form.

Warning! United States Postal Service only postmarks certain mail depending on the type of postage used. Postage that is not postmarked:

•

Metered mail, pre-canceled stamp, "Forever" Stamps, Automated Postal Center (APC) Stamps, Permit Imprint. Mail may not be postmarked

on the same day it is deposited into a receptacle.

If a payment is received after the delinquency date with no postmark, the payment shall be considered late and penalties will be imposed.

•

CHANGE OR BUSINESS CLOSURE

Please provide the following information if there has been a sale or closure of your business during this tax period:

Date Business Closed _____________________________

New Email _________________________________________

Date Ownership Changed _________________________

New Phone ________________________________________

New Owner’s Name ______________________________

Address ________________________________________

________________________________________

More information available at:

Mail or deliver completed Tax Return to:

City of Bellingham

Finance Department

210 Lottie Street

Bellingham, WA 98225

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1