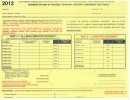

2008 Business Return Of Tangible Property And Machinery & Tools -Spotsylvania County Page 3

ADVERTISEMENT

__________________________________________________________________________________

SPOTSYLVANIA COUNTY, VIRGINIA

Complete this form in its entirety. If information is preprinted, please review for accuracy. Cross through

incorrect information and update as applicable.

WHO SHOULD FILE?

Virginia Tax code 58.1-3518 requires all business owners, including home based businesses, to file a

business tangible property return and current asset list annually. If you conducted business as an

individual, partnership or corporation, or if you own leased business equipment in Spotsylvania County

on January 1 of this year, you must complete and return this form. A separate form should be

submitted for each business location.

HOW & WHAT ITEMS DO I FILE?

st

All property located in Spotsylvania County on January 1

and used or available for use in your

business is taxable. Enclosed is the Business Property return on which to report all furniture, fixtures,

tools and equipment used in a trade or business. Machinery and Tools used in manufacturing, mining,

processing, reprocessing, radio or television broadcasting, dry cleaning or laundry business are to be

listed and segregated as a separate class (Virginia Tax Code Section 58.1-3507). Property required to

be reported on this form is not subject to proration and is taxed for the entire year, even if it is sold or

st

moved out of the County after January 1

.

Itemized List - Attach a copy of your most recent depreciation schedule used for the business

listed or an itemized assets listing. The list needs to contain the name of the item, acquisition

date and cost In the event there was no cost for acquisition, please provide an estimate of fair

market value at the time of acquisition.

This includes property that is:

o owned by the business

o owned personally and used in the business on a full or part-time basis

o received as a gift

o leased or rented

o fully depreciated or expensed for federal tax purposes.

o Example of items: hand held tools, power tools, computers, fax, desks, chairs,

calculators, cubicles, filing cabinets, telephones, shelves, pictures, pallet jacks,

forklifts, skidders, signs (fixed or portable), cameras, recorders, etc.

Incomplete Return - Upon receipt, all returns are reviewed for completeness. Do not write

“SAME AS LAST YEAR” or “SEE ATTACHED” as this will result in the rejection of the return.

Penalties may be incurred if form is not properly completed and signed.

No Cost Provided - Since the assessment is based on information and schedule(s) that you

provide, an assessment will be made by means of percentage of original cost and/or fair market

value. If no information is provided, the Commissioner of Revenue is required by law to assess

property based on the best information available.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4