Form Mt-201 - Tobacco Products Use Tax Return

ADVERTISEMENT

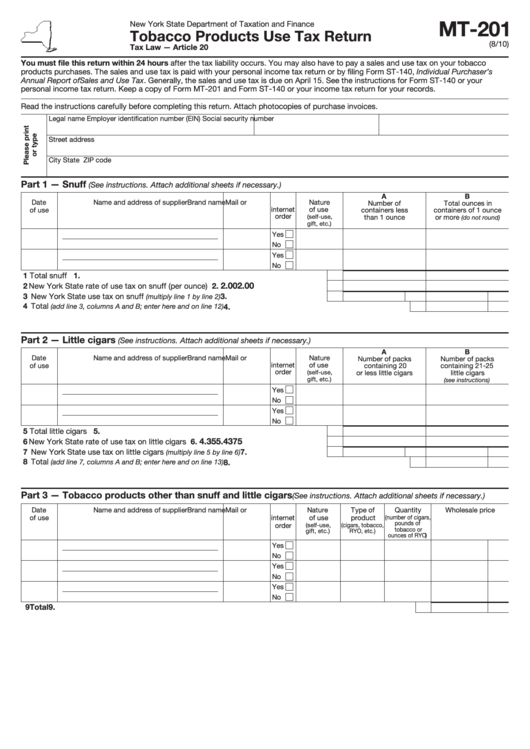

MT-201

New York State Department of Taxation and Finance

Tobacco Products Use Tax Return

(8/10)

Tax Law — Article 20

You must file this return within 24 hours after the tax liability occurs. You may also have to pay a sales and use tax on your tobacco

products purchases. The sales and use tax is paid with your personal income tax return or by filing Form ST-140, Individual Purchaser’s

Annual Report of Sales and Use Tax. Generally, the sales and use tax is due on April 15. See the instructions for Form ST-140 or your

personal income tax return. Keep a copy of Form MT-201 and Form ST-140 or your income tax return for your records.

Read the instructions carefully before completing this return. Attach photocopies of purchase invoices.

Legal name

Employer identification number (EIN)

Social security number

Street address

City

State

ZIP code

Part 1 — Snuff

(See instructions. Attach additional sheets if necessary.)

A

B

Date

Name and address of supplier

Brand name Mail or

Nature

Number of

Total ounces in

internet

of use

of use

containers less

containers of 1 ounce

order

(self-use,

than 1 ounce

or more

(do not round)

gift, etc.)

Yes

No

Yes

No

1 Total snuff .....................................................................................................................

1.

2.00

2.00

2 New York State rate of use tax on snuff (per ounce) ....................................................

2.

3 New York State use tax on snuff

3.

...............................................

(multiply line 1 by line 2)

4 Total

....................................................................................

(add line 3, columns A and B; enter here and on line 12)

4.

Part 2 — Little cigars

(See instructions. Attach additional sheets if necessary.)

A

B

Date

Name and address of supplier

Brand name Mail or

Nature

Number of packs

Number of packs

internet

of use

of use

containing 20

containing 21-25

order

(self-use,

or less little cigars

little cigars

gift, etc.)

(see instructions)

Yes

No

Yes

No

5 Total little cigars ...........................................................................................................

5.

4.35

5.4375

6 New York State rate of use tax on little cigars .............................................................

6.

7 New York State use tax on little cigars

......................................

7.

(multiply line 5 by line 6)

8 Total

....................................................................................

8.

(add line 7, columns A and B; enter here and on line 13)

Part 3 — Tobacco products other than snuff and little cigars

(See instructions. Attach additional sheets if necessary.)

Date

Name and address of supplier

Brand name Mail or

Nature

Type of

Quantity

Wholesale price

of use

internet

of use

product

(number of cigars,

pounds of

order

(self-use,

(cigars, tobacco,

tobacco or

gift, etc.)

RYO, etc.)

ounces of RYO)

Yes

No

Yes

No

Yes

No

9 Total ...................................................................................................................................................................... 9.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2