Application For Refund Form - Amherst Income Tax Department

ADVERTISEMENT

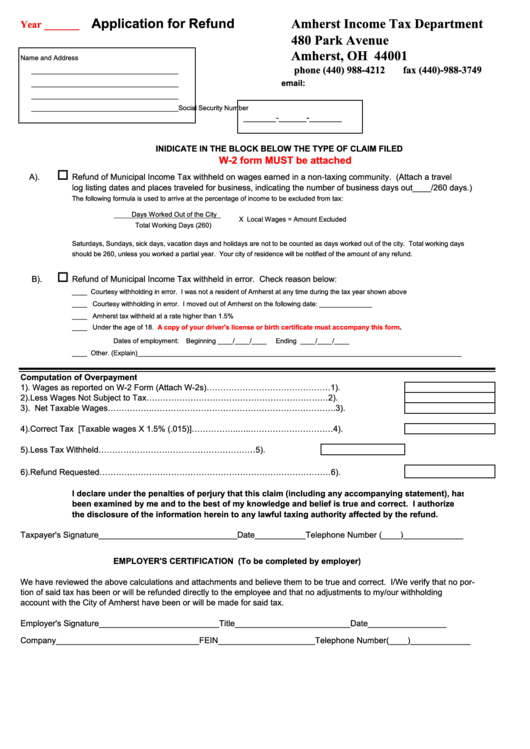

Application for Refund

Amherst Income Tax Department

______

Year

480 Park Avenue

Amherst, OH 44001

Name and Address

phone (440) 988-4212

fax (440)-988-3749

_______________________________________

email:

_______________________________________

_______________________________________

_______________________________________

Social Security Number

_______-______-_______

INIDICATE IN THE BLOCK BELOW THE TYPE OF CLAIM FILED

W-2 form MUST be attached

A).

Refund of Municipal Income Tax withheld on wages earned in a non-taxing community. (Attach a travel

log listing dates and places traveled for business, indicating the number of business days out____/260 days.)

The following formula is used to arrive at the percentage of income to be excluded from tax:

Days Worked Out of the City

X Local Wages = Amount Excluded

Total Working Days (260)

Saturdays, Sundays, sick days, vacation days and holidays are not to be counted as days worked out of the city. Total working days

should be 260, unless you worked a partial year. Your city of residence will be notified of the amount of any refund.

B).

Refund of Municipal Income Tax withheld in error. Check reason below:

____ Courtesy withholding in error. I was not a resident of Amherst at any time during the tax year shown above

____ Courtesy withholding in error. I moved out of Amherst on the following date: ______________

____ Amherst tax withheld at a rate higher than 1.5%

____ Under the age of 18.

A copy of your driver's license or birth certificate must accompany this

form.

Dates of employment:

Beginning ____/____/____

Ending ____/____/____

____ Other. (Explain)______________________________________________________________________________________

Computation of Overpayment

1).

Wages as reported on W-2 Form (Attach W-2s)………………………………………1).

2).

Less Wages Not Subject to Tax…………………………………………………………2).

3).

Net Taxable Wages…………….………………………………………………………….3).

4).

Correct Tax [Taxable wages X 1.5% (.015)]……………..…..…………………………4).

5).

Less Tax Withheld…………………………………………………5).

6).

Refund Requested…………………………………………………………………………6).

I declare under the penalties of perjury that this claim (including any accompanying statement), has

been examined by me and to the best of my knowledge and belief is true and correct. I authorize

the disclosure of the information herein to any lawful taxing authority affected by the refund.

Taxpayer's Signature______________________________Date___________Telephone Number (____)_____________

EMPLOYER'S CERTIFICATION (To be completed by employer)

We have reviewed the above calculations and attachments and believe them to be true and correct. I/We verify that no por-

tion of said tax has been or will be refunded directly to the employee and that no adjustments to my/our withholding

account with the City of Amherst have been or will be made for said tax.

Employer's Signature__________________________Title_________________________Date_________________

Company_______________________________FEIN_____________________Telephone Number(____)_____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1