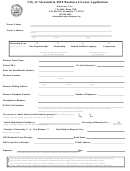

Business License Application - City Of Alexandria - 2016 Page 2

ADVERTISEMENT

PROCEDURES FOR OBTAINING A BUSINESS LICENSE IN THE CITY OF ALEXANDRIA

Obtaining a business license in Alexandria is generally a three-step process:

Step 1: Register the Business Entity

a. Registration of a Corporation or a Limited Partnership: All corporations (foreign and domestic) and limited partnerships conducting

business in Virginia must register with the Virginia State Corporation Commission. To become incorporated in Virginia, an organization

must file articles of incorporation and amendments with the State Corporation Commission. Procedures for filing can be found in the Code

of Virginia Stock Corporation Act, Title 13.1-601 through 13.1-800. For information on registration or incorporation, please contact the

Virginia State Corporation Commission, P.O. Box 1197, Richmond, VA 23218, 866.722.2551 or 804.371.9733. An online “Business

Registration Guide” is available on the Virginia State Corporation Commission web site at

b. Registration of a General Partnership or Trade Name: General partnerships and trade names must be registered with the Clerk of the

Circuit Court. A small fee is imposed by the Circuit Court. For registration information, contact the Clerk of the Circuit Court, 520 King

Street, Suite 307, Alexandria, Virginia 22314, 703.746.4044.

Step 2: Visit the Permit Center (One Stop Shop)

In an effort to improve the business license application process, the City has created a Permit Center or “One Stop Shop” where applicants

can obtain the approvals and registration needed by most businesses. For more information, contact the Permit Center (One Stop Shop),

Office of Building and Fire code Administration, 301 King Street, Room 4200, 703.746.4200. The Permit Center will be closed the first

Monday of each month. Businesses may visit the Finance Department, 301 King Street, Room 1700, 703.746.3903, for all business related

matters.

Step 3: Submit the Completed Application With Your Tax Payment and All Necessary Approvals and Documentation

The City business license application may be submitted at the Permit Center (One Stop Shop) at the address listed above or mailed with your

tax payment to the address on the application. Some businesses may be required to submit additional documentation and/or permits. For

more information on addition documentation required, please visit the Business Tax web page at alexandriava.gov/businesstax.

NOTES:

*If you have purchased the business and as a condition of the sale you acquired the liability and assets, you are entitled to transfer the

business license from the old to the new business by completing a Request for Transfer of City Business License form. The form must be

notarized and submitted along with the business license application. You must provide a copy of the signed and dated purchase agreement

detailing the terms and conditions of the sale. This agreement should specifically relate to the sale of assets and liabilities.

BUSINESS PERSONAL PROPERTY

Any individual, partnership or corporation engaged in any business or profession in the City of Alexandria as of January 1 of a given year

must complete and file a Business Personal Property return no later than May 1. All tangible business personal property, including furniture,

fixtures, machinery, tools, computers and peripherals used in any business or profession must be reported. Completed returns can be

sumitted to Business Tax, 301 King Street, Room 1700 or mailed to Business Tax, Department of Finance, City of Alexandria, P.O. Box 178,

Alexandria, VA 22313.

The law requires full and complete returns; therefore, a taxpayer must enter the purchase cost of all property owned or in his or her

possession. It is imperative that all tangible business personal property be reported and its purchase cost entered in the proper column.

Property being paid for by installments as a condition of sale is assessable in the name of the person possessing the property. The law allows

no deduction for indebtedness against tangible business personal property. Leased or rented tangible personal property must also be reported

in addition to the name and address of the lessor (owner) responsible for payment of the local personal property tax.

If a business begins operations in the city after January 1 of a given year, there is no business personal property tax liability for that year. If a

business moves or ceases business after January 1, the business is liable for the full tax year.

THERE IS NO PRORATION OF A BUSINESS PERSONAL PROPERTY TAX BILL.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2